Are sustainable funds really a better bet for the next bear market?

3rd September 2018 10:49

by Tom Bailey from interactive investor

With more sustainable investments focusing on companies which operate best practice, Tom Bailey discusses whether they could be more resilient when markets fall.

The rising profile of environmental, social and governance (ESG) focused investing over the past few years is no secret. Most major fund houses offer some form of ESG focused fund, or at least incorporate ESG screens into their stockpicking process. And the appetite for ESG investing is growing: two out of five investors aged under 40 report having made a so-called impact investment (an investment in funds or companies committed to generating a positive social or environmental impact) during their lifetimes, according to Barclays Impact Investing's latest report, up from 30% when the bank first asked the question in 2015.

Yet among many investors, scepticism about ESG investing remains strong. The perception is that lofty principles are often placed ahead of the hard-nosed business of investing for strong returns. Imposing additional ESG-inspired criteria (about which more follows) on the range of companies a fund manager can invest in, it is feared, will act as a major drag on returns.

This scepticism is easing, though. A study by BlackRock recently compared traditional equity benchmark indices with MSCI's ESG-focused derivatives. It found that "annualised total returns from the ESG indices since 2012 matched or slightly exceeded returns from the standard index in both developed and emerging markets."

However, one stubborn area of doubt still exists. The rising popularity of ESG investing has largely occurred over the past decade, a period in which markets around much of the world enjoyed an extended bull market. Over the same period, the world's major economies, developed and emerging, have undergone long periods of expansion. As a result, many managers running ESG funds have yet to see their strategies tested in tough times.

No sin, no win?

The big question, then, is: what happens to ESG focused investment funds and trusts when the next economic downturn or market crash arrives?

In the hit television series The Sopranos, mob boss Tony Soprano once asked his business associates: "What businesses have traditionally been recession-proof since time immemorial?" The answer is so-called 'sin businesses': gambling, tobacco and alcoholic drink companies, for example, are all firms that would fall foul of the socially responsible criteria adhered to by ESG investors.

Sin businesses are often seen as being resistant to the business cycle: smokers will smoke and gamblers will gamble regardless of the economic climate, giving shares in firms operating in these industries a reputation for being particularly resilient during recessions.

This, in theory, could spell trouble for ESG investments. By screening out sin shares from their portfolios, ESG investment trusts and funds will be unable to switch to solid defensive stocks when the next recession or market crash arrives, thereby amplifying the negative impact of the downturn on them.

Counting on quality

Such a criticism is, however, perhaps outdated. Jim Totty, a managing partner of the Nobel Sustainability Growth fund, says:

"Ten years ago, a lot of sustainable funds were a bit "10 commandments" – thou shall not invest in this or that. But the market has moved on."

Anthony Eames, vice president at Eaton Vance Management, concurs. He says: "It is a very old-fashioned approach to just exclude companies."

ESG investing is now less about negative screens and more about ensuring the firms in a fund’s portfolio are of high quality in terms of governance, or about following a broader, bottom-up, thematic approach.

According to Eames, what makes the ESG approach different now is the focus on very comprehensive research, particularly with regard to businesses' non-financial data.

"We look at a company's non-financial capital and ask how it is managed," Eames says. "We ask how firms are managing their human capital. We want to know how companies are managing governance and what their auditing controls are."

In short, a fund manager following an ESG strategy tries to find companies that are well-run, and have strong internal controls, accountable management and a strong corporate culture. Such companies would be very unlikely to be hit with a big fine by a regulator – for cheating on car exhaust emission tests, for example.

A firm's strong internal control and management structure will benefit investors in terms of reducing the risk of scandals (and therefore help support share prices), but it also points to the firm being of intrinsically higher quality and more likely to hold up in market turbulence.

Hortense Bioy, Morningstar's director of passive strategies and sustainability research for Europe, says: "Companies with higher ESG scores tend to be of higher quality, experience lower volatility and be relatively large. This bodes well for the potential of ESG strategies in a downturn".

Nick Curtis, another managing partner at Nobel Sustainability Growth fund, says:

"Think of leading brands. In a downturn, they are not hit too hard. Clearly, they will suffer, but top players with better management will suffer less."

Indeed, far from research costs being a potential drag on returns, ESG strategies now attempt to offer investors portfolios that have been subject to a rigorous research process, which can be seen as a form of risk mitigation.

Patrick Roefs, head of fund offering at Julius Baer, sums it up: "In the face of a downturn, clients tend to liquidate riskier assets first. Therefore, a superior- quality portfolio should be better protected from any severe drawdown."

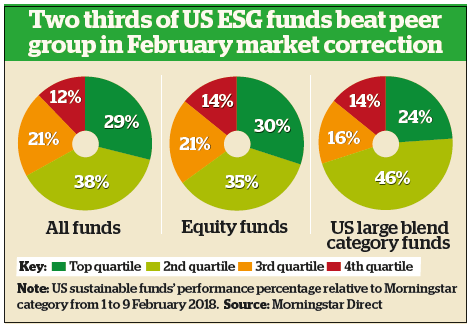

This theory has been tested in practice to some extent. As the pie charts below show, during the first week of February 2018, most major indices entered market correction territory. Yet during that week, ESG investments appeared to shine, or at least dimmed less than their peers.

Past performance is not a guide to future performance

Jon Hale, director of sustainable investing research at Morningstar in the US, in his end-of-week notes during the correction, noted:

"Among equity funds, 65% [of ESG funds] outperformed their peers, with more than twice as many finishing in their category's top quartile than in the bottom quartile."

Moreover, none of the major broad market indices tracking ESG equities underperformed compared with the wider market between 1 and 9 February this year. Reiterating the point about the higher quality of companies in ESG-focused funds, Hale says: "Companies that manage material environmental and social issues effectively and have strong corporate governance practice tend to be lower-volatility companies that hold up better during downturns. Sustainable funds have demonstrated lower volatility during the recent market downturn."

Note that the market volatility in February was brief and, crucially, wasn't accompanied by recession, nor did it cause one. However, that period of strong ESG performance shows the promise of these funds.

Forward thinking

The thematic approaches of ESG funds, it is argued, also make them more resilient to downturns in the business cycle. According to Totty:

"Come a downturn, it will be the laggards and old-fashioned business models that face trouble, not forward-thinking companies [the type that will often pass an ESG screen]."

Roefs takes a similar view. He says: "Companies that provide products and services that create value for society over the long term, and those with better and more sustainable business profiles than their competitors are less risky."

"Looking ahead, the whole global economy is going to go through a sustainability revolution," argues Totty. "We are in the early stage of a transformation that, to paraphrase Al Gore, has the magnitude of the Industrial Revolution and the speed of digital. We are seeing a multi-decade-long transformation of industries."

This transformation will touch nearly all industries, as well as spawning new ones. "These are long-term investment themes, 20- to 30-year trends that cut right across economic cycles," Totty says. Smokers may not stop in a recession, but neither do historic transformations.

The strength of his view leads him to a concrete, Brexit-related observation. "The sustainable and green sector is strong in the UK," he says. He also notes that the UK has seen some of the world's fastest moves towards decarbonisation, and that the country's science sector is remarkably strong. No matter what happens over Brexit, he argues, investment in green technologies is highly unlikely to abate.

"Post-Brexit, the government is going to be focused on playing to UK strengths, whatever the macro result from Brexit. Sustainability will be right at the forefront of how UK plc trades in global markets," he says.

What to look for in an ESG investment trust or fund

The first thing investors will want to know is how sustainable an ESG fund actually is, as some funds have stricter ESG requirements than others.

One way to do this, says Bioy, is to look at Morningstar's sustainability ratings for funds.

She explains:

"The ratings assess funds based on how well each of the underlying companies lives up to a set of ESG criteria."

Investors will also want to try to get to grips with what exactly a fund's ESG approach is. "Retail investors considering responsible investments should ‘lift up the hood and see what’s inside and how it works", says Eames.

"Investors should be looking at how managers think about ESG. Do they have a clearly articulated approach? Do they have an old-fashioned one?" If they take an [old-school] 'negative screening' approach, their fund is likely to underperform.

That said, Eames suggests making sure their approach is not too novel. He says: "There has been tremendous product proliferation – a lot of new products focused on ESG. Any investor should be wary of funds with strategies that don't have a proven track record [whether it’s an ESG fund or not]."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.