Could these out-of-favour funds rise again in 2014?

17th April 2014 15:01

by Helen Pridham from interactive investor

It is very tempting, when deciding where to invest your ISA allowance each year, to choose a fund or investment trust that has been producing good performance over the recent past.

Even though we all know that past performance is not a guarantee of future results, it seems more sensible to back a winner than to choose an underperforming fund.

However, sometimes investing in funds and trusts that have been struggling and are unloved (and therefore relatively cheap) can actually produce better results over the long term, as it means you’re buying better value.

In recent years, for example, investors who have chosen relatively unpopular areas such as Europe, Japan or property are now reaping the benefits.

Ben Yearsley, head of investment research at stockbrokers Charles Stanley, says he often prefers funds that haven’t been having such a good time recently. "I suppose it is because I am instinctively a contrarian investor, so I look for funds that I feel are undervalued," he explains.

Contrarian investors believe the best value can often be found by going against the general consensus and investing in areas that others are ignoring.

.jpg) Off the boil

Off the boil

Other investment experts tend to share this view, although it isn’t just a matter of choosing the worst-performing funds or investment trusts on the highest discounts to net asset value.

Considerable importance is laid on a fund’s longer-term past performance, the reason its performance may have gone off the boil in recent years, and in particular the skill and track record of the investment manager in charge.

Yearsley currently believes it could be a good time to invest in , for example. This fund invests in companies which are out of favour, in difficulty or whose future prospects are not fully recognised by the market.

It has been extremely popular in the past but has recently experienced two years of bad performance. Yearsley says: "M&G Recovery has had a tough time recently because it has been invested in areas that have not performed, such as mining. But the manager Tom Dobell is a good long-term manager.

The fact that it is a large fund has had some impact, because it has made it harder for him to invest in some of the smaller areas he went into in the past. But on the other hand the UK market has also become larger, and I think Dobell will still find good opportunities."

A new manager can also breathe new life into a troubled fund. Another large UK fund that has fallen out of favour in recent years is . It was previously one of the UK’s most successful funds, run by one of the country’s most iconic managers – Anthony Bolton.

Fidelity Special Situations has the potential to come good under Alex Wright"David Thomson

Since Bolton retired from the fund five years ago it has languished somewhat under his replacement Sanjeev Shah. But there are high hopes the new manager who took over at the beginning of this year could bring about its renaissance.

"Fidelity Special Situations has enjoyed mixed fortunes in recent years, but I think it now has the potential to come good under its new manager Alex Wright, especially bearing in mind all the resources he has to draw on at Fidelity," says David Thomson, chief investment officer at VWM Wealth.

He points out that Wright already has a strong performance record managing Fidelity UK Smaller Companies, although Wright himself has said he will continue to pursue the "contrarian value style" of his predecessors.

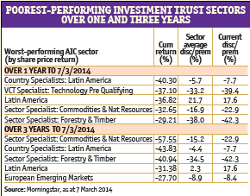

Whole investment sectors can also become unloved. One area that has gone from an investment must-have to "last year’s model" is the emerging markets sector. Performance has declined as international investors, concerned about global economic growth, have switched their money back to developed markets.

"A difficult 2013 has led to widening discounts on emerging markets investments trusts, and in the short term there will probably be more headwinds for these economies. But for those with a medium term view, this could prove to have been a good time to buy," says Charles Cade, head of investment companies at Numis Securities. investment trust, managed by the legendary Mark Mobius, is one of those that has seen its performance suffer of late and its share price discount to net asset value (NAV) widen. As Cade explains: "The manager’s rigid value approach to investing has meant that the trust has gone through a more difficult time than some others in recent years, but on the other hand it has outperformed in the long run."

On an medium-term view, it could be time to buy emerging market funds"Charles Cade

has also suffered but its short-term performance has held up somewhat better. This is the trust Numis prefers. "We like Austin Forey and think he is a good manager.

He has run the trust for the last 20 years. He takes a focused approach but he is also pragmatic," says Cade. He points out that the performance of various Asian investment trusts has also been hit recently, and that trusts that were previously on premiums are now on relatively large discounts – particularly those focused on quality companies, which have not been in favour over the past year. He cites trusts such as , and , which are all currently on discounts to NAV of over 10%. "These trusts are all run by good, highly experienced managers so they will at some point benefit from a re-rating and an improvement in markets.

Opportunities to buy them on these discounts don’t come along too often. Investors shouldn’t focus too much on (poor) short-term performance, because that’s what creates the opportunities," adds Cade. The investment arguments for gaining exposure to Asian markets, such as the trend towards a growing middle class in the region, remain as pertinent as ever, he says.

Miners at the bottom

Other key areas to suffer in recent years include mining and resources. "Mining has underperformed because slowing growth in China has reduced demand, but we now feel the bottom has been reached.

Evy Hambro has recently observed that there is a reduced potential for mining shares to fall further, after having significantly lagged general equity markets in recent years. The reason he gives for this is that the mining industry has made good progress in refocusing its strategy - operating costs have been aggressively targeted and investment in projects reassessed.

Many commodities are now trading close to or below their marginal cost of production, implying that price falls from these levels are likely to be limited, unless there is a complete collapse in demand. At the moment, generally improving global growth is supportive of commodity prices.

Focus on financials

The global financial crisis was the main cause for the setbacks that many funds have suffered in recent years. The slowdown in global growth affected the fortunes of some companies more than others.

Most directly affected was the financial sector, as banks were forced to seek government aid to keep afloat. Specialist financial funds lost ground as a result. However, Andy Merrick thinks these out-of-favour funds could be due for a comeback.

He says: " fund could be set for a period of outperformance versus many sectors. It is clear why financials were so unpopular.

Banks in particular had been so badly damaged, and public sentiment was so against them, that it has taken a while to recognise that the banks will continue to make money at our expense – and if they are not going bust they may be an investment opportunity, particularly as they may resume their dividend strategy once more. "

New environment

The global financial crisis also led to reduced attention being paid to environmental matters. However, some of the extreme weather events that have occurred more recently, such as the widespread flooding in the UK, may help to refocus governments’ attention.

Andy Merrick, head of investment at Skerritt Consultants, thinks that as a result funds such as may be poised to begin to deliver attractive returns for longer-term investors.

Merrick argues that it is often just when groups start closing funds, as they have done in the past with gold, natural resources and Japan, that sectors start taking off again. Therefore he believes one of the best "buy" signals for the clean energy sector was when BlackRock recently closed its New Energy investment trust.

"Timing is very difficult to get right, but there is a sense that we may not be too far away with this one," he concedes. "The investment objective of Schroder Global Climate Change is to provide capital growth primarily by investing in companies which will benefit from efforts to accommodate or limit the impact of global climate change. So it could do well."

Prior to the financial crisis, one of the major market movements to knock funds and investors backwards was the bursting of the technology bubble in 2000. Technology shares had risen sharply in the preceding three years and many investors had bought into the success of specialist technology funds. When share prices fell, investors had their fingers badly burnt.

Although the performance of funds in this sector has actually been rather good in recent years, many private investors have steered clear, so it has remained a relatively unloved sector. Yearsley says: "Private investors have tended to ignore technology funds because of past history.

It's taken a while to recognise that banks will continue to make money"Andy Merrick

But my view is that technology is continuing to change the world we live in and there are a lot of good technology companies out there. The fund we like for investing in this sector is ."

When looking for funds or trusts with improving prospects, however, investors don’t necessarily need to stick to specialist sectors. Charles Cade suggests that there are some global growth trusts that could also deliver improved returns in the near future.

, for example, has been lagging in recent years, but Cade says that situation is already changing. "Lord Rothschild is still involved, but changes have been made to its management team in recent years. Ron Tabbouche joined as investment manager in 2012 and performance had already started to improve last year, but the trust is still on a reasonable discount," he says.

Unloved generalists

Monks is another trust where performance has not been as strong as that of some of its Baillie Gifford stablemates, due to the nature of its diversified portfolio. But Cade believes the trust has a good manager and that its fortunes should improve as its investments start to come good this year.

Of course, investing in the unloved is not always a recipe for success . An example is gold. VWM’s Thomson says: "Gold has fallen from its perch. It may be a good idea to buy it for diversification when it is not at its peak price. But it is very unpredictable."