Important information: As investment values can go down as well as up, you may not get back all the money you invest. Currency changes affect international investments, and this can decrease their value in sterling. If you’re unsure if an investment account is right for you, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future. Please note images displayed are for illustrative purposes only.

If you’re new to buying shares, you’re in the right place. With ii, you’ll get the tools and insights you need to become a more confident stock market investor.

Buy and sell shares in companies from the UK, US and many other international markets. Embrace this choice with help from our experts; discover beginner’s guides, top-traded lists and the latest market news.

When you’re ready, you can open an ii account in minutes and start investing in the companies you believe in.

Our Head of Editorial, Lee Wild, explains the benefits of investing in shares.

“Over the long term (5+ years typically), investing your money in the stock market has the potential to bring you greater returns than leaving it in a savings account. But greater potential for returns also means more investment risk.

You can make money from shares in two ways: capital growth and dividends. Capital growth is the profit you make if you sell your shares for more than you bought them. While holding your shares, you can also earn income in the form of dividends. Dividends are your share of the company’s profits, usually paid twice a year.”

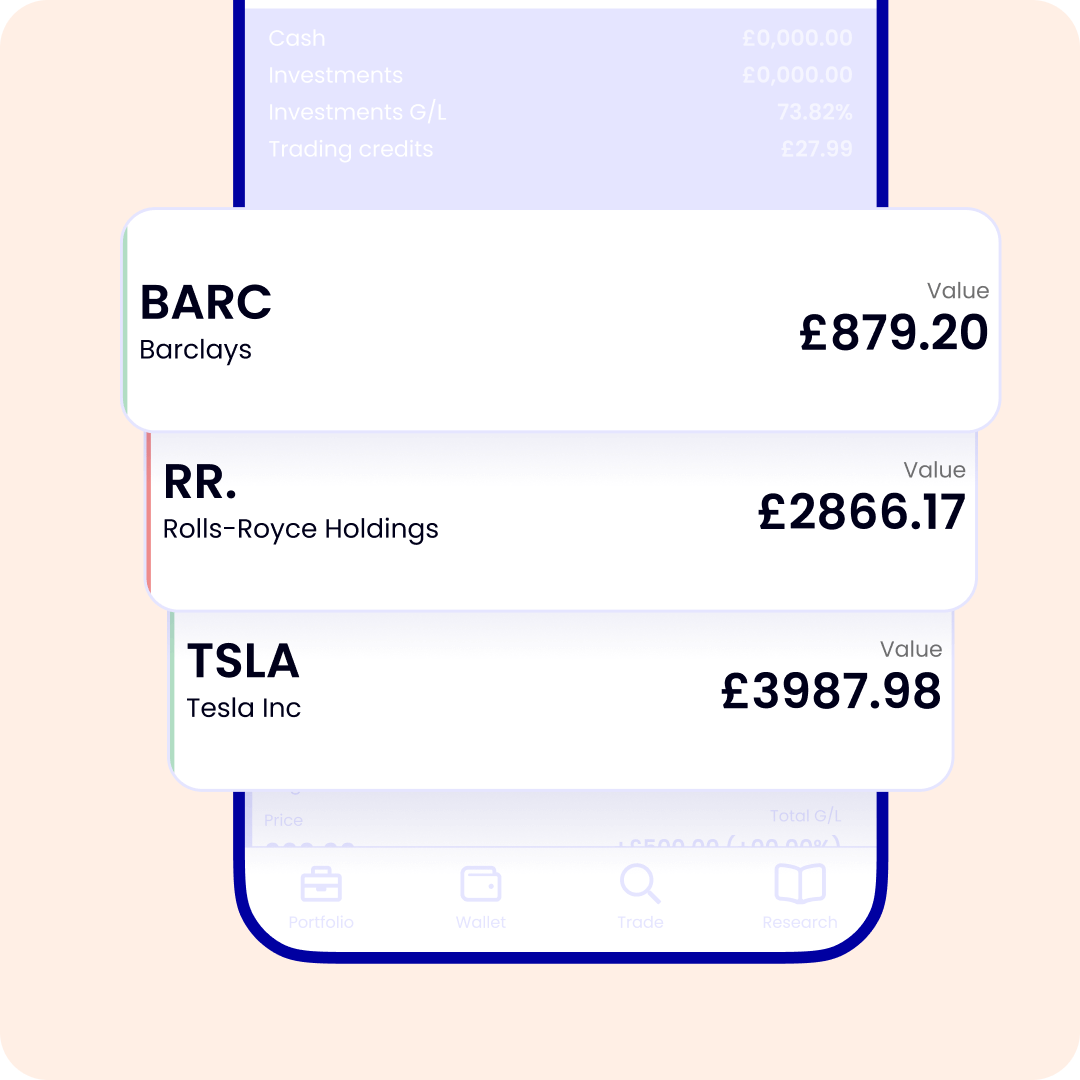

From the UK FTSE 100 to the US NASDAQ and beyond, with ii, you can buy and sell shares in companies from all over the world. See what’s out there and how other people invest to help you decide what shares to buy.

Our market-leading team of experts regularly gather and review the investment trends of over 500,000 ii investors.

Discover the team’s latest insights to help build your knowledge as well as your portfolio.

Access one of the widest ranges of UK, US and other international shares on the market. Choose from our wide range of investments and even save on trading fees with our free regular investing service.

Rest assured that you’re in safe hands when choosing and trading your shares. ii has decades’ worth of experience successfully executing online trades and securely holding £95bn of investors’ assets.

Get more than profits and income from your shares. As the Investors’ Chronicle Shareholder Rights Champion, ii empowers you to engage with and influence the companies you invest in.

Join over 500,000 investors, over 50% of whom have been with us for more than 10 years. See why Investors' Chronicle named us a 5-star platform and their Editor's Choice.

To start buying shares with ii, you’ll first need to open an account. Choose from our Stocks & Shares ISA, Self-Invested Personal Pension (SIPP) or Trading Account.

After choosing your account, you’re ready to open it. Get set up in less than 10 minutes here on the website or through our mobile app.

You’ll need to add cash to your account to buy your shares. You can either make a one-off payment or set up a monthly direct debit.

Research the companies you’re interested in and select the shares you want to invest in. Remember, you can explore our expert insights and ideas to help you choose.

When you know which shares you want, it’s time to buy.

With the cash ready in your account, you can place an order to buy your shares. If you want to invest a little in the same company every month, you can use our free regular investing service.

If you decide to buy US shares, you’ll usually need to complete a W-8BEN form before placing your order.

Find out more about how to buy US shares.

Shares, also known as stocks, are an investment in an individual company. Buying shares means you 'own' a part of that company.

Share prices rise and fall in line with demand and other economic factors. If the value of your shares rise, you can choose to sell them at a profit. On the other hand, you could lose money if share prices fall.

Owning shares in a company usually entitles you to certain shareholder benefits. These include earning a portion of the company’s profits, known as ‘dividends’, and voting on important company decisions.

To start buying shares, you’ll need an investment account, such as our Stocks & Shares ISA, Trading Account or SIPP. With any of these accounts you can access our low-cost trading platform and choose the shares that appeal to your appetite for risk.

If you’re ever unsure about which shares to buy, our expert guidance and research can help you figure this out. You can also use ii to buy US and international shares if you’re looking to broaden your financial horizons.

Find out more about how to buy shares with ii.

Selling shares is similar to buying them. Simply choose which ones you wish to sell and once the trade has settled, you can withdraw your cash from your ii account into your bank account.

You may pay tax depending on the account you sell your shares within. If you sell within a Trading Account, you’ll pay Capital Gains Tax (CGT) on any profits you make over your tax-free allowance. But selling shares within a SIPP or Stocks and Shares ISA is much more tax-efficient. You wouldn’t pay CGT in these cases, which makes these accounts a good choice to help your money go further.

Read more about tax-efficient investing.

When you buy a share you’re effectively buying a stake in a company. If demand is high or performance goes well, the value of your shares rises, and you can sell at a profit. The opposite is also true, meaning you could lose money.

It’s up to you to decide what your risk appetite is - i.e. how much do you want to invest and which companies you invest in. While there is risk of losing money, investing in shares can provide a chance of better returns than other investment options.

Shares may also pay dividends: money paid out to you on a regular basis depending on the company’s profits. Whether you withdraw this money or reinvest is up to you. If you choose to reinvest, you can do this automatically with our easy dividend reinvestment service.

Each time you buy or sell shares with ii, you’ll usually pay a one-off trading fee. The amount depends on the type of investment and which price plan you're on. Please see our charges for details. You can save on UK trading fees if you decide to use our free regular investing service.

Bear in mind you’ll often pay other charges each time you invest in shares, including when using our free regular investing service. These other charges include Stamp Duty Reserve Tax (SDRT) when buying UK shares and foreign exchange fees to convert your currency for international investing.

View our charges in full.