Are Next shares a buy for the long term?

18th May 2018 15:42

by Richard Beddard from interactive investor

What Next?

While high street stalwarts from to have disappointed traders with sub-par performance lately, , the fashionable but not too fashionable clothing and homeware retailer, has surprised them by reporting sales up 6% in February, March and April compared to the same time last year.

It's an easy comparison because sudden bursts of high summer temperatures in the spring encouraged more shoppers to buy shorts and T's. Next had also removed some of its most reliable sellers from stores the year before, favouring more trendy gear. Sales fell, and it spent the rest of the year putting staples back into shops.

This self-inflicted blow was one of the reasons full year profit for the year to January 2018 fell 7%, and 24% in Next's high street stores.

Why profit fell in 2017-2018...

Next already earns much more profit online than in its stores, but every pound in sales lost from retail stores has a big impact on profit because it cannot easily cut costs. Most store-related costs are fixed, like rent, rates and electricity.

Online costs like postage and handling returns tend to increase with growing revenue. Add higher variable costs to increased IT spending as Next beefed up its systems, and online profit only increased 7%, while revenue increased 9%.

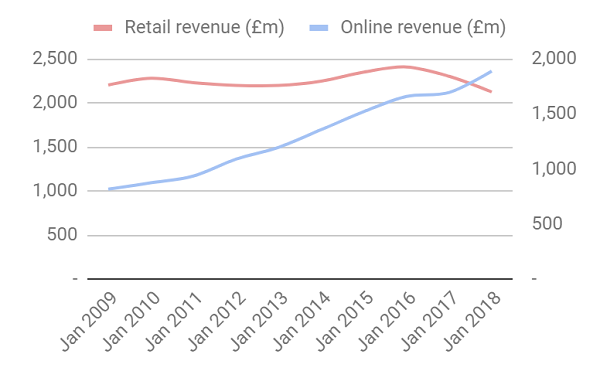

In terms of revenue, the situation doesn't look too serious, with online gains broadly making up for retail declines in the last two years:

Source: interactive investor Past performance is not a guide to future performance

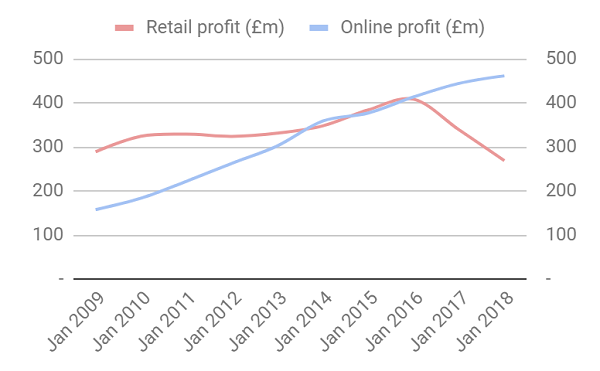

But plunging store profitability looks scary, and explains the 7% fall in profit overall:

Source: interactive investor Past performance is not a guide to future performance

We must be careful not to blithely project these trends into the future.

Next believes much of the decline in 2017-2018 was due to temporary factors: the 'range errors', higher prices for imported clothing, weak demand due to the squeeze on real incomes, consumer preference for experiences, like eating out, and increased IT spending.

In the year to January 2019, it predicts sales will still only increase modestly and profit will probably decrease, but not by nearly as much. It is happier with the product range, the strengthening pound will reduce import costs, and IT spending is flattening off after a two-year surge to catch up with online rivals.

The company believes we'll begin spending more on clothes again too, though it's not holding its corporate breath, which leaves the transition to the Internet as the big strategic challenge.

Still special?

Judging by the firm's performance, Next is still pretty special.

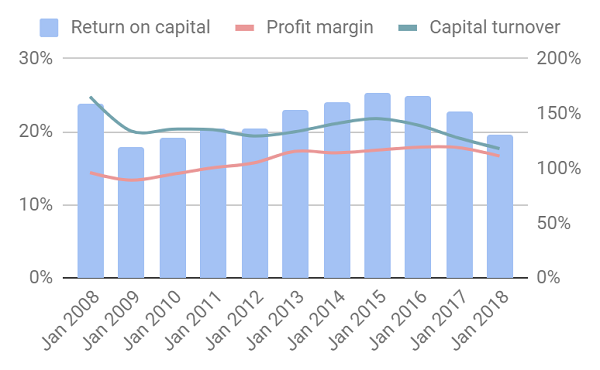

Source: interactive investor Past performance is not a guide to future performance

The chart shows profitability is high but dipping. Nevertheless, a 20% after tax return on capital is enviable, particularly for a retailer..

The dip, though, is worrying because the things that made Next special are diminishing.

Directory, it's peerless mail order catalogue, is now NEXT Online. Still highly successful, it competes with all the other online clothing retailers. While the printed catalogue still exists, it contains fewer pages and fewer photographs, and it's distributed to fewer people, every year.

Next's ability to judge fashion sensibilities and source clothes from the Far East, has also been challenged successfully by new brands with the capability to deliver the latest trends to their warehouses and stores in weeks.

Strategy #1 Defence

Next's strategy is, in part defensive, predicated on getting the retail basics right: improving the range, making efficient use of store space, sourcing cheaply, controlling costs, and focusing on the customer experience.

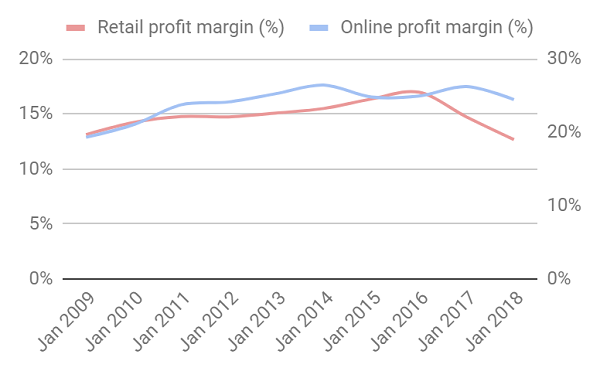

One of the best things about retailers is you can assess their operations any time you choose, just by visiting the stores and websites. I think Next does the basics well. The stores are smart relaxing environments, and the staff are as attentive as you want them to be. The average store after tax profit margin is 13%, still healthy.

Source: interactive investor Past performance is not a guide to future performance

But retail basics are not going to be enough to shore up profitability and get Next growing again. The company believes the shift to the Internet is profound. In its projections, Next uses a worst case scenario of 10% compound annual retail sales declines, which has focused its attention on controlling costs, while finding new ways to profit from stores.

Before it opens a new store, Next models whether it will still be profitable in the 10th year of operation if sales fall at the worst-case rate. It is renewing leases on shorter terms, which gives it the option of handing back stores before they become unprofitable. Next is forcing landlords to share the pain of high street contraction. Typically it's achieving more than 20% rent reductions on lease renewals, and renewal terms of only five years.

To keep the store portfolio profitable, it plans to rent space to concessions. A pilot store in Manchester's Arndale Centre has a restaurant, a cafe, a florist, a prosecco bar, a children's activity centre, and a card and stationary shop. Soon it will have a barber as well.

Strategy #2: Offence

Switching to offence, Next plans to maximise online growth, boosting the functionality of its back office systems and websites and focusing on areas it may already have an advantage: nextpay, distribution, and overseas online sales served through its European distribution hubs.

Two years ago investors were concerned about Next's lucrative credit service because it was shipping customers. Paying with credit and debit cards is more convenient online than the rigmarole of setting up a credit account. But Next has relaunched Next credit as nextpay and credit accounts are growing again. It plans to make it easier for customers to pay, both by offering nextpay in stores, and by allowing customers to pay online in three interest-free instalments without setting up an account.

While credit has stabilised, the fastest growing bits of Next are overseas online, and LABEL, the bit of NEXT Online that sells 'premium' brands like Ted Baker, Joules and Barbour. Next says distribution is so efficient it thinks it can be its partners' most profitable route to market, more profitable than their own stores or websites. Label and overseas online each earned revenues of about £300 million of total online revenue of £1.9 billion, having more than doubled revenue over the last three years.

Lots of parts, all of them moving

The future is mostly online and increasingly multi-brand. That's unsettling because it is not obvious how Next will differentiate itself in a very competitive market. Distribution and marketing are key to online growth, but though Next may have a superior distribution network I doubt its website IT is superior.

After recent investments, maybe it's good enough. NEXT says it's deploying a new Data Management Platform that should improve the return on targeted advertising, and a new search engine that learns from customers' searches.

My teenage and young adult kids don't shop at Next. I wonder whether their generation will ever become customers, habituated as they are to online insurgents and as well as youth focused brands like Topshop. Next tells me it hasn't noticed an appreciable change in the age profile of customers, who are typically between 25 and 45 years old, offering some hope today's youngsters will grow into the brand.

It also owns its own youth brand, Lipsy & Co, acquired in 2008. As well as Lipsy branded clothing, Lipsy sells Boohoo, Misguided and many other brands through NEXT online. It's growing at a fair clip, but revenue of £115 million puts it in the shade of the Next mothership (Revenue: £4 billion) and ASOS (Revenue: £1.9billion).

ASOS is the elephant in the room. In the year to August 2017, it earned a fraction more revenue than NEXT Online did in the year to January 2018. It's growing much faster, but makes much less profit. As Next loses customers from its stores, it may have to sacrifice profitability online, charging lower prices to compete. Increasing sales of other brands will also put pressure on NEXT Online's profit margins.

Change is unsettling, but doubts must be set against Next's long record of outstanding performance, which probably stems from its culture. I believe it's extremely well organised, and that professionalism will help it adapt.

The company promotes from within and Lord Wolfson, its principal architect, leads a very experienced management team. It's a big company and executive salaries are high, but the board has also shown restraint, suggesting the success of the business, rather than personal profit, is its main concern.

Scoring Next

As usual I score each category from 0 to 2 except valuation, which is scored from -2 to 2:

[2/2] How well does it makes money?

Next generates high levels of profit and cash and reinvests it only when it's confident it can make more.

[1/2] How will it make more money?

Many of Next's advantages are eroded, but it's building on strengths in distribution and shoring up weaknesses in IT.

[1/2] What could go wrong?

The industry is changing and the future is uncertain, but Next strategy addresses risks inherent in high fixed store costs and heightened competition.

[2/2] Will all stakeholders benefit?

Next has a highly commercial culture that rewards staff, shareholders and suppliers in the interests of shareholders.

[1/2] Are the shares inexpensive?

The shares trade at about 16 times adjusted profit in the year to January 2018.

Scoring Next wasn't easy. I'm worried I'm putting more emphasis on Next's illustrious past than it's uncertain future but [7/10] means, on balance, I think it is suitable for long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Richard owns shares in Next.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.