Why this fund manager is hanging up on Vodafone

Hear what this fund manager's trading and why he sold Vodafone shares ahead of upcoming final results

10th May 2019 14:20

by Tom Bailey from interactive investor

Hear what this fund manager is trading and why he sold Vodafone shares ahead of upcoming annual results.

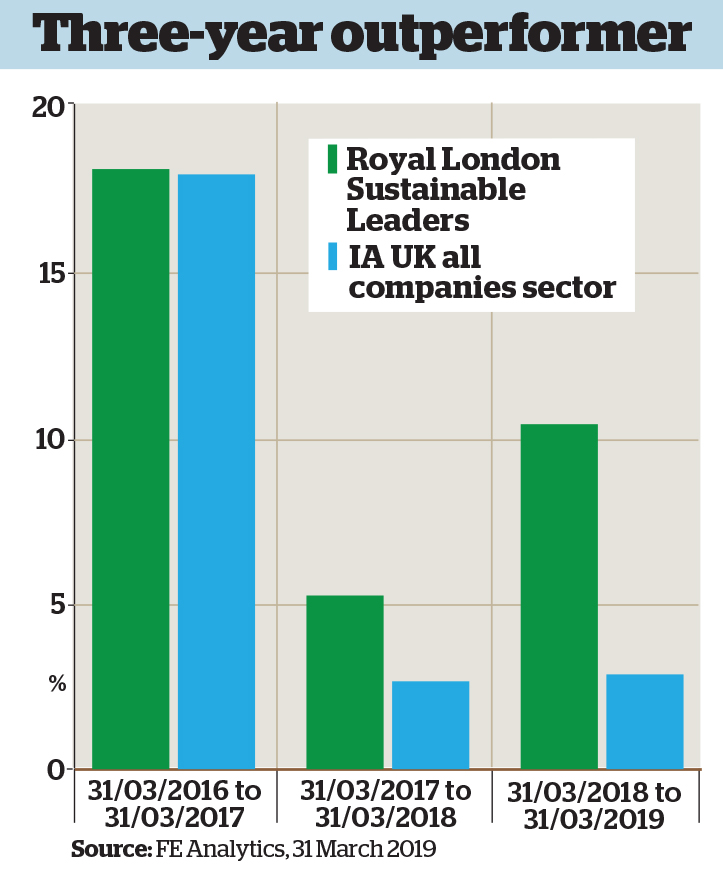

Royal London Sustainable Leaders, as the name suggests, focuses upon sustainable businesses. "Our investments are skewed towards companies with products and services that support transition to a cleaner, safer and more sustainable world," says Mike Fox, who has managed the fund since 2003.

Fox says the fund's stockpicking process is primarily bottom-up. However, alongside the usual fundamental analysis expected of any stockpicker, he also looks at the sustainability credentials of each company.

This process includes negative screens alongside positive ones – so as well as excluding those companies deemed to be at odds with environmental, social and governance (ESG) values, he also attempts to find firms that provide a net benefit to society and/or are sector leaders in terms of ESG management.

The fund is therefore heavy on certain themes such as healthcare, clean energy and cloud computing. However, Fox stresses, he does not set out to 'chase' themes. If the fund's portfolio is populated by a certain sector, that's simply the result of Fox's bottom-up, ESG-integrated stockpicking process.

Over the past five years, it has returned over 66% to investors, compared to 34% for the IA UK all companies sector average, as at 11 April 2019.

Buy: London Stock Exchange Group

(LON: LSE)

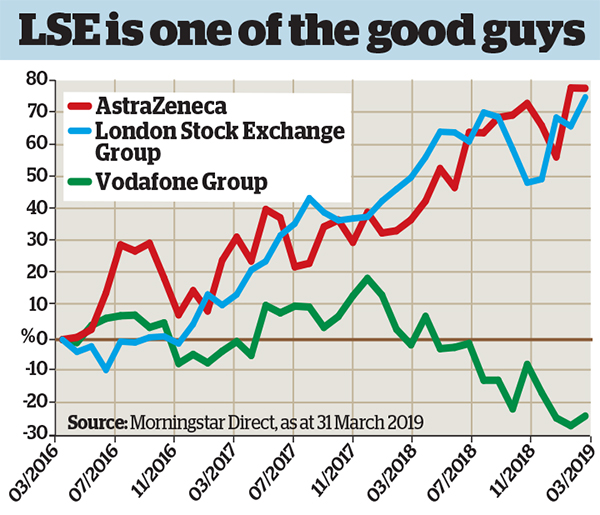

Until recently, Royal London Sustainable Leaders ruled out investing in the London Stock Exchange Group (LSE:LSE) due to a high-profile boardroom spat. "The company has clearly had corporate governance issues," says Fox; "those precluded us from investing." However, he says, corporate governance has been improving lately, allowing the fund to invest.

Of course, that alone would not be reason for investing. The company itself is "very attractive," says Fox. "We are now in an environment where stock exchanges are consolidating globally. This means very big barriers to entry." As ever, a business with such an economic moat has a strong chance of remaining profitable, with competitors unable to enter the market and drive down margins.

At the same time Fox says that the company produces a "net good" for the world. "Its underlying business model is to make capital markets work in a safe and efficient way. It keeps financial markets orderly." Fox started to build the fund's position in the company in March of this year.

Hold: AstraZeneca

(LON: AZN)

"We really like this company as it is involved with development of the next generation of cancer treatment, namely immunotherapy and gene therapy," says Fox. Such new treatments are expected to be more effective than chemotherapy. That this fits in with the "net positive" requirement for investors almost goes without saying.

But there is also a strong business case for the holding. According to Fox, development of immunotherapy and gene therapy products will help to meet the continuing need for cancer treatment.

The company, however, is just a hold for now. Fox notes that it now trades on very high multiples – a recognition by the market of the potential for the products AstraZeneca (LSE:AZN) is producing. That was not the case when the fund first bought into it over five years ago. Back then, notes Fox, there was still scepticism over the value of gene therapy and immunology. "Now there's more certainty that the area will be transformative. The current share price is a recognition of this. It's still the same story, but it has progressed," he says .

Sell: Vodafone

(LON: VOD)

However, it does not always happen that the market comes to agree with your buying thesis. The opposite occurred in the case of the fund's Vodafone Group (LSE:VOD) holding.

"We used to own Vodafone until three or four months ago," says Fox. He first bought a stake over five years ago. The thinking at the time was that the industry would see consolidation and that would be beneficial to Vodafone, but in the event Vodafone went out and purchased other companies. This left it with large amounts of debt.

This, he says, is a concern under the current conditions of the telecoms market, which is going through a period of structural change and disruption. The most obvious example of that is the gradual rolling out of 5G. With its levels of debt, Vodafone may not be in the best position to invest in the new technology. An investment in Vodafone would be a "highly leveraged play on that," says Fox.

"We owned the company for five or six years, so you could say it was a relatively long-term hold," he adds. "But the investment thesis turned out wrong and we did not see change, so we sold."

Fox points out that the decision to sell had little to do with the fund's ESG requirements. "From an ESG standpoint, the company was very good. It was not a problem of it not being suitable. It came down to financial analysis," he explains.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.