Important information: The value of any investment can go down as well as up and your child might not get back what was originally invested. The tax treatment of a Junior ISA depends on individual circumstances and tax rules may change. Please be aware that grandparents do not automatically have parental responsibility. If you’re unsure about the suitability of a Junior ISA or any investment please speak to a suitably qualified financial adviser.

A Junior Stocks and Shares ISA is a tax-efficient savings and investment account for under 18s.

Investments could give your child better returns than cash savings.

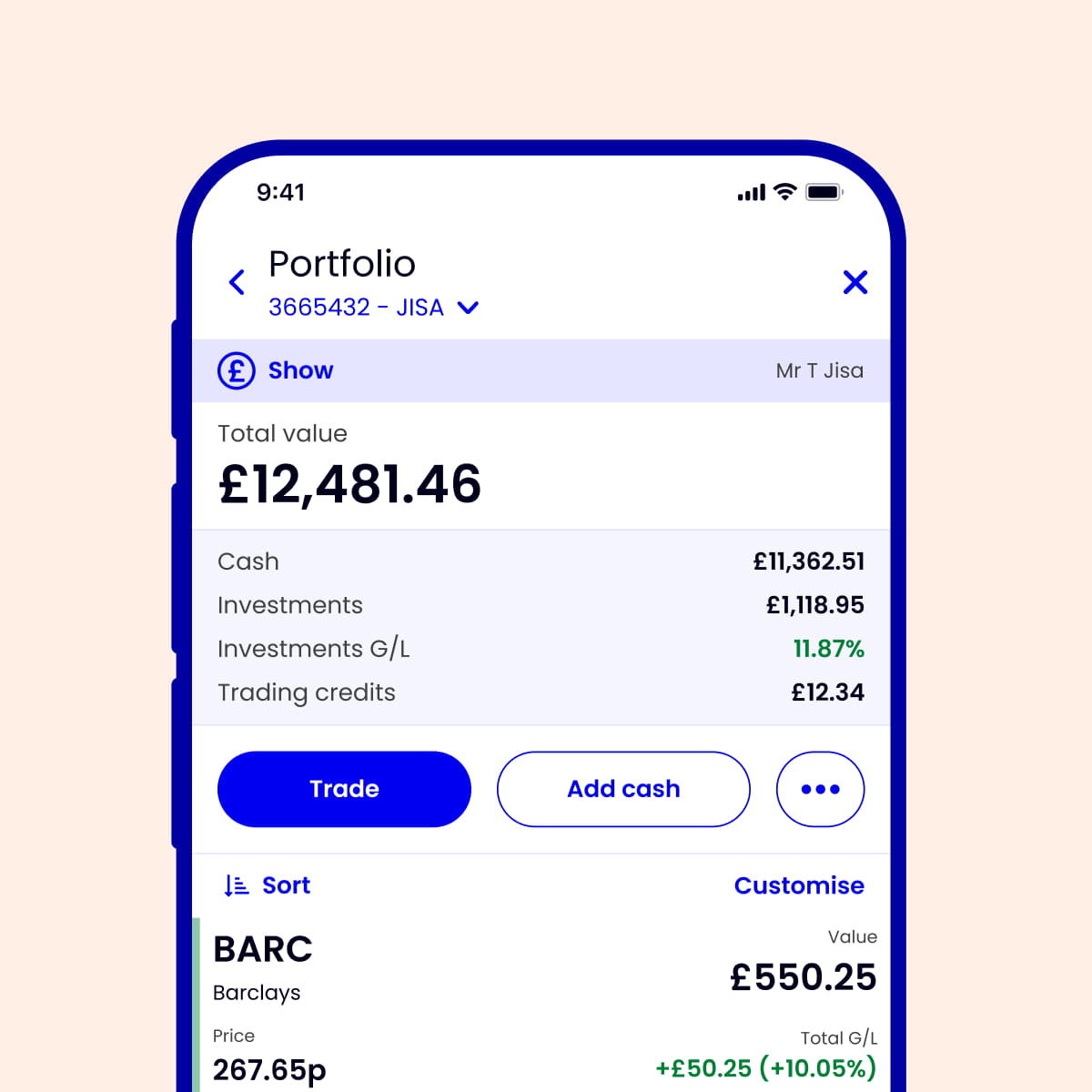

You’ll save and manage their money until your child turns 18, then the Junior ISA matures into an adult Stocks and Shares ISA.

If you're looking to start investing for your family, then a JISA is a great place to start.

This is the Junior ISA annual allowance.

Anyone can contribute to a JISA. But to open the account, you will need to be the child’s parent or guardian.

When your child’s investments grow, you won't pay any Capital Gains Tax or dividend tax on the profits.

Learn more about some key ISA tax benefits.

There’s no limit to how much your investments can grow.

Growth depends on your choice of investment and how they perform, but you won’t have an interest rate restricting you.

Transferring to ii is simple, smooth and straightforward. Even better, it’s free to move your existing Junior ISA or Child Trust Fund to ii.

We’ll support and guide you through the process from start to finish.

Before you can open a Junior ISA, you'll need to open your own account and upgrade to our Plus plan.

On desktop: simply Log in, click ‘Add an account’ and select Junior ISA.

On our mobile app: select your profile, ‘Account’, ‘Add an account’ and scroll down to ‘Open a Junior ISA’.

Put the Junior ISA £9,000 annual allowance to work. Choose from a wide range of UK and international options and start building your child’s financial future. Not sure where to start? Explore top funds for a Junior ISA from our experts.

Our low, flat fee means the more your investments grow, the more you can save for your children.

Make the most of one of the widest ranges of investments in the market including shares, funds, ETFs, investment trusts and corporate and government bonds.

Get in touch with our award-winning customer service team with any questions. You can also stay informed with a wealth of insights from our experts.

To open a Junior ISA with ii, simply open an ISA, Trading Account or a Personal Pension (SIPP) on our Plus or Premium plans. Then you can add as many JISAs as you need for no extra cost.

Find out more about our plans and charges.

The ii Junior ISA provides a range of options to suit any investor. From individual shares to ready-made funds, we’ve got you covered.

A Junior ISA can be opened by a parent or a guardian with legal parental responsibility.

The child must be under 18 and live in the UK. If they live outside the UK, they can still be eligible if you’re a Crown servant (for example, in the armed forces, diplomatic service or overseas civil service) and they depend on you for care.

Only a parent or legal guardian can manage investments in a Junior ISA, but anybody can pay into it up to the £9,000 annual limit.

Anybody can pay money into a Junior ISA either by bank transfer or by cheque. Find out how to make Junior ISA contributions here.

However, only the parent or guardian can set up a Direct Debit.

Please check the remaining Junior ISA allowance for the current tax year before adding money.

Yes, a child can have one Junior ISA of each type. The Junior ISA allowance of £9,000 will be split across both accounts if a child has one of each.

No, a child cannot have both a Child Trust Fund and a Junior ISA. The government replaced CTFs with Junior ISA in 2011 and both accounts benefit from having no income or capital gains tax. If you open a Junior ISA, you can ask your provider to transfer the trust funds into it.

Learn about the differences between a Child Trust Fund and a Junior ISA, and why some people choose to switch.

A Junior ISA is legally owned by the child. It's operated by the ‘registered contact’ - this can be a parent or legal guardian. The cash can only be withdrawn by the child, once they become an adult.

A parent or ‘registered contact’ can only close a Junior ISA during the initial cooling off period.

There are exceptions to this where a JISA can be closed:

A Junior ISA can't be closed just because the child is no longer a resident in the UK. It will remain open and you will still be able to add cash, it can also be transferred between providers.

Junior ISAs themselves aren't considered risky, but investments are riskier than cash as returns aren't guaranteed. Once you contribute to a Junior ISA, the cash can't be taken out until it matures into an adult ISA. So you can't move the cash into another savings product where you might get back higher returns.

Inflation can also play a part and can rise faster than your investments grow. In real terms this could mean that your child's saving are worth less.

The cash and investments in a Junior ISA remain locked away until the child turns 18. At that point your child's ISA becomes an adult ISA and the funds become available to withdraw.