Quick-start Funds

Discover an easy way to start investing. Seven low-cost funds chosen by experts.

Important information - the value of your investments may go down as well as up. You may not get back all the money that you invest. Investing in emerging markets involves different risks from developed markets. In many cases the risks are greater. The value of international investments is affected by currency fluctuations which might reduce their value in sterling. The selection of these funds does not constitute a personal recommendation. We have not assessed your personal circumstances or preferences.

What are Quick-start Funds?

Our six Quick-start Funds offer a simple starting point for investing. These funds have been specially selected by experts, and many experienced investors rely on them too.

All our Quick-start Funds are invested across a wide range of industries. They are like ready-made portfolios that give you one-stop access to the world's markets. Each one has a different level of risk, so you can decide which one is right for you.

You will need to decide between passive investing and active/sustainable investing and then select the fund that suits your attitude to risk and your goals. But please remember that these risk levels are just a guide, and there is risk involved with any kind of investing.

Vanguard LifeStrategy® Funds

Three Vanguard LifeStrategy® Funds were chosen for their balanced approach and low cost.

- Choose from three funds with lower, moderate and higher risk. You can decide which one best suits your attitude to risk.

- Passively managed. They follow the performance of the market and don’t have a fund manager. This helps make their charges lower.

- All sectors. Investments in a wide range of industries across the world’s markets.

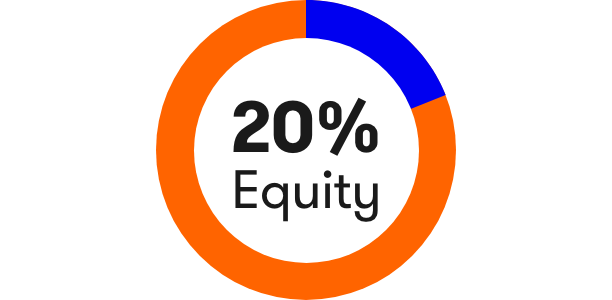

Vanguard LifeStrategy® 20% Equity Fund

If you are looking for less risk, rather than higher returns, this fund is a great place to start.

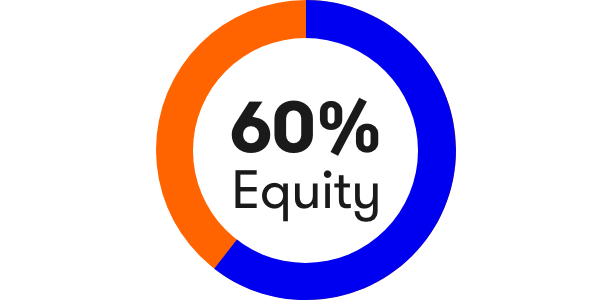

Vanguard LifeStrategy® 60% Equity Fund

If you are comfortable with a little more risk, this fund is a good middle ground investment.

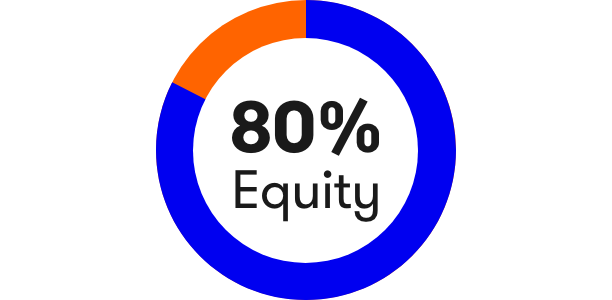

Vanguard LifeStrategy® 80% Equity Fund

For potentially higher returns, in exchange for more risk, this fund could suit your portfolio.

More information

- Each fund is created with 6,000 to 20,000 shares and bonds.

- Investments in the world's markets, helping to reduce your risk.

- Vanguard will rebalance your fund to keep the original proportion of shares and bonds.

- Investments in the full range of sectors including technology, media and energy.

Charges for LifeStrategy® funds

Ongoing charges of just 0.22%. For every £1,000 you invest, just £2.20 goes on management costs.

Including other fees, such as transaction charges, the total product cost is:

- LifeStrategy® 20% equity fund: 0.28%

- LifeStrategy® 60% equity fund: 0.27%

- LifeStrategy® 80% equity fund: 0.27%

You can review costs in more detail in each fund’s cost disclosure document. Simply select ‘See factsheet’ then select ‘View ‘Cost Disclosure Document’ in the Documents section.

Vanguard LifeStrategy’s four-point investment formula

Vanguard LifeStrategy defends ‘home bias’ to UK shares

Royal London Short Term Money Market Fund

- Very low risk. Likely to at least hold its value – investors can earn income on their cash with minimal risk.

- Pay Interest. Annualised yields on money market funds are generally just above the base rate, which compares favourably to many savings accounts. Bear in mind that as money market funds are sensitive to interest rate fluctuations, lower rates will lead to lower yields.

- Highly liquid. It’s easy withdraw money as funds offer daily trading.

- Our fund analyst team highlight the fund has an excellent long-term track record, low drawdowns (meaning it is low risk) and is competitively priced.

More information

- Money market funds invest in cash and cash-equivalents, as well short-term bonds, and must obey liquidity and risk rules.

- They are a very low risk way to hold your cash without having to move it out of an investment account and into a traditional bank. This means the money is kept within the tax-friendly ISA and SIPP wrappers.

- Diversified and highly liquid, meaning investors are not exposed to a single bond failing and can withdraw their money easily.

- Money market funds tend to be cheap and easy to trade, making them a cost-effective tool for managing cash.

Charges for Royal London Short Term Money Market

- Yearly ongoing charges of 0.1%. Therefore, if you invest £1,000, the fund fee will be just £1 a year.

- Including other fees, such as transaction charges, the total product cost is 0.11%.

- You can review costs in more detail in each fund’s cost disclosure document. Simply select ‘See factsheet’ then select ‘View ‘Cost Disclosure Document’ in the Documents section.

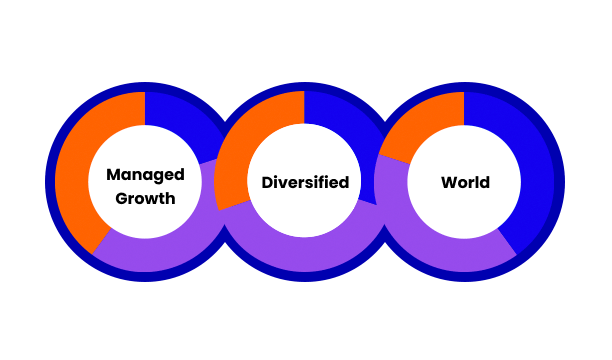

Royal London sustainable funds

- Choose from three funds – Managed Growth, Diversified or World. You can choose the approach to risk that suits you.

- Actively managed. They have a fund manager that selects investments.

- Sustainable. Investments in companies that look to make a positive contribution to our society and environment.

Royal London Sustainable Managed Growth Trust

If you are looking for less risk, rather than higher returns, this fund is a great place to start.

- Up to 35% in shares (typically 25%)

- See factsheet

- See selection rationale

Royal London Sustainable Diversified Fund

If you are comfortable with a little more risk, this fund is a good middle ground investment.

- 30 to 60% in shares (typically 60%)

- See factsheet

- See selection rationale

Royal London Sustainable World Trust

For potentially higher returns, in exchange for more risk, this fund could suit your portfolio.

- 50 to 85% in shares (typically 85%)

- See factsheet

- See selection rationale

More information

- Ongoing charges range from 0.67% to 0.77% for the RL managed funds.

- Investments in the world's markets, helping to reduce your risk.

- Royal London offers expertise in investing in sustainable companies that look to make a positive difference to our society and environment.

Charges for Royal London sustainable funds

Ongoing yearly charges for the funds range from 0.67% to 0.77%. Including other fees, such as transaction charges, the total product cost is:

Royal London Sustainable Managed Growth: 0.68%

Royal London Sustainable Diversified 0.85%

Royal London Sustainable World: 0.87%

You can review costs in more detail in each fund’s cost disclosure document. Simply select ‘See factsheet’ then select ‘View ‘Cost Disclosure Document’ in the Documents section.

Please note that ii does not endorse any particular product and cannot make a personal recommendation for you.

Tools and insight

We answer your questions about the Quick-start Funds and how to start investing. Click here to find out more.

Open an account

Whether you are looking for a general trading account, an ISA or a SIPP, we’ve got you covered with a low, flat fee.

Personal Pension (SIPP).

Get pension peace of mind with our four-time Which? Recommended Personal Pension (SIPP). Invest yourself or let our experts handle your investments for you.

Stocks & Shares ISA.

Get tax-free investing all wrapped up with our award-winning ii ISA. Take care of your own investments or let us manage them for you.

Managed ISA.

Let us manage your ISA for you. Save time, leave it to the experts and feel confident in your investment goals - all for a low monthly subscription.

Can’t decide how to invest your ISA?

You can always sit back, relax and leave it to the experts with a Managed ISA. We'll match you to a tailored investment portfolio, that reflects the risk level you're comfortable with.

Then our experts will look after your investments for you - so you can rest easy, knowing your money is managed.

Disclaimer(s)

Our six Quick-Start Funds have been selected by investment experts as a simple starting point for investing. They are split into three broad risk categories: lower, moderate, and higher risk.

However, you should note that the selection of our Quick-Start Funds is not investment advice or a ‘personal recommendation’. This means neither we, nor Morningstar, have assessed your investment knowledge, your financial situation (including your ability to bear losses), your investment objectives, your risk tolerance, or your sustainability preferences.

You should ensure that any investment decisions you make are suitable for your personal circumstances, and if you are unsure about the suitability of a particular investment or think you need a personal recommendation, you should speak to a suitably qualified financial adviser. Neither ii nor Morningstar are responsible for any trading decisions, damages or other losses related to the Quick-Start Funds.

The past performance of an investment is not a reliable indicator of future results, and ii does not guarantee or predict the future performance of the Quick-Start Funds investment list as a whole or the constituent investments.

Disclosure(s)

ii adheres to a strict code of conduct. Members of ii staff may have holdings in one or more Quick-Start Funds, which could create a conflict of interest. Any member of staff involved in the development of research about any financial instrument in which they have an interest are required to disclose such interest to ii. We will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, staff involved in the production of the Quick-Start Funds are subject to a personal account dealing restriction. This prevents them from placing a transaction in the specified instrument(s) for five working days before and after an investment is included or amended and made public within the Quick-Start Funds. This is to avoid personal interests conflicting with the interests of investors in the Quick-Start Funds.