The Dax, Germany and a sceptical look at Lloyds Bank too

8th November 2021 07:26

by Alistair Strang from Trends and Targets

Is a bullish period for Lloyds Bank shares over, or is there more upside to come? Independent analyst also looks at the German Dax index.

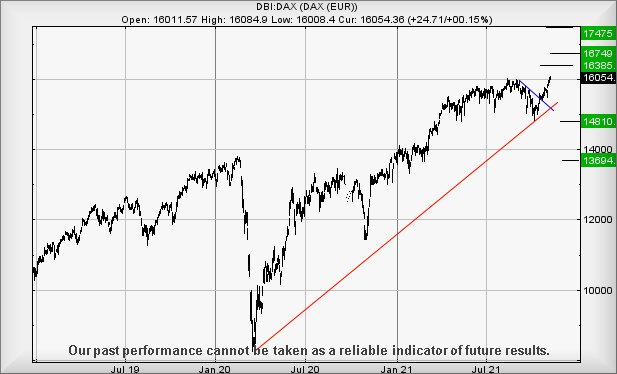

The German DAX index is looking quite extraordinary, now trading higher than any point ever. It has long bettered its pre-pandemic high, the index reached a logical ceiling level, and now is cheerfully powering upward to hitherto unimagined levels.

The argument will doubtless be made of such performance occurring due to a change in the DAX's make-up last month. It’s wrong, the DAX high back in August was a new all-time high, achieved before the constituents were shuffled.

The immediate situation is quite positive, the Big Picture claiming the DAX intends to head to 17,475 points eventually as the next major point of interest, a price level where normal calculations imply some hesitation should be expected.

Even nearer term, any ability to exceed 16,090 points signals the potential of movement continuing to 16,385 points with our secondary, if bettered, working out at 16,749 points.

- ii COP26 hub: see tips, news, comment and analysis from our experts

- Subscribe to the ii YouTube channel for interviews with popular investors

- Why reading charts can help you become a better investor

For everything to go horribly wrong for Germany, the market requires to trade below 15,100. Such weakness permits reversal to 14,810 initially with secondary, if broken, a rather more painful 13,694

Source: Trends and Targets. Past performance is not a guide to future performance

When we previously reviewed Lloyds Banking Group (LSE:LLOY) three weeks ago, we had been privately comfortable that the share price was heading to 51.9p next. The movement triggered eventually, the price surged over a few sessions and instead of achieving our smug 51.9p, the highest achieved was just 51.58p.

In the days since, the share price experienced mild hysterics at its temerity, slamming itself back down to the 48p level again.

The implication of this surge bothers us quite a lot. The suggestion is of weakness, despite the share breaking through its Blue downtrend last October. If this theory proves correct, travel below 48p brings the potential of a trip down memory lane to 46.3p.

- Chart analysis: Warren Buffett, Bank of America and Lloyds Bank

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

We’re being a little sarcastic, thanks to Lloyds appearing to enjoy the 46p level since April this year, hinting of a desire to pivot above and below such. If broken, our secondary is a less likely visit to 44.4p.

Should things start to go right for Lloyds Bank, the share price now needs better 50.7p to hopefully trigger movement to an initial 53p, with our secondary calculating at an attractive 58.3p. As ever, due to this matching the pre-pandemic high, we would anticipate some stutters should such a target make an appearance.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.