City View: Pick of the housebuilders

5th December 2014 12:48

by Lee Wild from interactive investor

It's the right time of year to be buying housebuilders. We said so last month and the sector has rallied since. There was an unexpected boost from the Chancellor of the Exchequer on Wednesday, which only serves to underpin the investment case.

A series of trading updates during November were largely positive and most housebuilders' share prices have done incredibly well over the past few months. This only reinforces the seasonal trade which Investors Chronicle columnist Simon Thompson wrote about recently – buy housebuilders now and sell in April, he says. It's a strategy that has worked for decades, and continues to do so.

A more sensible policy on stamp duty formed part of George Osborne's Autumn Statement. It lowers the cost of buying a home for low and middle income earners and was well-received. Share prices for , , , , and have all risen sharply since. But don't bail out yet, says UBS:

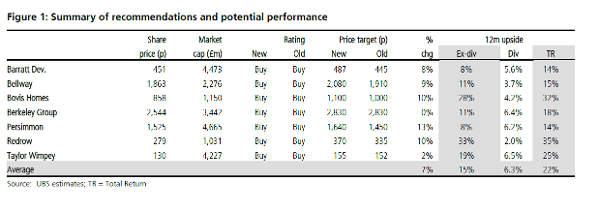

We remain positive on the UK housebuilders with a potential total return potential on a 12-month view of c20% on average. After a somewhat choppy Q2, the sector has rebounded strongly in H2 as rate rise expectations have been pushed out, bringing total return outperformance vs. the FTSEAllshare to 14% year-to-date. This should make 2014 the 4th consecutive year of significant outperformance of the sector.

(click to enlarge)

Of course, there could be slip-ups. The upcoming General Election in May 2015 is an obvious catalyst for a potential slowdown in activity, reckons the broker. Profit forecasts for 2015 also imply a return to historical peak margins and return on capital employed (ROCE). "The danger remains to value the sector on peak levels of profitability, in what remains a highly cyclical sector," cautions UBS.

We try to adjust for this with our normalised valuation approach, where we apply a 15% discount to peak returns in our normalised valuation. While all 7 stocks under our coverage are Buy rated, our top picks are Berkeley Group (exaggerated London risk) and Taylor Wimpey (highest upside from the larger stocks).

Panmure Gordon is a fan of the sector, too. The stamp duty changes should guarantee a "feel good factor" towards the sector as we head into 2015 and the most crucial trading period of the year for housebuilders. Interest rates are likely to remain low for longer, mortgage market conditions are tipped to remain "robust" and improving margins should drive profitability improvements across the board, says Panmure:

We continue to prefer the housebuilders which are trading on a significant PNAV (price to net asset value) discount to the sector; namely Bovis and Redrow which would be our key picks. The sector is trading on a December 2015 PNAV of 1.66x and a PE of 9.1x. Bovis trades on 1.18x and a PE of 8.1x whilst Redrow trades on a PNAV of 1.21x and a PE of 6.6x.

Here how Panmure rates the sector:

Buy recommendations

- Bellway (1,860p) - Target price 1,991p (from 1,756p)

- Bovis Homes (880p) - Target price 1,005p (from 956p)

- Redrow (281p) - Target price 324p (from 306p)

Hold recommendations

- Barratt Developments (458p) - Target price 438p

- (1,540p) - Target price 1,455p (from 1,300p)

- Taylor Wimpey (133p) - Target price 120p (from 116p)

Sell recommendations

- (1,220p) - Target price 1,019p

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.