Alternative ideas for generating secure investment income

As a replacement or complement for longer duration bonds, these alternative income funds are interesting.

11th October 2019 15:08

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

As a replacement or complement for longer duration bonds, listed alternative income funds look an interesting, well… alternative.

Bond proxy?

William Heathcoat Amory, Founder, Kepler Trust Intelligence.

Bonds have traditionally been a core part of private client portfolios. Harry Markowitz is generally credited with developing and popularising the modern approach to investment diversification, as part of his doctoral thesis in 1952.

Markowitz's 60/40 equity/bond portfolio quickly became a staple of retail investor portfolios, and for many years equity and bond portfolios built around this basic concept have been highly successful for investors.

The attractions were clear: aside from the solid income that bonds offer investors as a portfolio component portfolio, they also provided something of a hedge to equity exposure.

Topsy-turvy

Nowadays, however, in the topsy-turvy world of fixed income, the attractions are not quite what they were. QE has driven yields on fixed income securities to negligible levels. Indeed, according to Deutsche Bank research, 43% of all global investment grade bonds outside of the US trade at negative yields.

While most of these are in euros or yen, where the income boost has become an income drag, yields in the UK market are meagre at best: the average yield to maturity in the gilts market as a whole is 0.84% and in the UK corporate bond market is 1.8%. With inflation averaging 2% over the past 12 months, these are currently negative real yields.

The other element that bonds provide to balanced portfolios is a hedge to equity exposure. Lower (or negative) yields have increased the duration of fixed income assets, so other things being equal bonds are becoming more sensitive to changes in interest rates.

On the surface, then, bonds should theoretically provide an even better hedge to an economic shock (a downside scenario for equities) than in the past.

However two facts now present themselves that suggest they might provide less of a hedge than in the past. Firstly, in past years, the higher level of income that bonds continued to pay through a cycle contributed to their inverse correlation to equity markets on a total return basis.

The income was also a reliable source of returns when equity markets trended sideways. With UK gilts being issued with such low coupons (for example in 2018 a 2071 gilt was issued with a 1.625% coupon, while a ten year gilt had a coupon of just 0.875%), the income part of the total return to an investor has declined significantly.

Furthermore, over short but significant periods of time, the negative correlation between equities and bonds has been limited or non-existent. The prime reason for this is that confidence in central banks' ability to keep the economy ticking over has become crucial to the short term returns of both assets.

So when the market becomes worried that the US Federal Reserve might make a policy mistake, equities and bonds have both been taking losses.

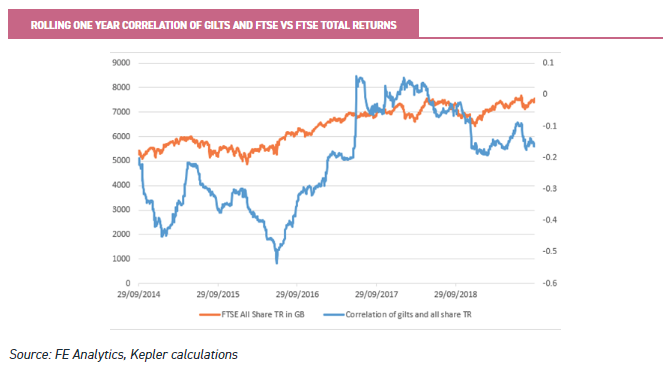

The graph below shows the rolling one-year correlation of bond and equity returns. It is noticeable that bonds and equities are still negatively correlated, but less so than they have been for a while. It is apparent that bonds may not provide the security they once did.

As such, long-duration bonds are less attractive than they once were. The derisory level of income they offer detracts from the yield obtainable from most portfolios of equities; and given the paths of equities and bonds are now intractably bound together by government policy, bonds role as a sure-fire hedge to equity risk is certainly less dependable than it once was. So where do investors turn?

Alternative income funds in the listed universe

Short-duration bond funds still provide a good measure of security for equity portfolios as an alternative to cash. However, they do not offer the potential for negative correlation in falling equity markets. As a replacement or complement for longer-duration bonds, the listed alternative income funds look an interesting, well … alternative.

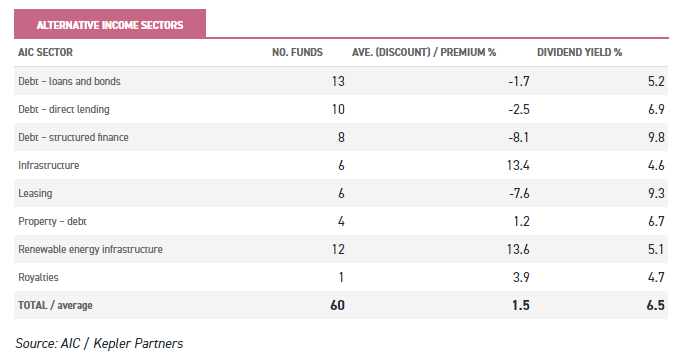

Outside of the property funds/REITs, which are subject to their own macro forces, there is a welter of alternatives in the listed fund sector. The AIC breaks these down into eight sectors, which we summarise in the table below. Sixty funds are currently listed, offering an average dividend yield of 6.5%.

Each sector has its own, often complex, investment rationale, and we would caution that investors need to size up each opportunity for themselves.

As observed in the direct lending sector, there are potential hazards in all these sectors, just waiting to trip up both fund managers and investors. It is also worth noting that not all these sectors invest in assets which are long duration, so the diversification benefits come from a variety of sources.

However, we believe that many of these funds have a number of strong characteristics that make them an interesting complement to equities in a traditional balanced portfolio.

Alternative income fund characteristics

The label 'alternative income' hides a wide range of very different types of funds. What unifies the majority of them, in our view, is that their underlying assets are unlikely to suffer from mark to market moves over the short term – and certainly not related directly to moves in equity markets.

As we discussed recently in this article, closed-end funds are well suited to holding many types of alternative assets given the long-term nature of those assets, and given that there is not a liquid market in the securities should the manager wish to sell. In contrast to the travails being experienced by Woodford Patient Capital Trust (LSE:WPCT), other investors in these asset types are more likely to be institutional and long-term in nature.

There are very few open-ended funds which own these asset classes, meaning that forced sales in a downturn, resulting in mark to market losses for the funds which continue to own them, are an unlikely prospect.

In many cases these funds can also take on gearing, which amplifies financial risks but also boosts returns – both on the capital and income front. Many of these assets, if held to maturity, offer returns that are significantly higher than the cost of borrowing; meaning that if an investment company can lock in this borrowing they can materially enhance returns for shareholders over the life of the asset.

Many assets command a yield premium because of their specialist nature and / or large lot sizes. In many cases it takes a specialist manager to access and 'operate' the assets, which clearly adds to potential risks and due diligence requirements for investors. However, in our view this factor is one of the key reasons why many managers are able to continue to deploy capital for shareholders in these companies at attractive rates of return.

Proof of the pudding?

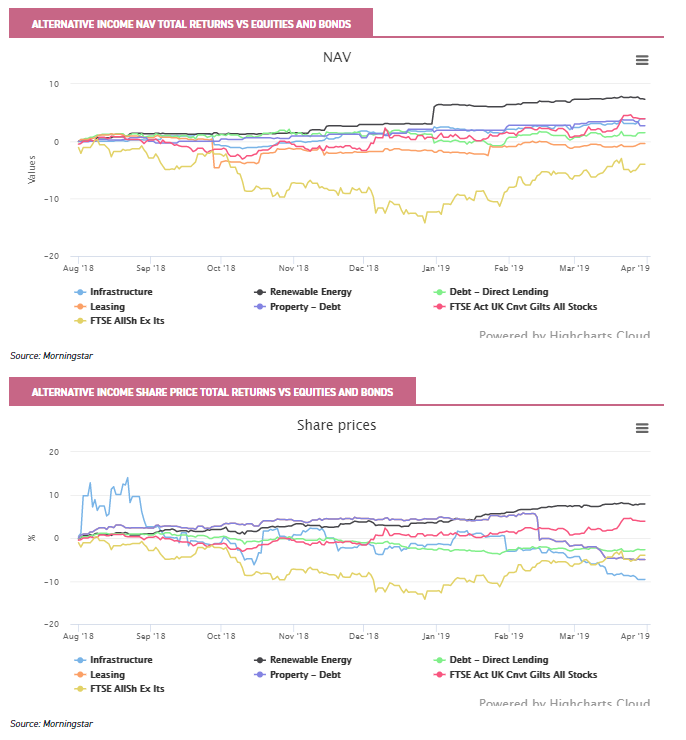

The graphs below show the Morningstar category average NAV and price returns for the various classes of alternative asset funds. We show that on a NAV basis, as well as a price basis, they provided significant diversification properties during Q4 2018 and – even more impressively – better returns than the government bond index.

In our view this offers good anecdotal evidence that the theory translates into practice, and that alternative assets can provide a good proxy for what investors traditionally look for in bonds in scenarios when bonds now disappoint. They offer both diversification benefits and an income boost to portfolios. Who could ask for more than that?

Below we review a variety of alternative income funds which we have either covered previously or hope to be publishing research on soon:

Infrastructure

HICL Infrastructure (LSE:HICL), it could be argued, was one of the forerunners of the now fully developed alternative income sector. HICL launched back in 2006 and is now one of the largest funds in the sector with a market capitalisation of £2.97 billion. The company invests in traditional infrastructure assets, the likes of which are usually bought by pension funds and other institutional investors.

The majority of the company's assets offer predictable cashflows, and are uncorrelated to the economic cycle. Currently, HICL has a portfolio of 118 investments located in the UK, France, Ireland, the Netherlands, Canada, and the USA.

The 12 year history of HICL illustrates why infrastructure investing has been so attractive for long-term investors – both in the consistency of returns and in the lack of correlation to equity markets.

In fact the consistency of the fund's positive annual returns illustrates the parable of the tortoise and hare. Over the short term, equity markets might easily show HICL a clean pair of heels, but over a cycle HICL has proven itself an impressive adversary on a total return basis.

In our view HICL remains the pre-eminent vehicle for investors to obtain access to lower-risk infrastructure assets. We hope to update our research soon.

Renewable energy infrastructure

Greencoat UK Wind (LSE:UKW)) was the pioneer in the renewable energy infrastructure sector, and remains the largest company in that sector. It provides a pure investment exposure to UK wind farms, with the aim of delivering a high RPI-linked income return for shareholders while also maintaining capital value in real terms.

The trust currently owns a portfolio of 35 wind farms around the UK, which it has assembled through purchases from a wide range of developers and operators.

UKW's advantages in the market are its sheer size and independence from any vendors. In our view these are the key reasons why the fund has been able to continue to purchase assets and grow as a UK specialist in what is clearly a relatively competitive market. We continue to believe that UKW offers valuable income and diversification properties to portfolios.

To date the company has delivered on all of its promises: dividend growth has matched RPI, and the capital value of the NAV has risen ahead of RPI.

The company employs a mix of longer-term and short-term gearing to enable it to pay a high level of dividends, as well as (in an average year) to reinvest around a third of cashflows in new assets to maintain the NAV in real terms.

Relative to equity funds, the key drivers (and risks) to returns are entirely uncorrelated. The dividend yield of 4.9% looks attractive in this context but the shares trade on a significant premium to NAV of 15.3% (Source: Numis).

As with any other trust trading on a premium to NAV, it is worth bearing in mind the magnifying effect that a reversal of the premium rating would give to share price returns should the company hit any road bumps.

The Renewables Infrastructure Group (LSE:TRIG) can be seen as an international one-stop shop for the burgeoning renewable energy sector. It differentiates itself from the other funds in the sector by being a non-specialist fund (wind, solar and battery storage so far) but also with a remit to invest across the UK and Europe.

Recently TRIG has announced a further extension of this policy, and the board is seeking shareholder approval to increase the proportion of assets the company can invest in Europe from 50% to 65%.

The aim of the company is to provide long-term higher income for shareholders, with any surplus cash flows after debt amortisation being re-invested to help maintain the capital value of the investment portfolio.

The current portfolio, when fully built out in 2020, will be represented by 71 projects, with net capacity of 1.5GW. Wind is currently the largest component of the portfolio (90% by value).

The push to invest overseas has gathered pace over the last couple of years, and during the 2018 calendar year 77% of new investments by value were made outside the UK.

For the six months to end-June 2019, the company has invested in five projects, all of which are overseas (in Sweden, France and Germany).

In total 45% of the portfolio is currently invested outside of the UK, up from 28% at the end of 2018. The current yield is 5.2%, and the share price premium over NAV is around 11.1%, in line with the sector average (Source: Numis).

Again though, as we note above, it is worth bearing in mind the magnifying effect that a reversal of the premium rating would give to share price returns should the company hit any road bumps.

Leasing

The three Doric Nimrod funds and the Amedeo Air Four Plus (LSE:AA4) are aircraft leasing funds which all currently offer very high running yields.

Uncertainty about the implications of the cessation of Airbus A380 production in 2021 has weighed on market sentiment.

These funds all have significant exposure to that aircraft, and all are currently trading at share prices below IPO. Widebody aircraft such as the A380 represent a solid asset backing with limited supply, as well as high quality lessees and excellent visibility of income.

In many ways, they resemble a commercial property investment and, like commercial property, as investments they deliver a high income return with the potential for capital growth.

The funds own aircraft and rent them to internationally recognised flag carriers on 'full repair and insure' leases. They finance these transactions with structured, currency-matched amortising debt.

The rent that the airlines pay then goes towards servicing the debt (both the interest cost and paying off the principal) and also enables the funds to deliver high levels of income. The majority of the leases provide that at the end of the 12 year term the assets must be returned in 'full life' condition.

In view of the specialist nature of the risks underlying each fund, these funds may have been considered by some investors to fall in the 'too difficult' camp.

Yet at current prices, all four of these aircraft investment funds offer potentially attractive total returns, including very high annual cash dividends.

These funds are not without risk – a significant part of the return from them depends on the final value of each aircraft when their initial 12 year leases mature.

That said, there are several catalysts on the horizon which will help to provide more certainty on these valuations in the next year or so. We hope soon to publish a note examining the investment case for these funds in more detail.

Diversified alternative assets

The investment objective of Tetragon Financial (LSE:TFG) is to provide stable returns across cycles. It aims to generate high returns on equity of between 10 and 15% per year, and seeks to distribute a proportion of these returns through a dividend. The company has net assets of $2.26 billion and has a USD and an unhedged GBP share class.

Tetragon's assets are invested in a wide range of alternative assets, meaning that in our view Tetragon can be seen as a "one-stop shop" for an alternatives allocation.

These assets include private equity investments in various management companies, who manage the alternative funds through which Tetragon achieves its exposure.

Currently 61% of the portfolio is invested in a range of alternative assets, while 31% is invested (private equity style) in the equity of the management companies, with the balance of 8% in cash. Tetragon's NAV performance has been extremely strong.

Putting it into context, over five years the fund has generated similar returns to Scottish Mortgage (LSE:SMT), but with the same volatility as RIT Capital Partners (LSE:RCP).

Importantly, it has exhibited correlation to equity markets of a fraction of the level observed for those two trusts; and at 0.17 against the MSCI ACWI it can be considered uncorrelated.

In terms of capital preservation, the maximum drawdown over five years is significantly lower than the other two trusts highlighted, at -8.5%. Tetragon trades on one of the widest discounts in the entire investment trust sector, currently 46%. We expect to publish a detailed note on the trust soon.

JPMorgan Global Core Real Assets (LSE:JARA) launched recently (23 September 2019), having IPO'd with around £149 million of assets. The fund aims to generate an attractive income and total return by investing across real asset sectors which are usually only accessible to institutional investors.

The target income yield is 4-6%, and the target annual total return is 7-9%. JARA will invest as a limited partner (LP) in private perpetual life strategies run by the J.P. Morgan Global Alternatives Group.

These will invest in private assets across the core global infrastructure, core real estate (US and Asia Pacific) and core global transportation sectors; together making up around 80% of the portfolio.

The remainder will be invested in publicly listed real asset securities, through segregated mandates investing in REITs (all-tranche) as well as infrastructure and transportation securities.

The managers believe these assets should generate steady returns through the cycle by generating two thirds of their return through highly predictable, mostly contracted sources of income.

In contrast to most trusts in the real asset sectors, JARA's income will be generated mainly from outside the UK (95% of the target portfolio), providing diversification for existing investors in these peer groups and exposure to assets that are currently difficult to access in listed format.

The expectation is that the trust will be 80% invested by six months, and 100% by 12 months. JARA provides an opportunity for wholesale and retail investors to gain access to an investment universe which – due to high minimum investment thresholds and structure limitations – is usually only accessible to institutions.

The combination of the defensive qualities and yield offered makes JARA an interesting proposition, we believe, particularly in the current market environment in which yields on fixed income look compressed and the global economy is closer to the next downturn than to an expansion phase. We wrote a detailed note on the strategy in our pre-IPO note.

Royalties

Hipgnosis Songs (LSE:SONG) is a relative newcomer to the listed fund universe. Currently with a hefty £409 million market cap, having listed in mid 2018, it has grown rapidly; its aim being to achieve income and capital growth through ownership of songwriters' music royalties. Streaming has led JPMorgan to predict that global music industry revenues will rapidly surpass the peak of the late 1990s, with 10% per year compound growth expected through to 2030.

In its first year, SONG has delivered what it promised at launch. The income so far earned on its investments is equivalent to a 6.1% gross yield, in line with projections made at launch. So far the company has paid its target dividend of 3.5p over the first year, with the aim to pay dividends of 5p in the current financial year (4.8% at the share price on 31 August 2019).

This is a new concept for closed-end fund investors, but having spoken to the manager, we understand that music royalties are relatively predictable and uncorrelated with equity markets.

With rights extending in some cases for 70 years past the death of a writer, these royalties have the potential to be significantly longer life assets than infrastructure or other alternative income asset classes.

Coming at a point in time when revenues from streaming are leading to a resurgence in the fortunes of the music industry, SONG looks to provide a very interesting combination of solid income with the prospect of capital growth.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.