Rationale for Vodafone 'buy' tip

26th July 2018 14:47

by Graeme Evans from interactive investor

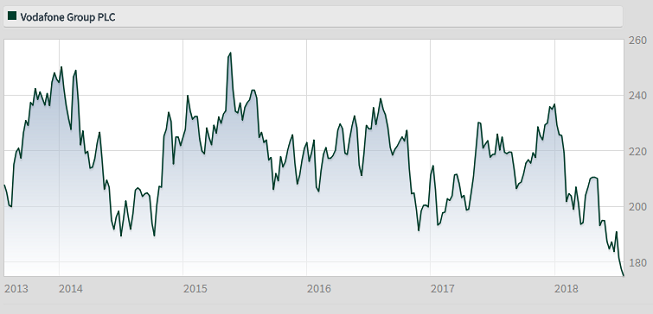

The City likes Vodafone shares, but they've been in freefall and trading around 35% below target price. Graeme Evans explains why.

With Vodafone shares still languishing at below 180p, the company's army of followers must be weary at being told that this is a high-yielding stock that should be trading at 250p or more.

So why isn't it? There’s no doubting that outgoing CEO Vittorio Colao has left the mobile phone giant in a healthy position following a decade of dealmaking and restructuring. Yesterday's first quarter update — Colao's final in charge — was largely positive, offset by rising competition in some markets.

One explanation offered by the team at Barclays is that the market has been too negative and backward looking in its approach to valuing the company.

In a post-results note, they said: "Vodafone offers a 7% dividend yield, and yet many seem to question its sustainability, not just its potential to grow.

"They question if Vodafone can monetize data, does convergence present a risk, will regulatory headwinds ever end, will cost cutting be net vs gross, will capex stop increasing, could Vodafone merge with Liberty Global?

"We see this as a backward-looking view."

Source: interactive investor Past performance is not a guide to future performance

Barclays has a price target of 240p, although its upside case of 280p is based on a sector-leading multiple of 8x enterprise value to earnings. This compares with a current ratio of 6.4x for both Vodafone and its European peers.

Significantly, Vodafone offers a projected 8.9% equity free cash flow yield and 7.9% dividend yield, compared with incumbent peers trading on 6.2% and 5.4% respectively.

While the Barclays team sees Vodafone as inexpensive, they remain wary about the impact of stiffer headwinds. This has led the bank to trim its full-year forecasts, with underlying earnings now likely to be towards the lower end of the 1-5% organic range guided by the company yesterday.

The headwinds are likely to increase in the second quarter, particularly as the division in Germany will be up against tougher comparatives.

They said: "Though Germany and the UK are performing well, competitive pressure is clearly rising in a number of key markets."

The biggest concern for investors at the moment is the performances in Spain and Italy, with bigger-than-expected service revenue declines reported in both countries during the first quarter amid elevated levels of competition.

Overall, organic service revenues were 0.3% higher in the three month period, which was broadly in line with consensus forecasts for 0.2%

Yesterday's trading update provided no momentum for the company's shares, which remain below the five year trading range of 180-255p, having fallen by 25% since the start of the year.

Among other City analysts, UBS's Polo Tang has a price target of 250p. He thinks the company is well placed to realise a tailwind from cost savings, as well as to reap rewards from an expanded portfolio that now includes the cable networks in Germany and eastern Europe bought from US firm Liberty Global.

Under Colao, Vodafone has been transformed from a consumer-focused 2G/3G mobile operator to a world-leading converged communications company offering television, mobile, fixed and broadband services. It also has significant businesses in India, Egypt, Turkey and in Africa.

Colao is due to leave in October, when he will be replaced by current finance director Nick Read.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.