Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Why Jerome transferred from Hargreaves Lansdown to ii

“I looked at the fees that were provided with my previous provider, Hargreaves Lansdown. It wasn't as competitive as ii.”

Jerome was with Hargreaves Lansdown. He felt our flat-fee model was easier to understand and more transparent. With a lot of different pensions in different places, he wanted to bring them together on one platform to make retirement planning simpler. He made the switch to ii and started saving more money for his future.

interactive investor vs Hargreaves Lansdown: what’s the difference?

Thousands of SIPP investors have already moved billions of pounds from Hargreaves Lansdown to interactive investor, so it’s natural to wonder how the two differ and, crucially, which is best for you.

There are many similarities, with both offering a range of investment accounts, including ISAs, Trading Accounts and – yes – Self-Invested Personal Pensions (SIPPs). And through these accounts, you can easily invest in your choice of shares, bonds, funds and ETFs.

But when comparing ii vs Hargreaves Lansdown, there’s one key feature that may make all the difference: what you’ll be charged.

ii vs HL: SIPPs at a glance

| interactive investor | Hargreaves Lansdown | |

| Platform charge | Flat fee | % of investments |

| Which? Recommended | ✔️ | ❌ |

| Free regular investing | ✔️ | ✔️ |

| Mobile app | ✔️ | ✔️ |

| Free cash withdrawals | ✔️ | ✔️ |

| Free personal contributions | ✔️ | ✔️ |

| Free employer contributions | ✔️ | ✔️ |

| Research tools | ✔️ | ✔️ |

| International trading | ✔️ | ✔️ |

| Hold foreign currency | ✔️ $, € and 6 more currencies | ❌ |

| Dividend reinvestment | ✔️ 99p per trade | ✔️ No charge |

| No exit charges | ✔️ | ✔️ |

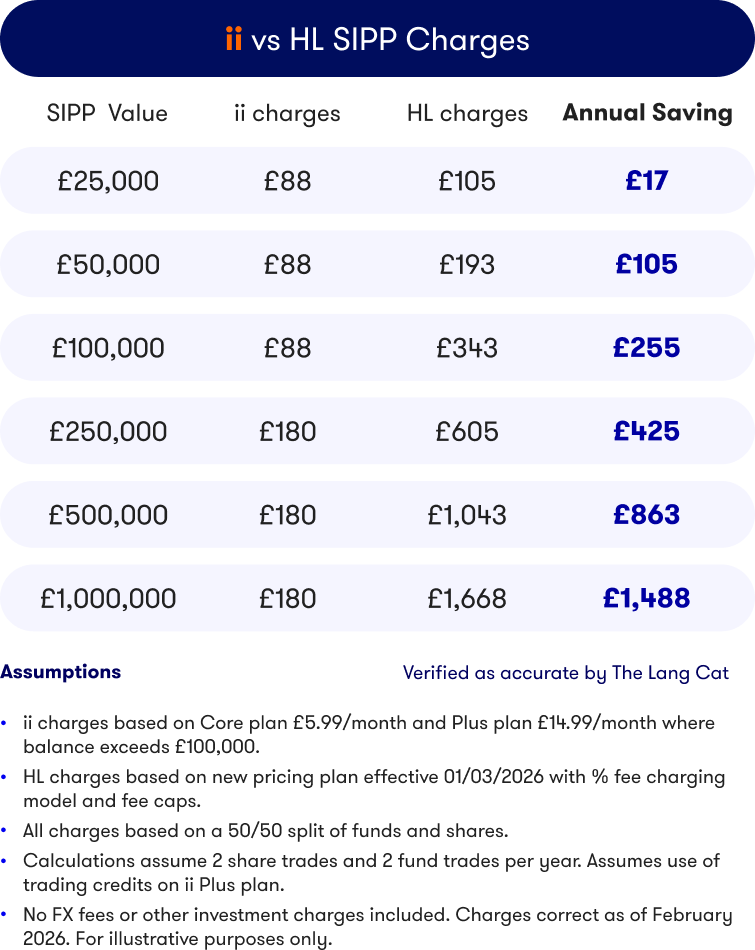

ii vs HL: SIPP charges compared

Platform charges compared

Simply put, depending on the value of your SIPP, how you choose to invest and the number of trades you place, you could pay less in charges with interactive investor.

If your pension pot is larger than £20,000, interactive investor may be cheaper than Hargreaves Lansdown.

interactive investor charge a flat fee

Unlike percentage-based fees charged by many providers, with ii you will always pay a low, flat fee. This could dramatically increase your retirement wealth over time.

Start on our Core plan at £5.99 a month and upgrade when you want access to a wider range of benefits - or when your portfolio grows above £100,000.

Hargreaves Lansdown charge a percentage fee

Funds: Annual charge to hold funds is tiered and will increase until a value of £2m is reached:

- 0.35% on the first £250,000 of funds

- 0.25% on the value of funds between £250,000 and £1m

- 0.1% on the value of funds between £1m and £2m

- No charge on the value of funds over £2m

Shares: Annual charge to hold shares, bonds, investment trusts, ETFs:

- 0.35% (capped at £150 per annum)

What about trading charges?

With interactive investor, when you buy or sell an investment, you’ll usually pay a one-off trading fee. The amount depends on the type of investment and which price plan you're on. Please see our charges for details. There are no trading charges when you invest monthly with our regular investing service.

With Hargreaves Lansdown, trading charges start at £6.95 for shares, ETFs and other equities and can drop down to £3.95 for frequent traders (20+ trades made in the previous month). Trading charges for funds range from free up to £1.95.

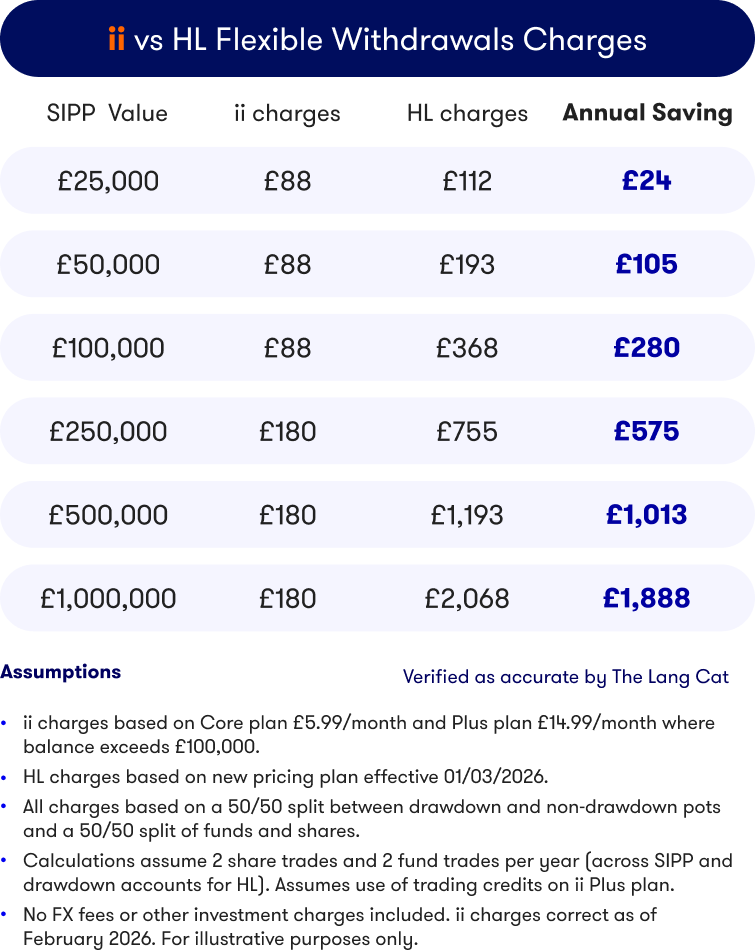

ii vs HL: taking money out of your pension

With interactive investor, you can withdraw cash from your pension without any additional charges using tax-free cash, drawdown & lump sums. Learn more: Pension options at retirement.

With Hargreaves Lansdown, there are no additional charges - as long as you aren't planning to move only some of your SIPP into drawdown - read on to find out more.

ii vs HL charges: Flexible Pension Withdrawals

One of the key benefits of a SIPP is the flexibility it gives you when you need to take money out of your pension. For example, many SIPP investors choose to move only part of their SIPP into drawdown, take a small amount of tax-free cash or blend both drawdown and lump-sum withdrawals.

With interactive investor, there are no additional fees when splitting your SIPP into drawdown and non-drawdown pots. It's all included in the same flat fee and the investments are simply allocated proportionally to the amount of pension you choose to hold in each pot.

With Hargreaves Lansdown, if you need this flexibility, drawdown and non-drawdown pots will need to be managed using two separate accounts, each of which will be charged separately.

This could mean increased charges due to HL's percentage-based fees applying to both pots. In some cases, the charges could increase by as much as 100%. By using two accounts, the investments are also held and managed separately.

How to transfer a SIPP from Hargreaves Lansdown to interactive investor

We transfer thousands of HL SIPPs to ii every year. You can transfer easily online once you open your ii SIPP.

2.

Start your transfer

You can do this quickly, easily and entirely online once you open an ii SIPP.

- Full or partial transfers

- Transfer cash or Investments

- Pensions in drawdown

3.

Leave the rest to us

We'll work directly with HL to complete your transfer seamlessly.

We will send you regular updates on how your transfer is progressing and let you know once everything's sorted.

Things to consider before you transfer

Please check that you won’t lose any safeguarded benefits if you transfer. This could include guaranteed annuity rates or lower protected pension age than the Normal Minimum Pension Age (rising from 55 to 57 in 2028).

Please also check any transfer-out fees. Please note that if you plan to hold both drawdown and non-drawdown pots in your ii SIPP, you cannot allocate specific investments to each pot separately. This means that the value of each pot will change in line with the overall performance of all the investments held in your SIPP.

Before transferring, we recommend seeking advice from a suitably qualified financial advisor or free, impartial pension guidance from MoneyHelper or (if you are 50 or over) Pension Wise.

Even better value when you consolidate to ii

The flat-fee savings only get better if you consolidate your investments with us. Most platforms charge on a percentage basis, meaning the more you invest the more you pay. We're different. Our flat fees mean that the more you keep with us, the more you save.

Whether you are looking for an ISA, Junior ISA, Trading Account or a SIPP, we’ve got you covered.

interactive investor vs Hargreaves Lansdown FAQs

Get up to £3,000 when you switch to our SIPP

You could keep more money for your future with our low, flat-fee Personal Pension (SIPP) and enjoy a cashback boost.

Get £100 to £3,000 cashback when you open a SIPP and deposit or transfer a minimum of £20,000. See more details on this offer.

Offer ends 28 February 2026. Terms and fees apply.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028).

Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as, guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser. Don’t transfer just to qualify for the offer, and don't rush any decision to meet the offer deadline. We periodically run offers, and there will likely be other opportunities in the future.

Save and make the most of your investments with ii

Open an account

Whether you are looking for a general trading account, an ISA or a SIPP, we’ve got you covered with a low, flat fee.

Personal Pension (SIPP).

Get pension peace of mind with our four-time Which? Recommended Personal Pension (SIPP). Invest yourself or let our experts handle your investments for you.

Stocks & Shares ISA.

Get tax-free investing all wrapped up with our award-winning ii ISA. Take care of your own investments or let us manage them for you.

Managed ISA.

Let us manage your ISA for you. Save time, leave it to the experts and feel confident in your investment goals - all for a low monthly subscription.

Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Why Hargreaves Lansdown customers choose interactive investor

Transfer of ISA & SIPP from HL to II

Moved my ISA & SIPP from Hargreaves Lansdown to Interactive Investor due to their lower annual fees.

All worked like clockwork. Very easy to transfer my funds. A couple of my funds weren't supported by Interactive Investor but they offered very close alternatives from the same fund manager. Spoke to one of their advisers (Kevin) who answered all my questions quickly and professionally. I was with HL for over 20 years so it wasn't easy to move away but so far so good. Overall very pleased with the experience.

Transfer of SIPP

I have recently transferred my SIPP over to Interactive Investor due to higher fees and slow phone customer service at Hargreaves. I must say I have called the help line twice now and on both occasions my queries have been handled quickly and efficiently. I am loving the great service and much lower fees concept. Also the ability to have multiple currency accounts will end up generating considerable exchange savings moving forward. Thanks BAS today for your help !

Excellent SIPP/ISA provider

Transferred all my investments to ii recently because of the low monthly charges and I have been impressed by both the tech that drives the service as well as the responsiveness of the support team if you need help.