The FTSE 100 levels you must keep an eye on right now

5th October 2018 08:57

by Alistair Strang from Trends and Targets

It's been a miserable week for the blue-chip index as it took a nosedive on sterling's recovery. Chartist Alistair Strang provides the key numbers to look out for on Friday.

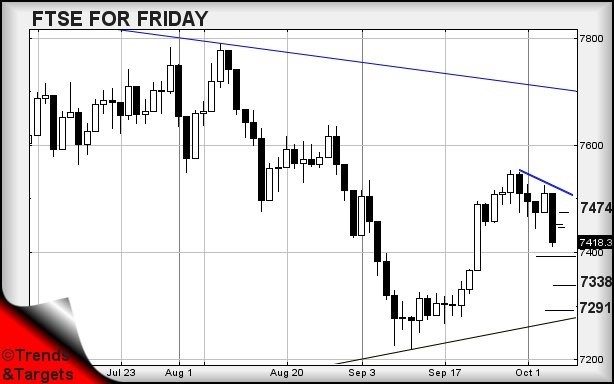

FTSE for Friday (FTSE:UKX)

Our report last Friday effectively proved a waste of time with nothing actually triggering on the day. In fact, it was to take the entire week before the triggering move at the open on Monday actually reached our proposed target of 7,425 points with a delicate little exact dip just before 11 am on Thursday. Waiting four sessions for a 50 point drop to complete suggested quite a degree of boredom.

Oddly, the clown sector - the retail banks - have each triggered a reversal phase which has not yet kicked into life. Our suspicion was the coming reversals in this sector would tend to balance illusory gains amongst major oil sector player but despite the price of crude, the oilers are not exhibiting disproportionate rises yet.

Perhaps we're facing a messy Friday as our 7,425 was eventually broken later in the FTSE 100 session with the market closing the day at 7,418 points.

For now, the scenario exists of FTSE weakness below 7,410 driving the market further down to an initial 7,392 points. If broken, secondary is at 7,338 points. If triggered, the tightest stop appears to be 7,474 points, a number which keeps raising its head. In the event 7,338 breaks, we can admit to the presence of 7,291, a region where some sort of bounce will make sense.

Something worth remembering for the week ahead is we still expect the FTSE to explore the depths around 7,120 points eventually. The market now requires above 7,700 to rubbish the suggestion entirely. It's at this point, where it's possible to hesitate and question if there is any point in exploring near-term long positions.

Unfortunately, the market constantly proves if something is obvious, it'll probably not happen anytime soon.

For a Long position to become viable, we require the index to better 7,435 points. This, in theory, should prove capable of triggering some recovery toward an initial 7,446 points. If bettered, secondary calculates at 7,452 points. Stop can be fairly tight at 7,410 points.

Importantly, for the longer-term, in the event of a miracle and the FTSE making its way above 7,452, we shall regard 7,474 as exerting an attraction. To be blunt, we've absolutely no idea why some numbers keep proving themselves important in our movement calculations.

Have a good weekend.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.