Important information: As investment values can go down as well as up, you may not get back all of the money you invest. If you're unsure about investing, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future. Please note images displayed are for illustrative purposes only.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). If you’re unsure if a SIPP is right for you, please speak to an authorised financial adviser.

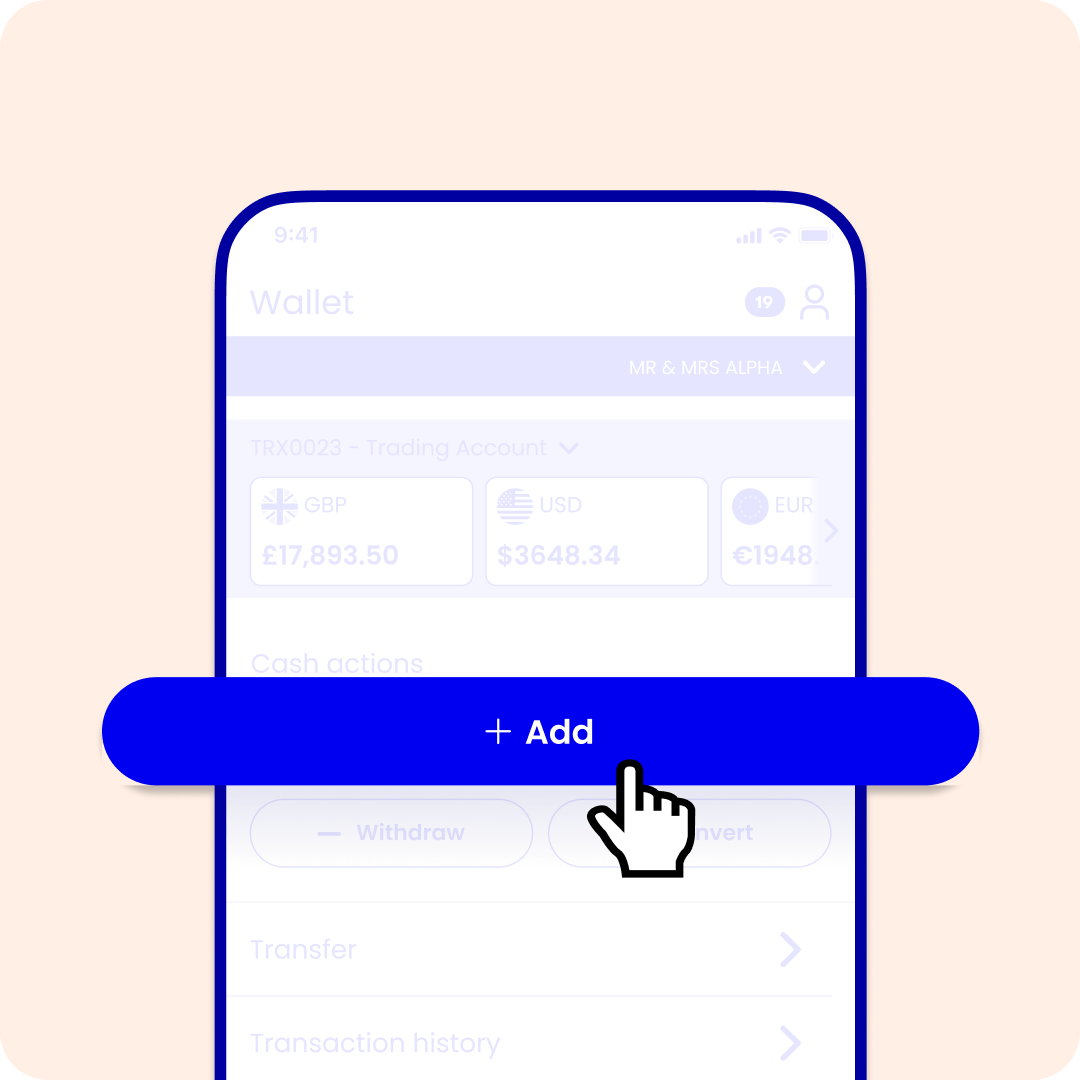

With your account open, you can add money to it in a way that works best for you:

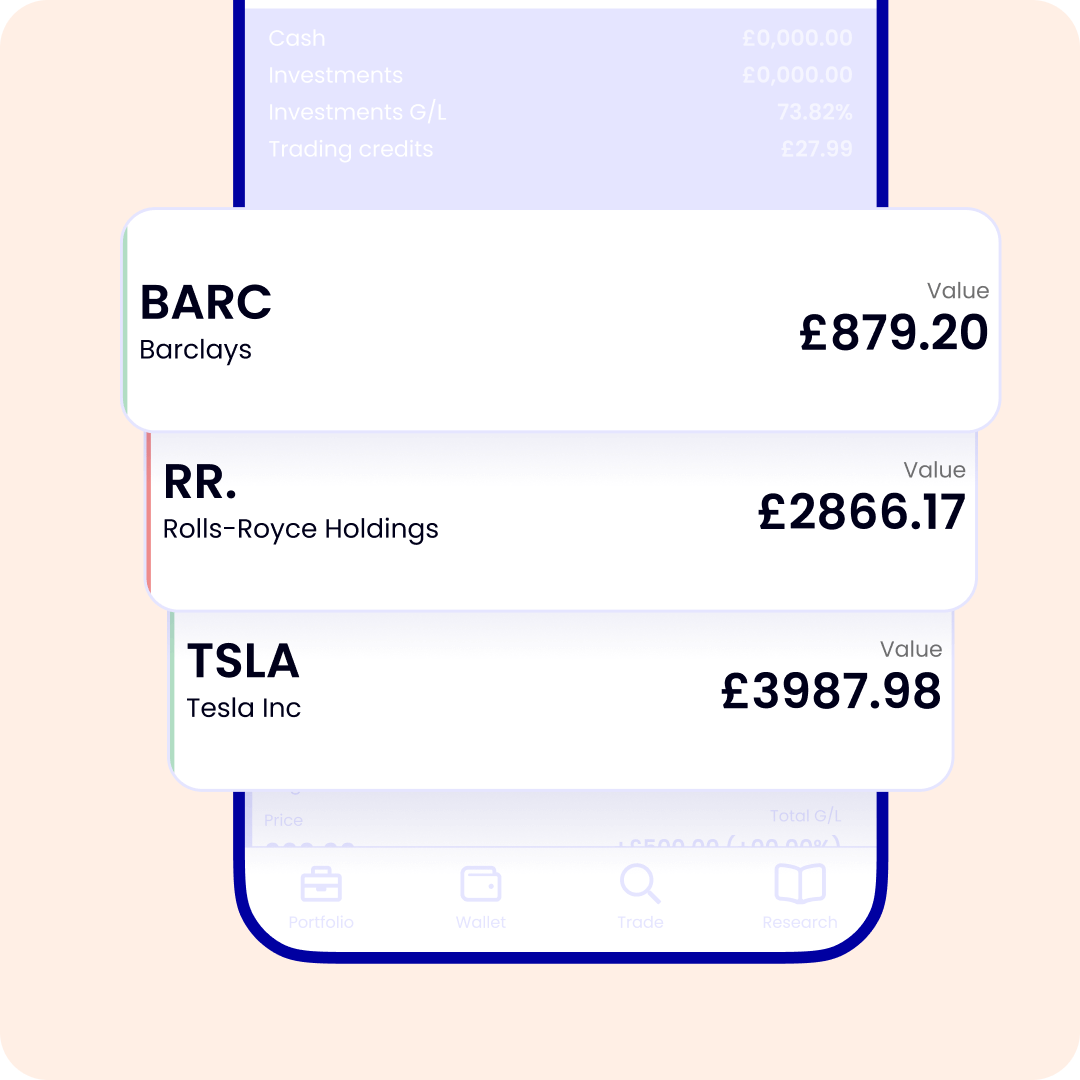

Choose from our wide range of investments, including UK and international shares, funds, ETFs and bonds.

To help you decide, we’ve narrowed down the field with our expert picks and ideas.

While most other providers take a percentage of your wealth, we charge a low, flat monthly fee. So you can keep more of what’s rightfully yours.

We’ve been helping people invest for 30 years. Our multi-award-winning range of accounts and expert insights are built on decades of experience.

Our award-winning customer service team is only a phone call away. It’s why over 50% of our customers have been with us for more than 10 years.

We understand just how important it is to trust who you invest your money with.

That’s why we’re proud of our multiple industry awards and thousands of 5-star customer reviews. They let you know you can rely on ii for safe and supported investing.