Do you have too many holdings in your portfolio?

15th June 2016 11:09

by Danielle Levy from interactive investor

Investors are often told to follow the old truism "don't put all your eggs in one basket" and instead to spread their investment across a number of different holdings.

But that good advice doesn't usually extend to guidance as to the ideal number of fund "baskets" that should be employed.

While most small investors will start off with no more than one or two funds, the question of how many funds to hold becomes more of a problem as your investments begin to yield results and your portfolio grows in value.

So how best to invest the proceeds from your growing portfolio? First, you have to decide whether to take profits or reinvest the cash. If you choose the latter you will be faced with two options: pay more into existing positions, or use it as an opportunity to initiate new investments. Which call should you make?

Diversification

Andrew Wilson, head of investment at wealth manager Towry, suggests that diversifying your portfolio remains "the only free lunch in finance" and therefore represents a sensible decision.

It means that if something in your portfolio doesn't perform as you had hoped, the other investments will hopefully pick up the slack. But having said that, investors must be careful not to diversify to the point where the benefits are negated.

"One can over-diversify and risk 'di-worsification', which essentially means reaching the point whereby all your positions are matching each other off and your portfolio goes nowhere," he explains.

"Alternatively, you could be better off buying a tracker as a cheaper and simpler way to achieve the same thing."

Against this, there are also risks associated with running a portfolio that is too concentrated in particular markets.

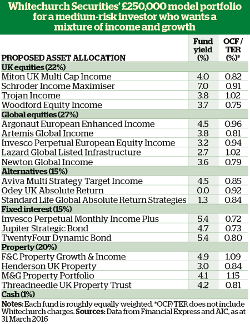

So how can investors strike the right balance? Gavin Haynes, managing director of wealth manager Whitechurch Securities, suggests building up the number of holdings as a portfolio grows in size, to ensure there is a good spread of investments.

"Portfolios that concentrate on only a few investment areas can be volatile," he adds.

However, he believes it is not just about the headline number of investments in a portfolio. For those who invest via funds, it is equally important to have an understanding of the underlying investments at a stock level, alongside the potential correlations between the funds.

"You need to understand how investments perform in different economic climates, to ensure that your portfolio holdings are not going up and down in tandem," he explains.

Strong sell discipline

While Haynes suggests that it can make sense to initiate new investments where appropriate, he believes it is equally important to have a "strong sell discipline" to make sure that each investment continues to earn its place in the portfolio.

This can be achieved by introducing target returns or share price targets, so the portfolio is underpinned by a clear strategy.

"Ideally you should rebalance your portfolio bi-annually or annually at least, to ensure it remains broadly in line with your risk/reward profile," he adds.

Those who are thinking about introducing new investments with the portfolio's proceeds will no doubt have a number of considerations. First, which asset class would they like to increase exposure to?

And do they have fund managers or stocks that have already been researched, which they feel positive about? Alternatively, they may need to research a raft of prospective investments, which can take time.

"You should channel proceeds to new fund managers only if you feel you have great ones on the bench. You have to be careful not to add managers just for the sake of it," advises David Coombs, head of multi-asset investments at Rathbones.

He acknowledges that the trade-off between topping up existing holdings and initiating new investments can prove tricky. In his view, it has to come down to how much conviction you have in either scenario.

If you don't have a high level of conviction in either of them, there is nothing wrong with holding cash for the time being until better opportunities come up.

Assess objectively

Nick Sketch, a senior investment director at Investec Wealth & Investment, suggests the process of deciding where to invest proceeds provides investors with an opportunity to make an objective assessment of how their portfolio is positioned.

"It is usually best to try looking with fresh eyes and to ask whether, given what we know now, this is the portfolio that you would buy today. If not, changes may be needed, whether that means trimming a 'winner' or giving up on a bad performer," he says.

Is there an ideal number of positions that you should be running in your portfolio? Sketch suggests there is no right answer to this question. The same is true with regard to the issue of how big a single position should be allowed to grow within the portfolio.

For example, a small portfolio of relatively small positions will incur higher dealing costs, whereas larger portfolios can potentially afford to have more holdings. Sketch says it should ultimately come down to how many "compellingly good" investment ideas an investor has.

Wilson is also of the opinion that there is no ideal number of holdings in a portfolio. This is because much will depend on the investor's appetite for risk and the underlying mix of investments.

"Some say that once you have seven to 10 holdings then you have already taken the bulk of the benefit of diversification, but others suggest that 20 to 25 is a better number," he adds.

For investors who are investing primarily in funds and have upwards of £100,000, Coombs advises having between 12 and 15 funds.

For those who favour investing directly in shares, he suggests 35 to 50 positions. Most importantly, he urges investors to avoid trading in the portfolio unnecessarily, because trading costs eat into returns.

Don't be knocked off course

Investors should also try to avoid looking at their portfolio too often, to give the underlying funds time to perform. Unless a fund manager leaves or there is a major unforeseen event, he suggests looking at the portfolio once or twice a year - and a maximum of once a quarter.

Depending on the size of the portfolio, Haynes suggests the number of positions can range from a single diversified multi-asset fund for a first-time investor through to a portfolio of 20 to 25 funds.

The box to the right shows a Whitechurch medium-risk portfolio comprising 19 funds.

For anyone looking for a ready-made core portfolio tailored to specific goals, the 12 Money Observer Model Portfolios could be a useful starting point.

Each holds six or seven funds, chosen partly because they complement each other in style and content.

Unfortunately nothing stands still in the world of stockmarkets, and to make matters worse there are no hard-and-fast rules to investing.

One sound piece of advice is to not lose sight of your investment objective and the purpose of the money when deciding how to put your cash to work.

"Whether a portfolio has been going up or down in value, it is usually sensible to try to keep the same investment approach and not to be knocked off course by mood, panic or success-inspired confidence," Sketch concludes.

Four rules to help you run a tight ship

The devil is in the detail

If you invest via funds, then it is imperative that you do your best to keep abreast of the underlying investments in the portfolio, so that you can anticipate how different positions correlate.

Rebalance

As your portfolio grows in size, make sure that the different allocations stay in line with the strategy you outlined at the time of the portfolio's inception, and that they still align with your investment objective and risk profile.

Do your research

Conduct thorough research if you are adding a new investment to the portfolio, so you understand what you are buying and how it is likely to perform in different market conditions. This research should be ongoing.

Don't over-tinker

If you are a long-term investor, try to avoid checking the portfolio too often. You may find that you are tempted to sell a fund or stock, and you do so at exactly the wrong time and incur unwelcome trading costs in the process.

This article was originally published by our sister magazineMoney Observer here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser