Best month yet for winter portfolios

3rd March 2017 15:12

by Lee Wild from interactive investor

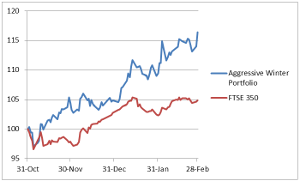

We're now four months into the Interactive Investor Winter Portfolio strategy and things are really beginning to hot up. Launched in October, our two seasonal baskets of shares based on the best-performing stocks of the past 10 years are both thrashing the market.

Now in their third year, that the portfolios are outperforming is no surprise, and picking them was relatively straightforward. Employing the services of Stock Market Almanac author and mathematician, Stephen Eckett, we screened the FTSE 350 for share price performance over the six winter months in each year of the past decade.

Our so-called Consistent Winter Portfolio contains the five most reliable FTSE 350 companies of the past 10 years - each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Investing in the reliable basket of shares for the past 10 years would have netted an average annual profit of 18%. In return for the obvious increase in risk, the aggressive portfolio has averaged annual profit over the past decade of 32%.

Shooting the lights out in February

After beginning the year with a small loss, stockmarkets fought back in February. The added 164 points, or 2.3% as buyers couldn't bear to be out of the market. The FTSE 350 benchmark index was up 2.5%.

Miners struggled, but fleeting interest in excited the bulls and Unilever trades up 18% for the month. That performance was matched by after Goldman Sachs analysts backed a recovery at the iconic engineer.

Despite some mixed company results and stretched valuations both here and in the US, enough firms are increasing profits at a fair lick to generate buying interest.

Donald Trump's first address to Congress came after the final bell of the month, but stocks had already cancelled out losses suffered during a few nervous trading sessions. Markets were also optimistic the president would pull something out of the bag.

And, after a recent mixed performance, both our Winter Portfolios had an amazing month.

Our Consistent Winter Portfolio jumped a stunning 4.8% and the Aggressive Winter Portfolio 6.3% in just one month, thrashing the benchmark.

That gives the aggressive basket of shares a four-month gain of 16.4% and the consistent basket 5.5%, ahead of the FTSE 350, up 4.9% over the portfolio period so far.

Aggressive Winter Portfolio

Workspace provider (formerly Regus) had been unimpressive until a few days ago when it sprang to life following full-year results. The numbers were good enough to trigger a 10% surge in the share price, leaving them up over 13% for the month.

Much of Wimpey's full-year update had been flagged already, but strong sales rates and that bumper dividend proved a major attraction, offsetting concerns around Article 50 and Brexit.

With no obvious catalysts, seems two of the portfolio's star performers took a breather in February. , up 30% on excitement around Donald Trump's infrastructure spending plans, rose 3%. It had published results in December. JD will not report until April, but still edged up over 1%.

Consistent Winter Portfolio

A 4.8% gain for the consistent stocks was almost double the benchmark's 2.5% improvement for the month, and that was with Irish building materials giant and catalytic convertor specialist posting monthly share price losses of 1.8% and 5.8% respectively.

These two had already done well ahead of the start of this seasonal strategy, driven by the weak pound following June's Brexit vote, so further gains would always be hard won.

It's a similar story with speciality chemicals firm , although it did manage a 4.8% gains for the month following well-received results.

Few in the investing community will know Bodycote, but the heat treatment specialist that works for car and plane manufacturers is building quite a following in the City.

It was already up 7% for the month, making it the best-performing stock in the consistent portfolio so far. But full-year results extended gains to 19% as the £1.6 billion company triggered a fresh round of profit upgrades in the Square Mile.

"The good news that after a long period of inactivity, the management believes that there are now opportunities to invest as opposed to returning excess cash to shareholders," said Panmure Gordon analyst Sanjay Jha.

"Our estimates assume no acquisitions, so the risks to forecasts are on the upside. We raise our target price to 872p, which values the stock at 10x 2017 EBITDA which is conservative given that some of the heavily-indebted stocks like Weir are trading on 18x EBITDA.

"The fact that Bodycote will also benefit from any cyclical upturn in energy and commodity markets is a bonus."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.