ii Top 10…ways to avoid greenwashing with funds

A checklist of warning signs and practical tips to avoid funds potentially engaged in greenwashing.

7th October 2021 11:07

by Kyle Caldwell from interactive investor

Share on

A checklist of warning signs and practical tips to avoid funds potentially engaged in greenwashing.

This week is Good Money Week, which aims to raise awareness of sustainable, responsible and ethical finance. A decade ago, it was the only time of the year that ethical or sustainable funds received column inches in the mainstream personal finance or money sections. This is no longer the case; thanks to Greta Thunberg and the David Attenborough effect, all things ESG (environmental, social and governance) are the height of fashion.

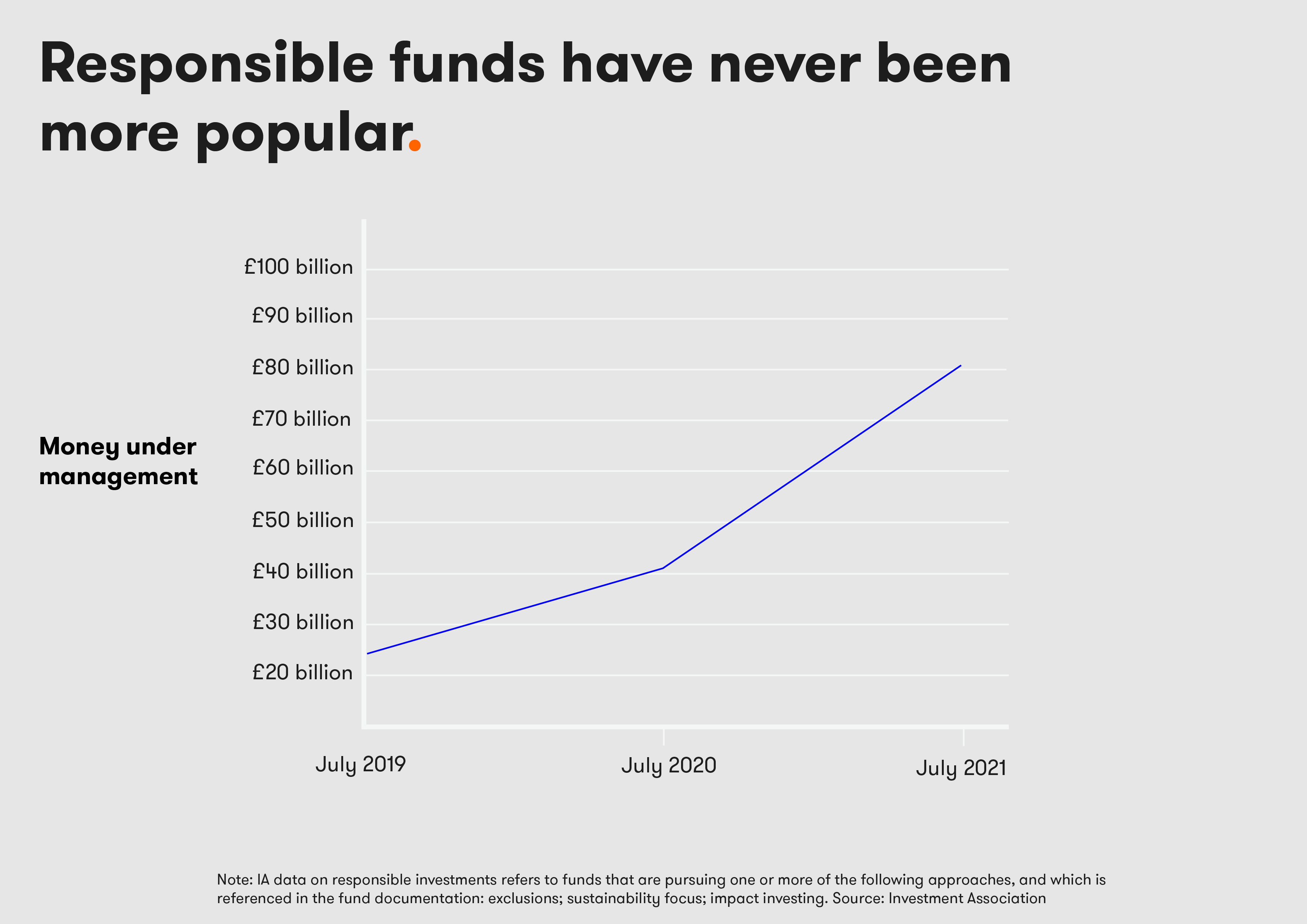

The graphic below shows how assets under management for responsible investment funds (the Investment Association's label for ethical or sustainable funds) have snowballed. There are other factors at play (check out the link below), among them the debunking of the deeply entrenched view that returns must be sacrificed to invest ethically or sustainably. In recent years, various pieces of research have shown this to be a misnomer, instead finding that investing ethically or sustainably enhances returns.

As a result, increasing numbers of investors are looking to ensure their money is invested in businesses that are ‘doing good’ in some form or other – a trend that, of course, has not escaped the attention of fund management companies’ marketing teams. Over the past couple of years, scores of new funds have been launched with ESG at the centre of the investment process. In addition, existing funds have notably fleshed out how ESG has always been part of, or at the heart of, the way the fund manager invests.

While a greater choice of funds is to be welcomed, investors need to be wary of ‘greenwashing’. This is a term describing when asset managers push themselves or their funds as ‘green’ through marketing, rather than fully integrating ESG and sustainability into their investment processes.

Greenwashing is on the radar of the Financial Conduct Authority (FCA), which recently rapped the knuckles of some fund management firms. The regulator said that applications for new ethical and sustainable fund launches often “fall below expectation” and “contain claims that do not bear scrutiny”.

- City Watchdog warns fund firms on poor quality ESG fund launch applications

- ESG fund speed dating: the key questions to ask to find your match

Below is a 10-point checklist for fund and investment trust investors who want to avoid potential greenwashing.

1. Get to grips with the lingo

As is common to other areas of fund management, the world of ethical investing is a minefield for investors to navigate, not least due to a variety of terms and phrases used by the fund management industry.

As a starter for ten, check out our ethical jargon buster to get to grips with the various approaches.

2. Work out what sustainability means for you

You may be surprised to find that some sustainable funds invest in miners and oil companies, adopting a ‘best-in-class’ approach. Such funds have exposure to unethical sectors, focusing on firms with a better environmental or social track record than others in their peer group. They argue that it is better to engage with certain “sin stocks” rather than ignore them to improve their practices.

3. Understand the strategy

You now know your ESG from your elbow, and you’ve decided on your sustainability priorities. Time to find an investment strategy to match. If you get to grips with how the fund invests and what it is trying to achieve, there’s less chance of falling victim to greenwashing. Avoid setting too much store on the fund name - as some are unintuitive.

As part of your research, browse interactive investor's ethical long list. We have categorised socially responsible and environmental funds, investment trusts and exchange-traded funds. From that long list, we have selected our ACE 40, the UK’s first rated list of ethical investments, with each fund sorted by asset class and allocated one of our ii ACE ethical styles.

4. Do the fund’s holdings tally with its strategy?

Some fund houses disclose their funds’ full holdings, while others make only their top 10 available on a monthly basis.

Whichever list you have available, it is worth scrutinising. If there are any holdings that look out of place for the fund’s strategy, then this certainly warrants further investigation.

5. Engagement

ESG funds don’t just exist to meet investors’ expectations on returns – vital though that may be. They also have a responsibility to engage with thee firms they invest in, challenging them on issues that matter to investors.

You should be able to look through the fund manager’s voting records for its holdings companies on issues that are important to you, for example, equal pay or reaching net zero, and see how they have voted at AGMs.

Be wary of fund firms that do not give examples of how they engage meaningfully with companies.

An example of good practice in this respect is BMO. The firm produces an annual report on how many companies they have engaged with over the past year and ‘milestones’ achieved.

Three of BMO’s Sustainable Universal MAP funds are endorsed by interactive investor as part of our Quick-start Fund choices for beginner investors.

6. Parent company hypocrisy

A fund management firm should practise what its sustainable team preaches. If your sustainable fund positively engages with companies to increase female representation at board level, then you should expect to find women on the board of its fund management company. Similarly, if a sustainable fund avoids companies that are not committed to meeting net-zero targets, then you should expect the asset manager selling – and making money from – the fund, to have its own net-zero plan in place.

7. Heritage of the team of running ESG money

Has the fund manager been investing sustainably since Greta Thunberg was in nappies, or are they in their early years as an ethical investor? A novice fund manager at the helm may do a good job, but a fund management team with experience of investing ethically way before it became trendy reduces the risk of greenwashing.

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

- The ii Ethical Growth Portfolio: a ready-made diversified ethical portfolio, selected and managed by our experts

8. Track record of the fund

The track record of the fund is another thing to check. Has it had an ESG mandate for a long time, or launched or changed to an ESG strategy relatively recently? Be sceptical about launches from fund firms with no experience in the ESG space. Financial advisers typically like to see a three-year track record as a minimum.

9. Resource

Does the fund firm employ a large team of ESG fund managers and analysts? If it does, this arguably shows a healthy level of commitment towards sustainable investing.

It is also worth finding out whether the fund managers and analysts assess the ESG/sustainability characteristics of companies themselves, or if they rely heavily on third-party data providers.

10. Transparency

Finally, if your fund is purporting to be good for society as well as your wallet, you should expect transparency to be part of the package. After all, it’s your money, which you have entrusted to a fund house in good faith. You can look into a fund’s transparency to varying degrees. Above, we discussed whether a fund’s full holdings were available – if not, why not?

But your fund should be transparent beyond where your money is invested. As an investor, you should be able to access all the information that we’ve covered in our checklist.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.