50% upside makes water shares exciting

5th June 2015 16:20

by Lee Wild from interactive investor

Investing in water companies is hardly for thrill-seekers. Utilities are typically held for income than for significant capital gain. However, while yields remain impressive, share prices have risen sharply over the past year, too. But that doesn't make water shares a no-go. On the contrary, attractive fundamentals and a possible wave of takeover activity make water stocks exciting again.

With the recent regulatory review process now over, the sector enjoys visibility on water prices out to 2020. New dividend policies mean payouts should grow by at least RPI inflation for the next five years - , and currently offer payouts way better than real government bond yields. There's political certainty following a Conservative majority at the election, too.

"As share prices have increased 'investor returns' have converged toward the low risk peer group," say analyst at Deutsche Bank. "However, we think there could be scope for the UK water stocks to trade at a premium to the peer group, given high visibility and M&A potential." Outperform, and incentive programmes could trigger even better returns.

Deutsche repeats its positive views on United Utilities ('buy', 1,100p target price from 1,040p) which offers a prospective yield of 4%, and Severn Trent ('buy', 2,350p from 2,200p), where the broker rolls over valuations to a March 2016 basis and updates estimates following recent full-year results, offering 3.9%.

(click to enlarge)

And there's potential capital upside from takeovers amid a growing trend for infrastructure funds to buy listed water companies. Severn Trent spent £19 million in 2013 defending itself against a £5.3 billion approach worth 2,200p per share from the LongRiver Partners consortium, led by Canada's Borealis Infrastructure Management. But there's been action more recently and infrastructure funds now own half the industry.

"OFWAT has signaled an increased openness to M&A and Pennon's recent acquisition of Bournemouth Water at more than a 50% premium to RAB [Regulatory Asset Base] (on a fair value of debt basis) could be the start of a wave of M&A in the UK water sector in our view," writes Deutsche. "We see scope for transaction multiples to rise and renewed interest from infrastructure or sovereign wealth funds in the space."

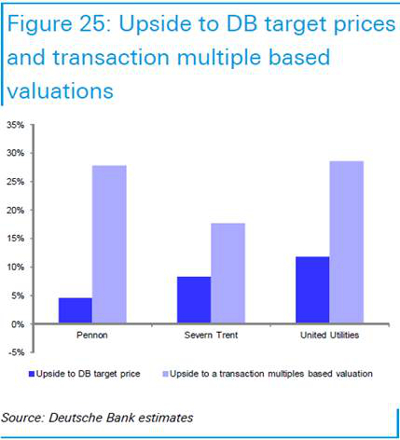

Indeed, despite the sector trading on a 30% premium to RAB - broadly in line with the 2007 peak - the bank thinks there could be at least 20% upside to the value of listed UK water companies based on its analysis of potential transaction multiples. There's potentially materially greater upside if there are mergers, it says.

(click to enlarge)

Sticking with just takeover possibilities, Deutsche reckons a bidder for United Utilities or Severn Trent could justify up to a 40% premium, while a bidder for Pennon's water business, South West Water, could justify up to a 60% premium because of its higher returns.

"We think that a bidder could justify a bid at c.£25.5/share for Severn Trent, c.£11/share for Pennon; and c.£12.5/share for United Utilities. Our illustrated transaction multiple based valuations offer c.15-30% upside to current share prices. Adding merger synergies would lift the potential upside to c.50% on average for the three stocks."

Water isn't boring anymore.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.