AIM star Filtronic watches shares crash 56% in one morning

12th December 2018 14:27

by Graeme Evans from interactive investor

They quadrupled in less than four months this year, but Filtronic just lost over half its value in quick time. Graeme Evans explains what happened to this popular AIM stock.

As hard as it tries, technology company Filtronic just can't rid itself of the performance fluctuations that continue to dash the high hopes of investors.

The most recent bout of optimism stemmed from its Massive MIMO antenna product, which enables the use of beamforming techniques essential to 5G networks. Announcing a partnership with Nokia in April, Filtronic said the benefits represented a compelling business case for mobile network operators and a major step in the development of dense 5G networks.

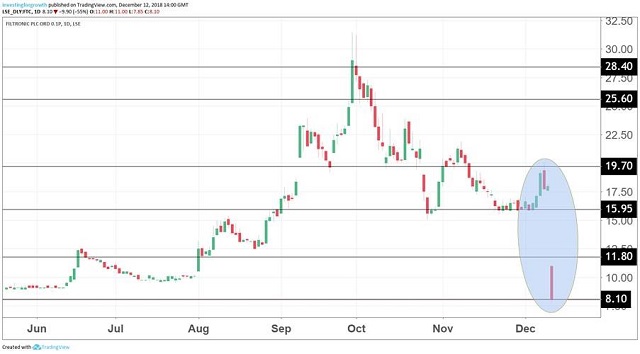

Shares peaked at over 31p in September, only to slump more than 50% today to a low of 7.9p after Filtronic reported a significant cut in forecast demand due to a lead client looking to deploy different frequencies to those it had originally indicated.

This has forced the company to write down the development costs relating to Massive MIMO in its half-year results. It is now reviewing its options for this part of the business.

Source: TradingView Past performance is not a guide to future performance

It's yet another setback for the stock, which suffered a similar fate between 2013 and 2015 when shares fell from 80p to 5p. Earlier this year, the stock slid to 9p after it said sales were highly concentrated and exposed to fluctuations in demand due to the types and size of projects in its portfolio.

As our companies analyst Edmond Jackson wrote in September, Filtronic remains a stock "that can put hairs on your chest" despite its lowly valuation of less than £40 million.

Those with long stockmarket memories will be able to recall its tech boom days when shares were trading at 2,350p a share. There have been plenty of false dawns since, but what makes today’s warning unfortunate is the progress that Filtronic had been making on addressing its lumpy revenues performance.

It has been looking beyond its traditional mobile telecoms infrastructure market, with revenues and profits from defence and aerospace and public safety networks higher in the year to May 31.

Away from today's antenna business setback, it said that further progress had been made in critical communications markets, with this part of the business trading in line with expectations.

There have been further contract wins in defence and aerospace, while the public safety market continues to see robust demand as government agencies expand their secure private networks.

Sales for the half year fell to £10.4 million from £12.8 million a year earlier, but this was ahead of internal projections. Net cash fell £800,000 to £2.3 million, with Filtronic confident it has sufficient reserves to operate at this lower level of revenues while it explores a strategy for the antenna business.

Other recent moves to improve the company's performance have included a reorganisation of its sales force into two teams. The Filtronic Wireless and Filtronic Broadband businesses have also been combined so the company can better utilise the respective engineering, operations and sales resources.

*Horizontal lines on charts represent levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.