S&P 500: are we about to see a new all-time high?

What way will the US index go when the votes come in? Our chartist shares his views.

4th November 2020 10:14

by Alistair Strang from Trends and Targets

What way will the US index go when the votes come in? Our chartist shares his views.

The S&P 500 and CRISPR too! (SPi:SP500 & Nasdaq:CRSP)

It's been mentioned several times, a usually reliable ‘tell’ for US election results is the state of the markets. If the markets are doing well, the incumbent president wins.

By the time voting closes, it appears the S&P shall be up 56% during Trump’s time in office, the Nasdaq up 135% and Wall St up by 49%.

In comparison with prior presidential results, this tends suggest Trump should experience a landslide, able to again frustrate virtually an entire media who dislike the bloke.

Perhaps this year shall prove to be the election result which turns ‘normal’ on its head.

After all, 2020 has utterly failed in providing anything else approaching normal.

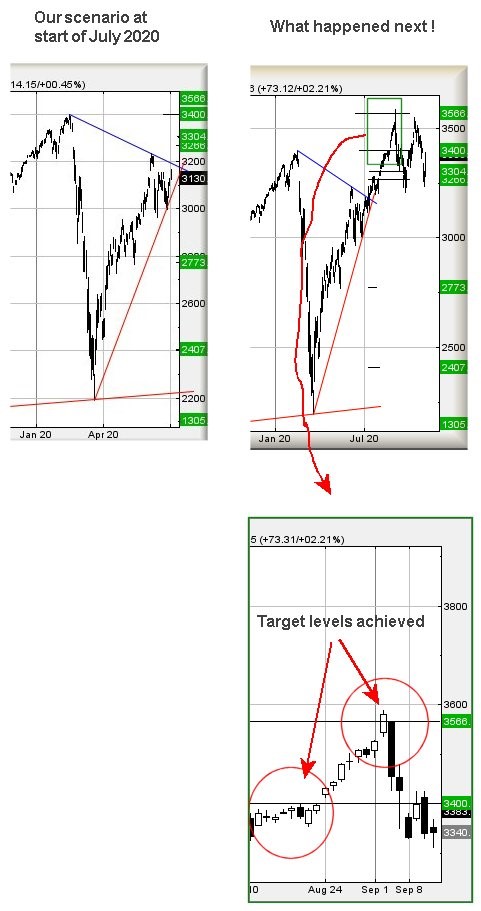

However, our previous analysis against the S&P in July proved pretty concise, the index performing pretty much as expected at each target level.

Source: Trends and Targets Past performance is not a guide to future performance

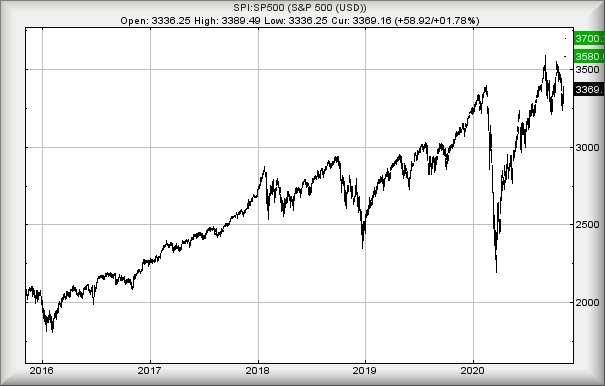

The last week has seen the S&P execute some fairly interesting movements, ones which almost feel like they attempt to conceal optimism.

It's quite apt, given the singer Lady Gaga has been campaigning for Biden, the S&P performed its own Gaga manouvre, a gap down followed by a gap up.

This sort of nonsense is usually a precursor to solid market gains and in the case of the S&P, we shall be convinced if the market heads above just 3,430 points.

This should prove significant, triggering movement toward an initial 3,580 points with secondary, if beaten, a comfortable looking 3,700 points and a brand new, shiny and confident all-time high.

It appears, if the numbers can be trusted, we should anticipate Trump again excelling at issuing incomprehensible tweets from the bar at the White House, at odd hours.

Source: Trends and Targets Past performance is not a guide to future performance

CRISPR Therapeutics (Nasdaq:CRSP)

It's unusual to come across something which sounds like crisps without seeing Gary Lineker, a former footballer turned unhealthy food promoter, involved in the background.

Recent price moves have felt defensive, CRISPR Therapeutics (NASDAQ:CRSP) carefully avoiding closing a session below the red uptrend since March of this year.

Perhaps this indicates some surprise recovery is almost upon us.

Price weakness below $84 (£64.90) certainly risks some danger, apparently capable of triggering reversal down to an initial $68.

Visually, we're not convinced a bounce shall be generated at such a level, especially as any weakness below allows a bigger picture reversal to a hopeful bottom of $48.

If we choose to take hope from the price refusing to close below red, some surprising gains look pretty certain if the share price manages a miracle recovery above blue, presently $99.

A trigger such as this calculates as capable of an initial $111, matching the previous all-time high.

If bettered, further traffic to $131 works out as possible. The bad news?

We suspect it intends $48.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.