Three AIM income shares for your ISA

19th February 2016 16:12

by Andrew Hore from interactive investor

As we approach the end of the tax year, it's time to think about using up your ISA allowance. This week I'm making three suggestions for stocks to put in your ISA, all of which have a decent yield as well as potential to grow earnings.

All three of these companies offer a potential yield of at least 4%. That kind of income is difficult to obtain these days without taking a significant level of risk. While these small AIM companies have their challenges, they do have good track records and generate cash.

Next time I will make three more suggestions weighted more towards growth than income.

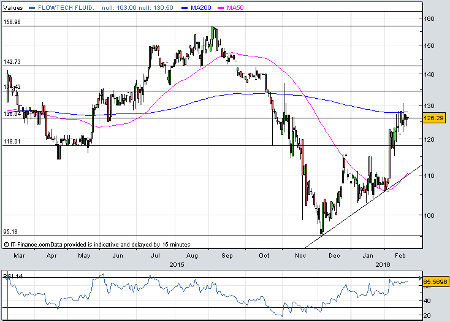

Flowtech Fluidpower

125.63p

is a supplier of niche fluid power products with a strategy to be a consolidator in its markets. Lancashire-based Flowtech is already the UK's leading supplier of technical fluid power products. Fluid power is a fragmented market, though, and that is why such a small company, capitalised at just £54 million, can have a leading position and maintain margins in this area, unlike at the commodity end of the market.

Flowtech has a strong base and the plan is to expand through bolt-on acquisitions and more are likely in the next 12 months. Management says that there is little competition for the businesses it seeks to acquire. Flowtech keeps the names of the acquired businesses so that it benefits from their long-term reputation.

Trading has been tough in the past year, in part due to the poor demand from the oil and gas sector. In the six months to June 2015, revenues rose by one-quarter to £21.4 million and underlying operating profit edged up from £3.28 million to £3.4 million. Profit was held back by a weaker contribution from the Benelux business, partly due to the decline of the euro, and the added cost of being quoted on AIM, which the company joined in May 2014.

A trading statement indicated that full-year revenues were 15% ahead at £44.7 million and profit is expected to improve from £6 million to £6.7 million, helped by contributions from acquisitions. House broker Zeus Capital forecasts a 2016 profit of £8.1 million and a 2017 profit of £8.4 million.

Net debt was £7.46 million at the end of June 2015 and, due to subsequent acquisitions, this rose to £8.9 million by the end of 2015. Cash was generated from operations last year.

Earlier this year, the share price had fallen back to just above its May 2014 placing price of 100p, but it has recovered. Even so, the shares are trading on nine times prospective 2016 earnings. The total dividend last year was 5p a share and a rise to at least 5.25p a share is expected for 2015, suggesting a yield of 4.2%. The dividend should grow along with earnings.

This is a steady business with potential upside from consolidation.

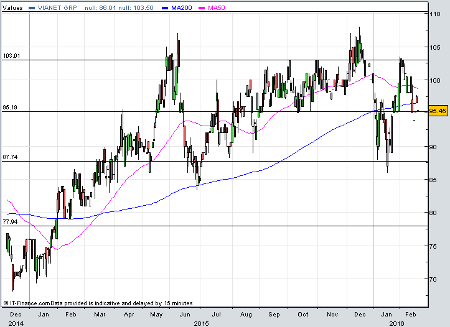

Vianet

96.5p

Fluid monitoring and machine-to-machine systems supplier has strengthened its balance sheet by selling its fuel division to Wayne Fueling Systems for £3.5 million in cash. That deal was completed on 1 February. Vianet will instead focus on its leisure and vending monitoring and data management operations.

The iDraught system for pubs and bars is still being hit by the uncertainty in the pub market and merger activity in the sector, but new sales are being made. There is also potential to grow sales in the US, but progress has been slow.

The part of the business that has greatest scope to grow is the vending telemetry operation. Hiring new management has increased costs and dampened short-term profit, but the contactless payments service has been launched and a number of pilots with potential customers are underway.

Vianet maintained its interim dividend at 1.7p a share. The fuel division made an operating profit of £224,000 in the six months to September 2015 out of total group operating profit of £1.75 million on revenues of £9.84 million, of which £2.89 million came from the fuel business. This represented a recovery from a poor performance by fuels the previous year. The leisure business, including iDraught, still makes most of the money.

Net debt was £2.32 million at the end of September 2015 and the business has been generating enough cash to cover capital investment and the cost of the dividend. The cash from the disposal should leave Vianet in a positive cash position.

There is no growth forecast for the Vianet dividend for the next couple of years, but, importantly, the earnings are growing and providing a healthier dividend cover. This provides some comfort that the dividend will not be cut. Further earnings growth will provide an opportunity for a dividend increase.

A full-year profit of £2.6 million is forecast, which puts the shares on less than 13 times 2015-16 prospective earnings, while the yield on an unchanged dividend is 5.8%. The dividend cover would be around 1.3 times this year.

There has been some share buying by directors in recent weeks. Vianet does not have the ideal record of smooth profit growth, but it has invested in machine-to-machine and other technology which should make greater contributions over the next few years.

Pressure Technologies

168.5p

Engineer has been even more hard-hit than Flowtech Fluidpower by the decline in the oil price, and its profit dived last year. However, Pressure Technologies has a good long-term track record and it is strong enough to continue to make money even in negative markets that push parts of the business into loss.

Sales of wear parts to oil producers are holding up, but it is the exploration side where demand is poor. Management cut costs to bring them into line with the current level of business and further cost savings have been put in place since the September year-end. Benefits will come through in the second half.

The core business of the group is the production of high-specification seamless steel gas cylinders and the company has more than one century of experience in this area. Demand is increasing from the defence sector, but this remains a relatively small part of revenues. The group has built up a presence in the US in order to try to gain defence business in North America.

Engineering products and precision machined components businesses have been added over time, and these are particularly dependent on the oil and gas sector, and the latest diversification was into the supply of cylinders to the biogas sector. This new business took a long time to take off, but it is proving useful now that the oil and gas sector is not generating the work it did previously.

In the year to September 2015, revenues grew from £54 million to £55.6 million, but acquisitions masked the decline in oil and gas related revenues. They still accounted for nearly three-fifths of the group total, though. The drop in oil and gas-related business meant that underlying pre-tax profit slumped from £7.6 million to £2.7 million, although £5.94 million of cash was generated from operations.

Net debt was £7.1 million at the end of September 2015. The final dividend is 5.6p a share meaning that the total dividend is unchanged at 8.4p a share.

Management admits that there is little prospect of an improvement in demand from the oil and gas sector this year, but it believes that it is maintaining market share. Cantor Fitzgerald forecasts an underlying 2015-16 profit of £3 million. That puts the shares on just over 10 times prospective 2015-16 earnings with a yield of 5% on an unchanged dividend. The main concern regarding this forecast is that the ultimate timing of deals for the biogas sector could mean that revenues are delayed.

Another thing to note is that the shares are trading at a discount of nearly one-third to the net asset value of £36.3 million at the end of September 2015.

This is a good time to buy shares in Pressure Technologies for an ISA and tuck them away ready for the upturn.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.