The real concern isn’t tech stock performance: it’s your psychology

When picking stock winners seems too easy, you might not be seeing the whole picture.

9th February 2024 10:41

by Stéphane Renevier from Finimize

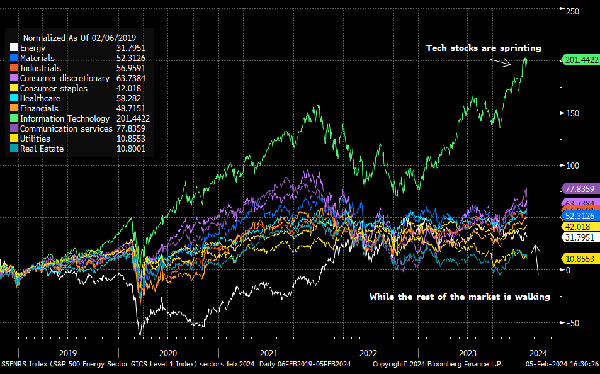

The broadest stat never tells the whole story. For example, the S&P 500 is at record levels right now, but only one of its 11 sectors is actually above its previous highs: information technology – a.k.a. tech stocks. (And the two sectors that come closest are helmed by Magnificent Seven tech stars too – Meta and Alphabet fall in the communication services sector, and Tesla’s in consumer discretionary.)

Now, their strong performance makes sense: tech companies are of higher quality (meaning, they hold a strong competitive advantage, pricing power, impressive margins, and can finance themselves at very attractive rates) and have more attractive growth opportunities – even in less favorable market conditions.

Case in point: the Magnificent Seven saw a 14% revenue growth in the past year, compared to a mere 2% for the rest of the market. As for their margins, they expanded by nearly 7.5 percentage points to 23% while the rest of the market saw margins contract by 1.1 percentage point to 9%.

And these giants could continue this outperformance. If you assume that their valuations will remain unchanged and that their earnings will achieve what the consensus expects, then their prices should appreciate by 16% through year-end.

But if you’re going to try to ride this possible wave, you’ll want to be aware of the risks created by strong past price performance. Behavioral biases like the fear of missing out (FOMO) can lead to impulsive decisions, driven by the worry of being left behind, regardless of the value you get for that price. Extrapolation and recency biases can fool you into believing that what prospered last year is guaranteed to flourish this year too. And the endowment effect can cause you to form such an emotional attachment to certain stocks that it prevents you from considering other opportunities. These very human tendencies not only increase the likelihood that you’ll overpay for an asset, but also that you’ll make ill-timed decisions – buying at a peak or selling during a dip.

Now, I’m not saying you should shy away from tech stocks: they do have a brighter outlook, are (generally) higher-quality businesses, and might generate above-average returns. What I’m saying is this: when picking stock winners seems too obvious, you might not be seeing the whole story. Hidden risks – both financial and psychological – are probably lurking. So be aware of your biases, have a plan in case things go wrong, and make sure you’re investing for the right reasons.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.