Annualised returns of 12% since 2013, but now I am selling

Share Sleuth explains why it's time to dispose of one of the portfolio's holdings.

1st July 2019 11:20

by Richard Beddard from interactive investor

Share Sleuth explains why it's time to dispose of one of the portfolio's holdings.

News that Science (LSE:SAG) has acquired 9% of Frontier Smart Technologies Group (LSE:FST) has sealed the former company's fate as far as the Share Sleuth portfolio is concerned. On 28 May, I liquidated the shareholding.

As I reported last month, a strategic review at Science has opened the door to large acquisitions, potentially unrelated to the company's existing scientific consultancy business. As Science's executive chairman and majority shareholder has a reputation for turning businesses around, the chances were that the review would involve the company using money raised by mortgaging properties it owns to buy struggling companies. Then it would set about improving their performance.

Frontier is the first of Science's targets to come to our attention because, around the time it acquired the shareholding, Science also made and then withdrew an offer to buy the company. Frontier, which is in debt and losing money, rejected Science's offer, claiming it was not in shareholders' interests. Science disagrees.

A frontier too far

I have not considered the merits of this deal, or the possibility that something will come of it. As a public company, Frontier has not made a profit, so it is not the kind of business I am comfortable evaluating. It is also headquartered in the Cayman Islands, a tax haven that shelters Frontier from regulation. The putative deal confirms what I feared, that as it absorbs companies like Frontier, Science will also slip beyond my ken.

On 28 May, I 'sold' the portfolio's entire holding at a price of 198.4p, the actual price quoted by a stockbroker. After deducting £10 in lieu of broker's fees, the trade added £5,267 to the Share Sleuth cash balance.

I first added Science in 2013 at a price of 100p and added more shares at 115p in 2014. While the investment turned out to be one to buy and hold for five or six years rather than forever, it brought me some joy. Including dividends, Science earned the Share Sleuth portfolio an annualised return of 12% according to SharePad, the software I use to track performance. Science worked for a fee, developing sometimes unproven technologies for other companies. It was a low-risk way to invest in progress. Now it's buying technology companies, the risk has risen.

While the portfolio has nearly £6,000 in cash to burn, more than enough to fund a new addition, I mainly have sales on my mind. Portmeirion (LSE:PMP) could be the next share on the block.

The potter, famous for highly stylised classic British tableware designs such as Portmeirion Botanic Garden, issued a profit warning in May. The reason for the warning was an unquantified but calamitous slump in sales in South Korea. Not long ago, South Korea was the biggest market for Botanic Garden, Portmeirion's most popular design, but in the financial year ending in December 2018, before the recent collapse, sales in South Korea were 45% lower than their peak in 2014. South Korea is no longer vying with the UK and North America to be Portmeirion's biggest market.

Small dip on an upward path

Strategic drift

Although sales have grown outside Portmeirion's three biggest markets and compensated for the decline in South Korea, I had thought the huge popularity of Botanic Garden was evidence that Portmeirion's designs can be enduringly popular in the Far East as they have been here and in North America. Now I am worried they are a bit of a fad.

These fears are exacerbated by Portmeirion's strategic drift. Once focused on tableware, the company branched out into scented candles with the acquisition of Wax Lyrical in 2016. Portmeirion expects to repeat its export success, but I am doubtful scented candles are as distinctive or as enduring as the tableware designs – some popular for centuries.

Selling science

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 5,900 | ||||

| Shares | 118,004 | ||||

| Since 9 September 2009 | 30,000 | 123,904 | 313% | ||

| Company | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 1,022 | 2 |

| AVON | Avon Rubber | 192 | 2,510 | 2,523 | 1 |

| CFX | Colefax | 434 | 943 | 2,322 | 146 |

| CGS | Castings | 1,109 | 3,110 | 4,680 | 50 |

| CHH | Churchill China | 341 | 3,751 | 5,371 | 43 |

| CHRT | Cohort | 1,600 | 3,747 | 6,640 | 77 |

| DTG | Dart | 456 | 250 | 4,072 | 1,529 |

| DWHT | Dewhurst | 735 | 2,244 | 8,269 | 268 |

| GAW | Games Workshop | 198 | 568 | 8,732 | 1,438 |

| GDWN | Goodwin | 266 | 6,646 | 8,140 | 22 |

| HWDN | Howden Joinery | 748 | 3,228 | 3,740 | 16 |

| JDG | Judges Scientific | 252 | 5,989 | 7,787 | 30 |

| NXT | Next | 45 | 2,199 | 2,582 | 17 |

| PMP | Portmeirion | 349 | 3,212 | 3,560 | 11 |

| QTX | Quartix | 1,085 | 2,798 | 2,864 | 2 |

| RM. | RM | 1,275 | 3,038 | 3,086 | 2 |

| RSW | Renishaw | 92 | 1,739 | 3,581 | 106 |

| SOLI | Solid State | 1,546 | 4,523 | 7,544 | 67 |

| SYS1 | System1 | 463 | 1,793 | 1,097 | -39 |

| TET | Treatt | 1,222 | 1,734 | 5,572 | 221 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,320 | 186 |

| TRI | Trifast | 2,261 | 3,357 | 5,336 | 59 |

| TSTL | Tristel | 750 | 268 | 2,325 | 767 |

| VCT | Victrex | 150 | 2,253 | 3,009 | 34 |

| XPP | XP Power | 339 | 6,287 | 7,831 | 25 |

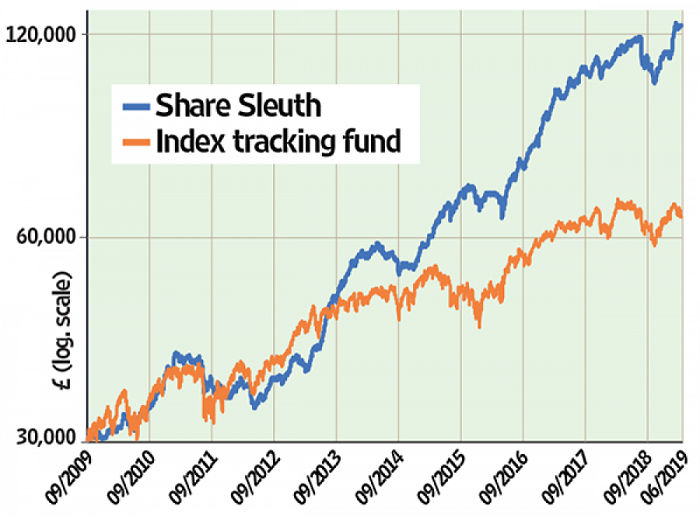

Notes: No new additions. Transaction costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £123,904 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £63,089 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, 4 June 2019.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.