Chart of the Week: A rebound for Royal Mail?

While Royal Mail shares continue to frustrate, our chartist asks if a recovery could be on the cards.

15th April 2019 11:16

by John Burford from interactive investor

Share on

While Royal Mail shares continue to frustrate, our chartist asks if a recovery could be on the cards.

Does Royal Mail (LSE:RMG) have any friends at all at the moment? The stock has been beaten down to the recent 234p low from an all-time high of 632p last May. What a stunning collapse!

Some may wonder if its mail delivery service is passing into oblivion with the multitude of hungry competitors out there. But it certainly has staying power on its side, having started life in 1516 in the reign of Mary Tudor!

Perhaps a major low in public approval came in February when it was forced to apologise following a hike in the price of first and second class stamps by 3p to 70p and 61p respectively. The increase broke Ofcom's price cap on second class stamps of 60p, which had been in place until April 1.

Today I want to examine the case for putting it into my Buy Low/Sell High list.

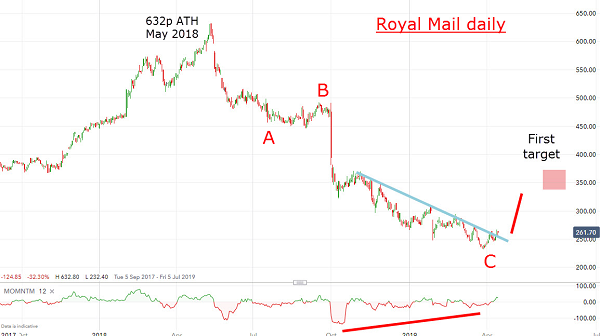

So have we reached a major low? Here is the chart:

Source: interactive investor Past performance is not a guide to future performance

It shows the steep slide off the May high and appears to be in three major waves. If so, I expect a reversal up at some point since a three wave pattern is counter-trend. But is the timing right for such a reversal now?

The last part of the decline from October is a pattern that contains overlapping waves giving the impression that the market is only grudgingly giving up ground to the bears. And the huge momentum divergence shows considerable accumulation is taking place.

This has all the hallmarks of an impending upside reversal and last week, my minor blue trendline was on the verge of being penetrated.

It is a universal feature of bombed-out shares that there appears few obvious reasons to be bullish - and plenty to be bearish. Of course, some situations have little hope and these go bust. This is an almost unthinkable option for the Royal Mail.

Yes, it has many problems — the poor productivity and the ongoing pay/pensions battle being two major issues. Also, the dividend was cut recently. Not a pretty picture - and that is why the share price is low.

But the technical picture I have drawn tells me that while it may not reach its all time high at any time soon, it does have major upside potential with low downside risk.

My first target is at the 350p - 370p region. After that, there will almost certainly be some bullish developments that are invisible today (such as a credible restructuring plan to be announced in May, perhaps?).

For what it is worth, the CEO is buying, so it has at least one friend.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.