Find out which portfolios did best in Q1

27th April 2018 09:20

by Faith Glasgow from interactive investor

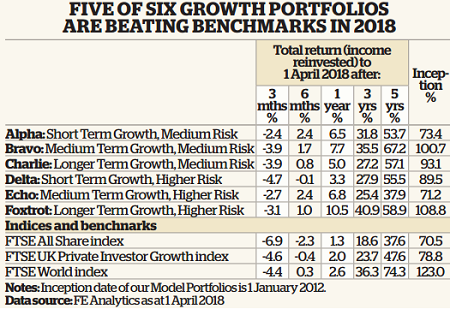

It has been a busy and somewhat unnerving time for investors in the period since our last review in February, which focused on the performance of the Money Observer model portfolios throughout 2017. In the tumultuous first quarter of 2018 they have held up relatively well. While all portfolios lost money during the first quarter, they nonetheless outperformed the UK stockmarket.

February was easily one of the wildest rides for investors since the depth of the great financial crisis a decade ago: after a prolonged period of extreme calm, the US stockmarket plunged into correction territory (down 10% or more) with Japanese and European markets following suit.

Investors suddenly became worried that president Donald Trump's huge tax cuts could cause the economy to overheat, which would send inflation spiralling and force central banks to raise interest rates faster than expected.

The sell-off saw the CBOE Volatility index, commonly referred to as the 'fear index', soar to its highest reading since mid-2015.

Past performance is not a guide to future performance

As startling as it was, February's bout of extreme volatility proved short-lived: stocks had recovered almost half of their lost ground by the end of the month.

Nevertheless, both UK and global markets ended the quarter down as much as 7%, as other factors - notably a lack of confidence in Europe following the Italian election result, the flare-up of political tensions with Russia and Trump ratcheting up talk of trade protectionist measures - served to temper gains. However, it was the poor performance of global technology-related giants, which had led the US market gains in 2017, that did the most damage in the first quarter.

Pessimism about Brexit despite the agreement on a transitional period hurt the UK equity income sector and meant , our higher-risk, immediate income portfolio, is the quarter's worst performer with a 4.9% decline. , our medium-risk, short-term growth portfolio, has a more international growth focus and is our top performer with a 2.4% loss.

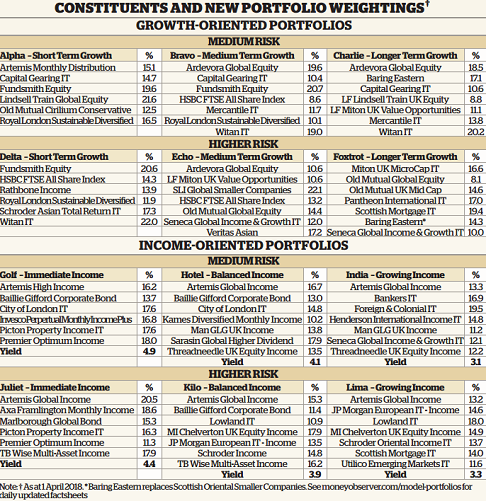

Growth portfolios

Higher risk

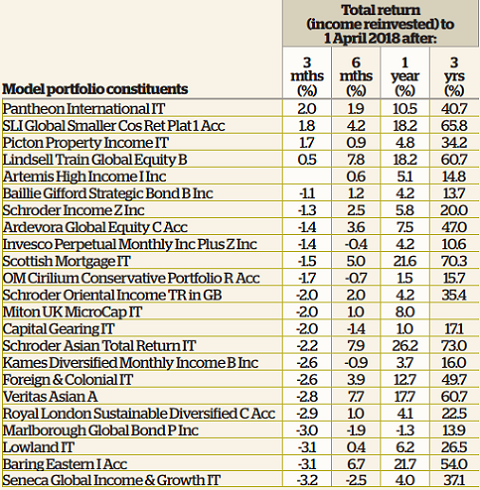

It is reassuring that only three of the 47 funds that make up our model portfolios suffered a drop in line with or greater than the benchmark . Four of them fended off the stockmarket slide to deliver a positive return to shareholders, with being the stand-out performer behind private equity specialist Pantheon International.

A newcomer to our Money Observer Rated Funds and models for 2018, the SLI-managed fund replaced in the Echo portfolio at our last review and proved a great change to make: the fund's modest rise over the quarter compared with a near 6% loss for the trust it replaced.

The Standard Life fund has more than 80% of assets in overseas equity markets, whose performance is hampered for UK investors when sterling rises, as it has been. The pound has been one of the best-performing major currencies since it slumped after the referendum in June 2016, most recently being buoyed by the Brexit transition deal.

However, Alan Rowsell, its manager since inception in 2012, demonstrates that good stockpicking can trounce adverse currency movements. He runs a concentrated portfolio of 50 high-quality stocks, and believes there is no more important time than now to be invested in companies that earn strong returns on capital and reinvest them for sustainable growth.

Another new addition bodes well for , our higher-risk longer-term growth portfolio. replaced on account of its smaller size and greater nimbleness, and held up well over the quarter with a 2% loss.

Foxtrot's performance has, however, been held back by , which lost 8.4%, making it the second-poorest performing fund in our models. A Rated Fund since 2013, it has lagged peers and we are offloading it in favour of , a Rated Fund since 2017.

We have decided that Scottish Oriental's capital preservation focus is not best-suited for a higher-risk portfolio seeking longer-term growth. The Baring Eastern fund, which is also a member of the , longer-term growth portfolio, backs the next generation of companies emerging across Asia, so should provide more of a kicker to returns.

In , our higher-risk shorter-term growth portfolio, , introduced at the start of the year in lieu of , outperformed the fund it replaced and was the portfolio's top contributor over the quarter. Holdings in and dragged performance lower, though, making Delta our worst-performing growth portfolio this quarter.

Medium risk

Two switches in Alpha, our medium-risk shorter-term growth portfolio, are working equally well: this is the best-performing portfolio over the quarter. Its outperformance was driven by , a cautious multi-asset fund that aims for low risk and minimal volatility. It replaced , the weakest constituent across all of our portfolios in 2017, at our annual review.

At the same time, was introduced to this short-term portfolio to bring a crucial element of capital preservation in the event of a market correction. That has proved to be excellent timing. The trust replaced HSBC FTSE All-Share Index fund, which lost more than three times as much over the quarter.

Charlie, our medium-risk longer-term growth portfolio, also switched out of the HSBC tracker at the start of the year, this time into . It focuses on medium-sized firms and should outperform the index over the portfolio's longer-term profile. Down 5% in the first quarter, Mercantile did not lose as much as the wider UK stockmarket.

, our medium-risk medium-term growth portfolio, still holds the HSBC-managed tracker, but benefited from a five percentage point reduction in both that and Mercantile in favour of . It was Bravo's second-best performer behind , also a constituent of Charlie and Echo.

Source: Money Observer Past performance is not a guide to future performance

Income portfolios

Higher risk

Lima, our higher-risk growing income portfolio, has been the strongest of all 12 portfolios since launch and is the second-best income portfolio during the quarter.

has been the greatest contributor to its success in recent years. It is also the portfolio's best performer so far this year, closely followed by . Although Scottish Mortgage has grown its dividend for 35 consecutive years, its main purpose in Lima is to serve as a means for investors to withdraw capital should income payments fall short of expectations elsewhere. Given its strong run, we reduced this holding by five percentage points at our annual review, funnelling the money instead into , a more income-oriented investment trust with a yield of 3.4%.

Juliet, our higher-risk immediate income portfolio, produced the worst performance in capital terms among our income portfolios, held back by the underperformance of UK equity income funds.

replaced at our annual review. This has been a poorly timed switch as the Schroder fund has lost 1% compared with an 8.5% loss from its replacement fund. It was also the worst-performing fund among all model portfolio constituents and therefore also Juliet's weakest constituent, followed by .

Both, however, are the highest-yielding funds in Juliet, so are important components of an immediate income portfolio. Poor performance in capital terms was offset by a strong showing by , the third-best performing fund overall during the quarter and a component also of the .

A switch from Rathbone Income to has so far paid off for Kilo, our higher-risk balanced income portfolio; while Rathbone's fund (still held by Delta) is floundering in the bottom 10 funds, the Schroder fund is our top-performing UK equity income fund.

The introduction of the income shares of to replace the underperforming has not done as well, although the trust betters the performance of the fund it replaced. Caution on Europe has seen it perform in line with the wider market, but we remain optimistic about its longer-term prospects.

Medium risk

Exposure to UK equity income funds - Premier Optimum Income and - acted as a drag on performance at Golf, our medium-risk immediate income portfolio, which is nevertheless our top-performing income fund this quarter.

Weakness in income shares was offset by exposure to the sterling strategic bond sector -, and . was sold in favour of the Artemis fund at our annual review, and that switch is so far proving favourable.

Our final two portfolios, India and Hotel, received a real shake-up at our annual review and the new additions are, encouragingly, these portfolios' top performers.

Disappointing performance from saw it ejected from both, being replaced by in India and in Hotel. was switched in favour of the cautiously managed in India and in Hotel, while both portfolios ditched Invesco Perpetual Income for .

The Seneca and Man GLG funds are among the top three performers for both portfolios, while the Kames fund is also top three for Hotel.

Source: Money Observer Past performance is not a guide to future performance

Source: Money Observer Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.