Key FTSE 100 levels you need to know

30th June 2015 11:24

by Lee Wild from interactive investor

It's the last day of the first half of 2015, and there's really very little to celebrate. European equity markets have slumped again as investors take money off the table ahead of Sunday's referendum in Greece. The country's bailout also ends today, which means missing out on its final €7.2 billion of rescue cash, and it's almost inevitable that it will not repay the €1.6 billion IMF loan by the 11pm BST deadline.

Despite the short-term damage to sentiment and sharp rise in volatility, however, Greek action should at least bring the "will they, won't they exit" farce to an end, albeit a potentially bloody one. This is not just a vote on austerity, but on EU membership. A "no" vote is "a clear decision against staying in the euro," said German vice chancellor Sigmar Gabriel.

Deutsche Bank's resident regional expert George Saravelos said yesterday that a "no" vote would just about be his current expectation. That's a worry, and polls coming out of Greece in the run up to the weekend will be closely monitored.

At Barclays, the equity strategists are "cautiously constructive" on European equities. "Markets are unlikely to react favourably in coming days. However, beyond this initial reaction, we suspect that things will stabilise," they say. "We think European equities will end the year higher than they currently are."

The broker still tips the to end 2015 at 7,300. It's currently 6,566 - exactly where we started 2015 - but has been as low as 6,540 Tuesday. There's every chance is could go lower, especially if Greece takes the exit route on Sunday (more of that later). Yet UBS believes the UK is a relatively safe port in a storm.

"The UK and Switzerland are likely to be reliable safe havens through this period of heightened political risk," write UBS economists. "They are also less expensive than has been the case previously."

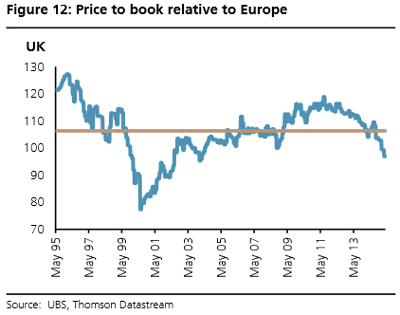

Falling energy prices have been a key reason for relative underperformance here this year, but the UK is now cheaper than its 20 year average, according to UBS stats. (See Figure 12).

(click to enlarge)

The real risk to Britain, however, is contagion. Despite momentum here being largely driven by domestic demand, an improving eurozone economy has been an obvious boost for UK companies. Spain, Portugal and Italy are heavily exposed to Greece, and any dip in fortunes on the Continent - our largest trading partner - would inevitably dampen our own prospects.

FTSE 100 levels to watch

Down over 8% since hitting a record high of 7,122 on 27 April, the FTSE 100 sits at a five-month low and a couple of bad sessions from "official" correction territory.

Alistair Strang, a technical analyst at regular Interactive Investor contributor Trends & Targets, has run the numbers again and flagged up some of the key levels investors should look out for over the next few days.

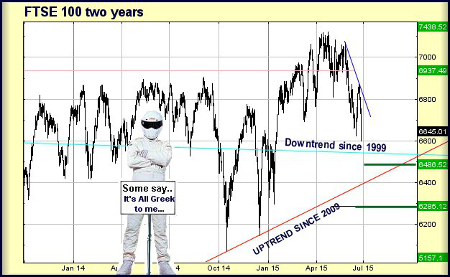

(click to enlarge)

"Allegedly [the FTSE 100 is] heading to 6,486 points with secondary, if broken, at 6,282 points. There's a couple of things legislating against this and they are both historic market trends." Says Alistair:

Our first area of hope is the Light Blue line on the chart. This dates from 1999 and if the chart is viewed on closing prices only, it seems the market attaches considerable importance to this historic downtrend. At time of writing, it becomes likely there will be some sort of bounce from around 6,538 points.

Our second area of hope is RED and this dates from 2009, the year of the last crash. At no time has the market been permitted below this line in the last six years, so it must have some importance. At time of writing, it's at 6,400 points and again, we'd hope for a bounce if Light Blue breaks.

Our third area of hope is at 6,850. All the FTSE need do is trade above this level (Dark Blue) to utterly cancel the prospect of 6,282 on the immediate drop cycle.

And finally, now the bad news. Visually it's stuffed and needs a miracle. If it were a share, we'd suspect all our hopes would be dashed and it will head to our bottom level. We're not immune from noticing the market did indeed trade above our mythical 6,937 but in honesty, never with any real conviction. As a result, as Greece is showing, weakness tends to establish itself rather fast.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.