Why global fund managers are piling into US equities

15th June 2018 10:35

by Tom Bailey from interactive investor

After over a year being underweight US equities investors are flocking back, according to Bank of America Merrill Lynch's June Global Fund Managers Survey.

This suggests fears over US market being overvalued and on the edge of a downturn have eased.

"Investors have their eyes on the US this month," said Michael Hartnett, chief investment strategist. He adds: "With a record high favourable outlook for profits and a return to US equity allocation."

Most investors still view the US as having strong economic fundamentals. The majority of investors surveyed do not think the US will enter recession until at least 2020, while a sizeable minority expect growth to end towards the end of 2019.

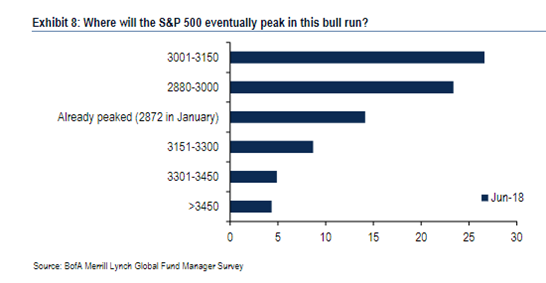

Bullish sentiment can also be seen in predictions for the S&P 500 index. Roughly half of investors surveyed believe the index will peak past 3,000 points, with 25% of the total surveyed predicting a peak at somewhere between 3001 and 3150. On 11 June 2018, the index closed at 2,782.

Past performance is not a guide to future performance

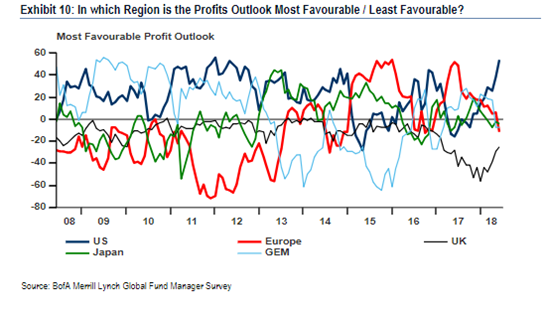

Likewise, investors are hopeful on US profits. As the dark blue line on the chart below shows, 64% of investors surveyed now think that the US has the most favourable profits outlook compared to other regions around the world, the highest figure reached in 17 years.

Past performance is not a guide to future performance

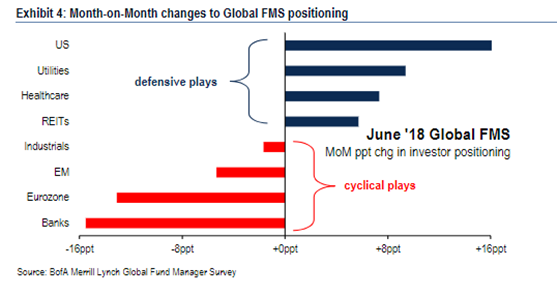

Part of the bullishness of the US stems from a decline in sentiment surrounding other regions. As the chart below shows, the rotation in US equities has been in part at the expense of emerging market and eurozone equities.

Indeed, investors have been moving back in tech, following fears around the sector earlier this year.

Past performance is not a guide to future performance

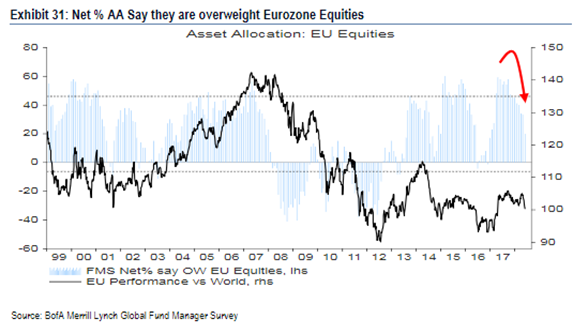

While investors have warmed once again to US stocks, eurozone equities were hit hard. They saw their largest drop in allocation among global fund managers since the UK's vote to leave the European Union in 2016.

Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.