Final salary pension transfer demand declines during coronavirus crisis

Data reveals a notable decline in final salary pension transfers, with pension savers putting off decis…

17th April 2020 10:28

by Kyle Caldwell from interactive investor

Data reveals a notable decline in final salary pension transfers, with pension savers putting off decision-making in light of steep market falls.

Transfers out of final salary or defined benefit (DB) pensions have notably declined following the steep market falls that have taken place over the past two months in response to the coronavirus pandemic.

Analysis of data from company pension schemes by pension consultancy LCP found that member interest in transfers out of DB pension schemes is at its lowest level since early 2014, before the introduction of the pension freedoms.

According to LCP’s analysis, volumes of requests for transfer value quotations were already markedly down in 2019 compared with 2018, but the first quarter of 2020 has seen further declines.

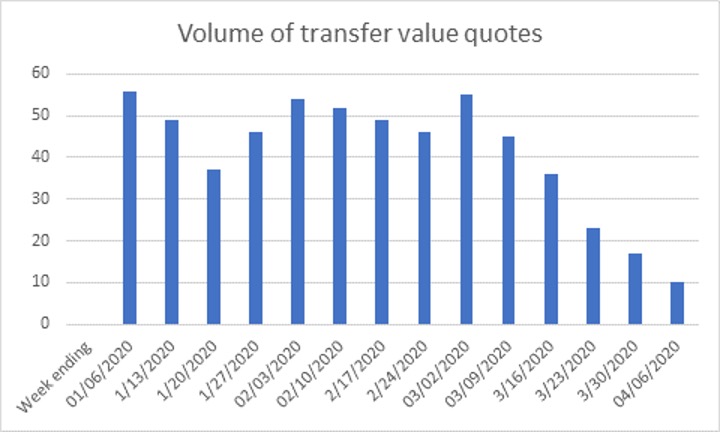

Based on a sample of around 80 DB pension schemes administered by LCP, the chart below shows the weekly number of requests for DB transfer values. In January and February, a typical week saw 40 to 50 scheme members request a transfer value, but that number has been falling steadily since the start of March, with volumes now down by more than three quarters.

According to LCP, possible explanations for the most recent decline in requests for transfer values include pension savers delaying decision-making in light of steep market falls. Another key driver is that the coronavirus has disrupted the work of financial advisers, which might have otherwise led to inquiries about transfer values.

On this front, in order to help financial advisers, the Financial Conduct Authority (FCA) has stepped in to reduce their workload by relaxing for six months a regulatory requirement that requires advisers and wealth managers to notify clients when a portfolio suffers a 10% or more drop in a three-month period.

In addition, a significant number of DB schemes have decided to put a temporary hold on providing transfer quotations to allow market volatility to settle down and give them time to review their transfer value calculations. In turn, this is likely to reduce overall transfer activity further for a period of time.

Bart Huby, partner at LCP, says: “Regulators are understandably concerned about the risk of people under financial pressure transferring money out of their pensions and being exposed to scams. But our data suggests that in the short term there has been a sharp drop in the number of people asking for information about transferring out of their salary-related company pension.

“This could reflect nervousness about market conditions or simply the fact that people have other things to focus on at the moment. What is not yet clear is whether transfer volumes will bounce back later in the year, as schemes relax temporary restrictions on processing transfers and more members decide that they need to access their pensions to meet financial pressures.”

- Why you should resist dipping into a pension after sharp market falls

Other recent developments have included proposed regulatory changes to final salary pensions delayed for six months. As things currently stand, financial advisers get paid only when a client moves a final salary pension pot (a practice known as contingency charging), which the regulator was considering banning; but the decision on these changes has now been delayed.

No reasons were given for the delay; instead, the FCA quietly updated its position on the matter on its website to say that its final decision on whether to ban contingency charging will be made in the second or third quarter of 2020. Its previous stance had been that a decision would be made in the first three months of this year.

The Work and Pensions Committee has previously called on the FCA to ban contingency charging, which it sees as a “key driver” of poor advice as it creates an incentive for advisers to recommend that their clients transfer out, whether it is the best option for them or not.

Anyone looking to transfer out of a defined benefit pension scheme needs to get financial advice before doing so if their pot is worth more than £30,000.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.