Important information: As investment values can go down as well as up, you may not get back all the money you invest. If you're unsure about investing, please speak to an authorised financial adviser. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Wouldn’t it be great to invest your money without investing your time?

That’s the ii Managed ISA. It’s all the tax-free benefits of our Stocks and Shares ISA, but with our experts choosing the investments for you.

We handle your portfolio, always ensuring we work towards your financial goals – and your future. You can start investing quickly and easily in a way that suits you, all for ii’s flat, monthly fee.

Like the sound of a low, flat-fee ISA?

Open an ii ISA - including our Managed ISA - and enjoy £100 to £3,000 cashback when you add at least £20,000. See more details on this offer.

Offer ends 5 April 2026. Cashback based on money and investments transferred/deposited across all new accounts opened. Terms and exclusions apply.

Time is precious; you may not want to spend it researching investments. That’s where our Managed ISA steps in.

Feel confident knowing our team of experts will pick your investments and manage them for you.

Simplify your investments without the price tag. Get the convenience you need for our same low, flat subscription.

Your ISA is made for you.

Before opening your Managed ISA, you'll answer a few questions to match you to one of 10 investment portfolios. This is to find the portfolio that best suits you and the level of risk you're comfortable with.

Once that's done, check you're happy with the portfolio match, then you're all set to open your ISA and leave it to the experts.

Answer some questions about how much you want to invest and your appetite for risk.

If you aren’t sure what's right for you, we’ll help you through the process.

Once we know more about the type of investor you are, we can match you to your portfolio.

Then it's time to set it up and hand it over to us.

We’ll monitor your investments and adjust as needed to keep them in line with your goals.

Check in on it anytime, and if anything changes, you can easily switch to a different portfolio.

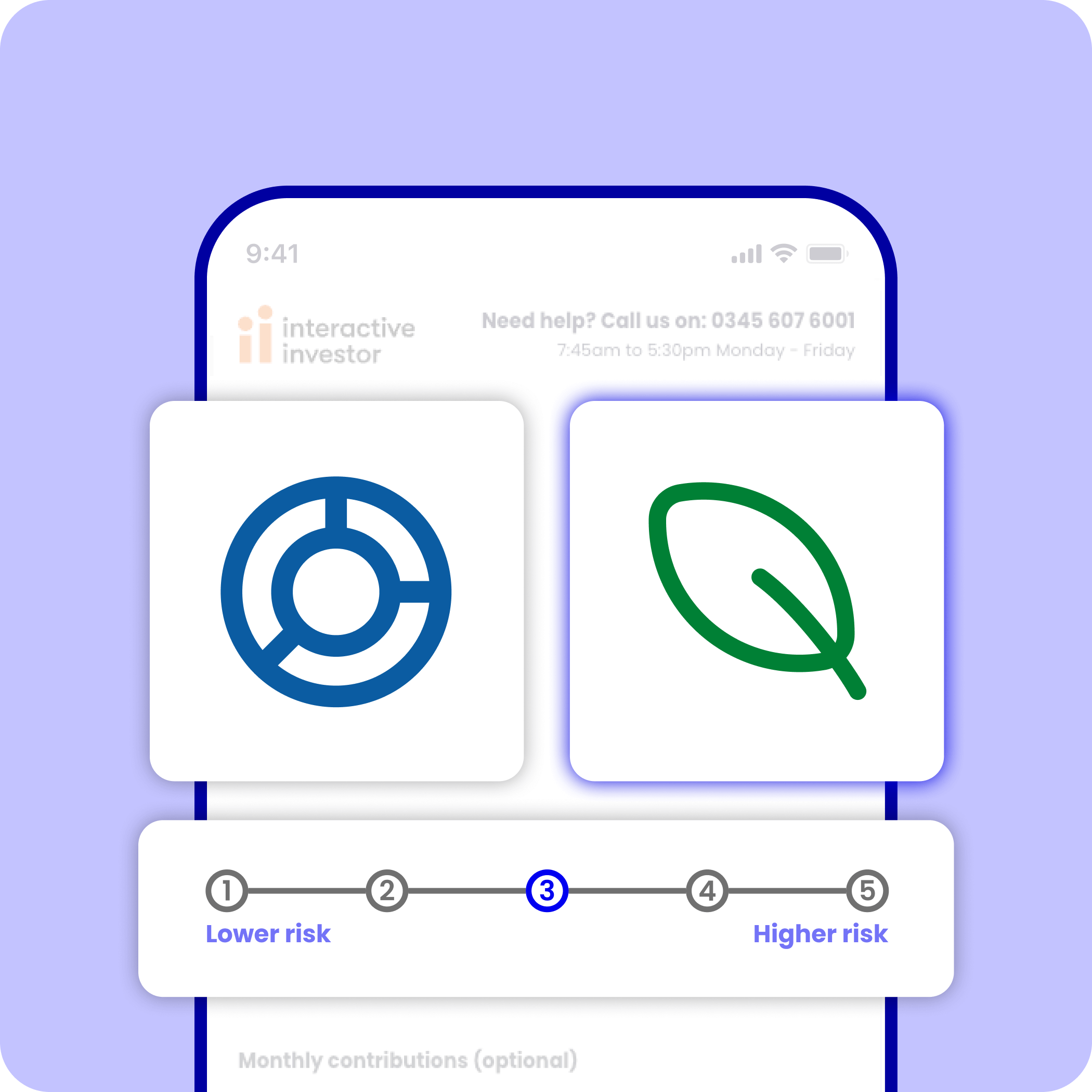

With 2 distinct styles and 5 levels of risk to choose from, you can find an investment portfolio that matches the type of investor you are. While there's no minimum investment period, all our portfolios are designed for long-term growth (at least 5 years).

Want to understand more about risk? Learn how you can strike the right balance.

Important information: interactive investor (ii) is an Aberdeen company. Aberdeen advise ii on the fund selection for the Managed ISA portfolios. The portfolios contain funds predominantly managed by Aberdeen but may also include funds managed by other third-party managers. Find out more about how ii and Aberdeen work together.

Please review the portfolio Factsheets for more details on the underlying funds and each portfolio's performance. More information about the recent performance of the portfolios can be found in our Quarterly Commentary. Remember, past performance isn't indictive of future returns.

Unlike percentage-based fees charged by many ISA providers, with ii you will always pay a low, flat fee. This can add up to real cost savings as your wealth grows.

Start on our Core plan at £5.99 a month and upgrade when you want access to a wider range of benefits - or when your portfolio grows above £100,000.

It’s a transparent, cost-effective way to invest tax-efficiently for your future.

| Invest up to | Monthly fee | Plan |

|---|---|---|

| £100,000 | £5.99 | Core |

| No limit | £14.99 | Plus |

As with any other investments, you'll pay an ongoing management charge for your Managed Portfolio. This is taken directly from the value of the fund and can range from 0.10% to 0.22% (costs may change over time), depending on your portfolio choice. See our factsheets for more information on these charges.

Our low-cost Managed Portfolios, and flat monthly fees, mean your total costs for an ii Managed ISA are some of the lowest around for an ISA managed by experts.

| Fund Charge | £20,000 | £50,000 | £100,000 | £300,000 | |

|---|---|---|---|---|---|

| ii | 0.15% | £101.88 | £164.88 | £329.88 | £629.88 |

| JP Morgan | 0.20% | £130.00 | £325.00 | £650.00 | £1,550.00 |

| Vanguard | 0.37% | £104.00 | £260.00 | £520.00 | £1,485.00 |

| Wealthify | 0.16% | £148.00 | £370.00 | £740.00 | £2,220.00 |

How this is calculated: How this comparison is calculated: Costs of investments in portfolios include fund fees, market spread and variable transaction charges. Vanguard illustration based on Vanguard’s Managed ISA. Wealthify illustration based on Balanced Plan. JP Morgan Personal Investing illustration based on Fixed Allocation Plan. Account fees include any account fees, subscription fees or management charges. The ii account fee is a monthly subscription. Other providers' account fees are on an annual percentage of the amount invested. This is only an estimate. Actual costs may vary depending on the performance of underlying investments.

Source: Boring Money, 1 February 2026

Did you know adding an ISA doesn’t just give you access to the Managed ISA? It also includes our Self-managed ISA, meaning you can make your own investment decisions alongside it. It’s one ISA, but many opportunities.

Are you more of a hands-on investor? Or simply prefer to leave it to the experts? Either way, we have the ISA for you. And all for our same low, flat monthly subscription.

In 2022, interactive investor (ii) became part of Aberdeen, a global wealth and investment group dedicated to helping people be better investors. And in 2024, the ii Managed ISA was launched with the support of Aberdeen.

The Managed ISA portfolios are designed for people who don't have time to manage their own investments or would simply prefer to leave it to the experts.

Aberdeen uses its wealth of investment expertise to advise ii on the strategic asset allocation and fund selection for the Managed ISA portfolios. This includes Aberdeen's in-house funds but may also include funds managed by other third-party managers.

Each fund used in the portfolios, including Aberdeen-managed funds, charge a management fee. This charge is taken directly by the fund manager.

ii's Investment Committee oversees the relationship with Aberdeen and manages any conflicts of interests. This includes the risk that ii may favour the use of Aberdeen funds for the Managed ISA portfolios rather than considering alternatives. The Committee act as the final decision maker on the portfolios, ensuring they offer value for money and continue to meet your needs.

For more details on the Managed ISA portfolios, including the fees, please view the portfolio factsheets.

A Self-managed ISA lets you pick your investments yourself. The Managed ISA is closely monitored by our experts, who take care of your portfolio on your behalf and make ongoing buy and sell decisions to keep you aligned to your chosen appetite for risk.

Yes, you can transfer an existing Cash ISA or Stocks and Shares ISA to us.

Depending on the provider, it should be straightforward. Transferring an ISA to ii is easy—you can start the transfer when you open a new account or log in and do it at any time.

You can’t transfer any existing investments into the Managed ISA. Still, we make it simple to transfer them into our Self-managed ISA (which is included in the subscription), where you can then sell them and move the money into your Managed ISA.

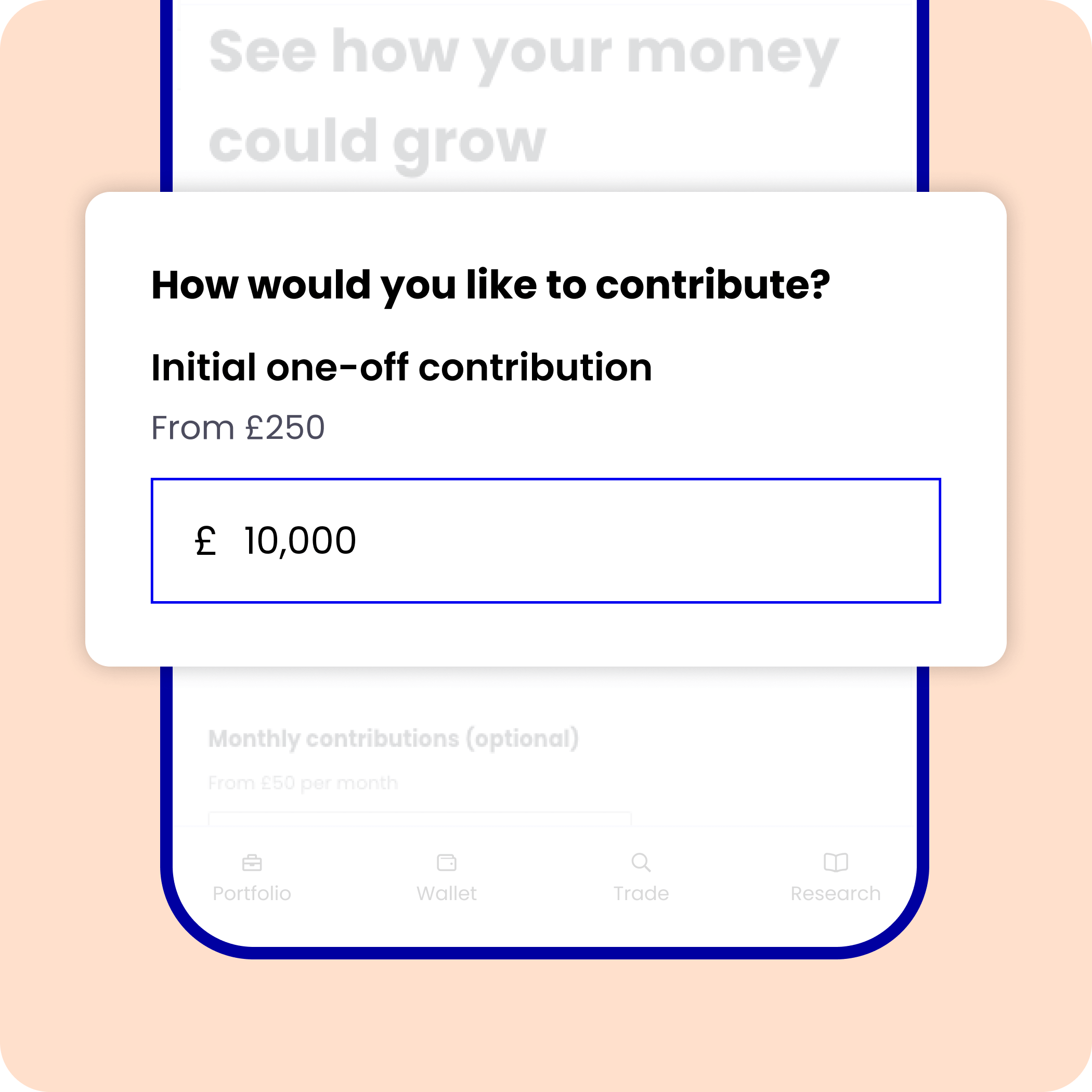

To open a Managed ISA, you can invest from an initial lump sum of £250 or set a monthly deposit from as little as £50. The maximum you can invest in any given tax year is £20,000.

But remember, this allowance includes all types of ISA with any other provider. So if you also have a Cash ISA, this counts towards your £20,000 annual allowance.

The minimum investment amount is either a £250 lump sum or a £50 regular payment.

If you're starting with a lump sum you can do this when you set up an account via debit card.

If you're starting with a regular payment you will be prompted to set up a direct debit on account opening.

You can also transfer your existing ISA to ii.

Any deposits into your Managed ISA account above £50 will automatically be invested into your chosen portfolio. The minimum is in place to ensure there is sufficient cash available to be invested into each of the chosen assets in the portfolio. Each portfolio typically contains around 20 underlying investment funds, although the actual number be higher or lower depending on the portfolio chosen

Yes, you can withdraw your money from our Managed ISA at any time without penalty or exit fee. However, any money you withdraw from your ISA does not renew your annual contribution allowance. Once you've paid into an ISA, that part of your allowance has been used.

A Managed ISA is much the same as a normal Stocks and Shares ISA.

It has the same £20,000 annual allowance that you can invest with and pay zero tax on the returns, meaning it's an effective way to make your money work harder.

When you open a Managed ISA, we ask you a few questions to understand your goals. This involves finding out how risky you want your investments to be, and whether you want our index investment style or sustainable investment style.

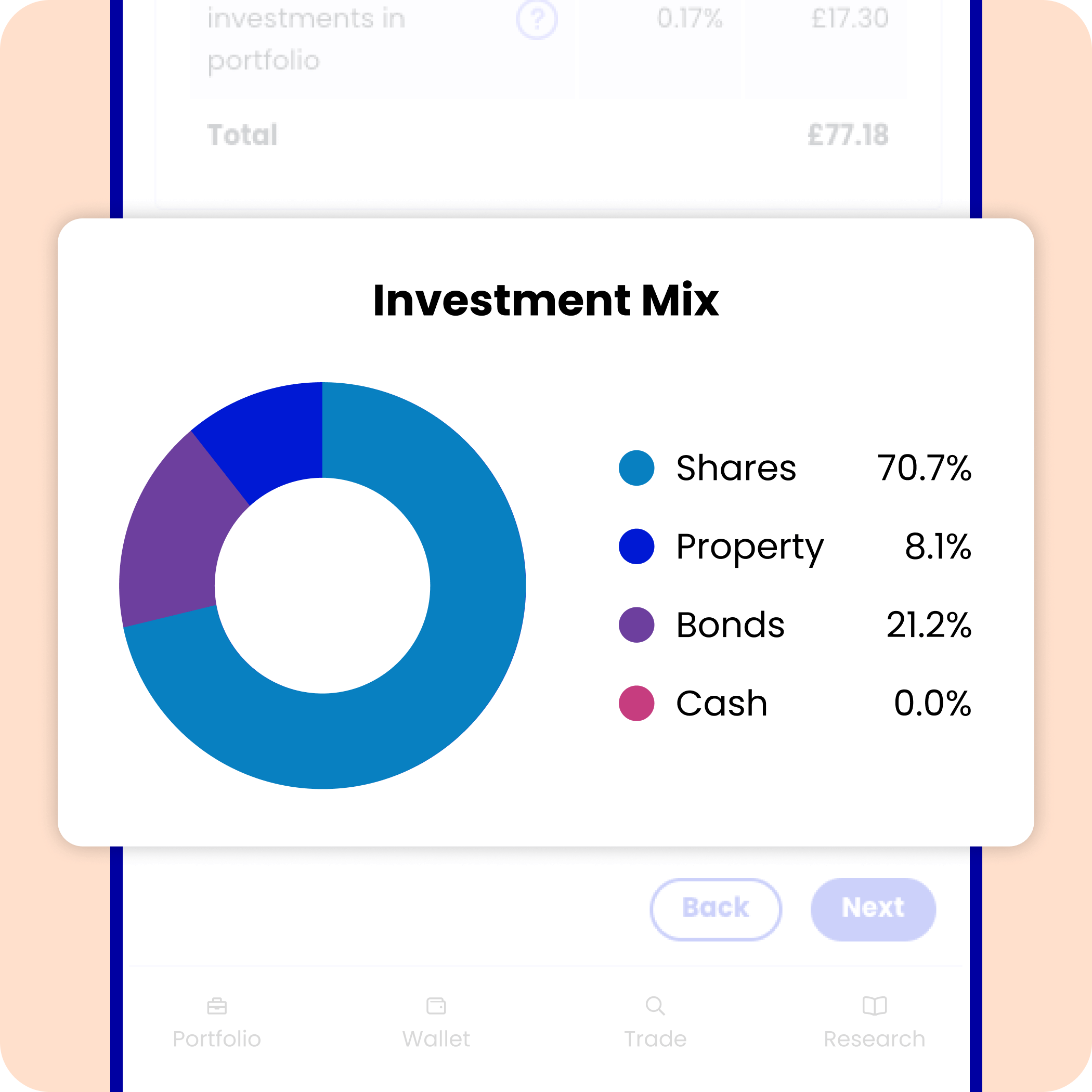

There are five levels of risk across these two styles, meaning there are 10 portfolios available to you. You’ll be able to see more details on what these are during the selection process.

The portfolios mainly investment in passively managed funds which aim to replicate the performance of a market index. Funds will hold different assets, such as UK and international shares and government and corporate bonds. The overall asset mix will depend on the portfolio you choose.

You can read more about the Managed ISA Factsheet.

A Managed ISA might not be for everyone. It’s ideal for you if:

Of course, there could be many reasons beyond this, too. But because the ii ISA includes both the managed and self-managed options in one subscription cost, you can try one to start and try the other when you’re comfortable. You can even benefit from both at the same time with separate pots.

Our experts are qualified investment managers with a wealth of experience in managing portfolios.

You can rest assured that your investments are managed by humans, not algorithms. They reassess your portfolio regularly to make sure it’s doing as much for your money as possible.