Why it's worth keeping an eye on Chariot Oil

12th September 2018 09:29

by Alistair Strang from Trends and Targets

It's been a tough year for this AIM-listed oil and gas minnow, but chartist Alistair Strang believes the current share price is fascinating.

Chariot Oil & Gas (LSE:CHAR)

Unfortunately, there's little going on at present with Chariot Oil & Gas which looks like easing the mood of melancholy.

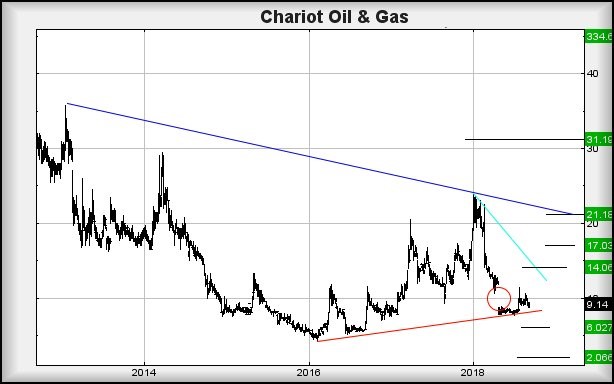

We last glanced at the share at the start of this year and it's accomplished nothing since, other than confirm a red trend line. This lack of upward mobility is a real concern, given weakness now below 8p looks very capable of an initial 6p but, realistically, any break below such a point is liable to generate a bottom of 2p.

Quite oddly, some hope is being taken from the circled manipulation gap back at the end of April. Generally this sort of thing is the precursor of a share price being driven down fairly substantially with an entirely new trend expected to form.

In the case of Chariot, the market gapped it down and the price stopped falling. Perhaps this indicates some real residual strength as visually we shall not be aghast if some news appears, next causing the market to gap it upward.

While being a little clichéd, this gap down/gap up scenario would present a pretty reliable suggestion of some miracle recovery ahead.

To make it real, any movement now exceeding 10.75p should prove capable of running uphill to an initial 14p. If bettered, even slightly, a secondary of 17p becomes a sane ambition.

With the share presently trading around the 9p mark, perhaps it's silly to speculate on a movement which has not happened, but for now, it's proving fascinating and probably worth keeping an eye on.

Source: interactive investor Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.