Chart of the week: is it heresy to short Apple shares here?

7th February 2022 12:53

by John Burford from interactive investor

It has been one of those ‘never sell’ stocks, but technical analyst John Burford Is not so sure now. Here’s what he thinks of the current chart set-up.

Last week, Apple (NASDAQ:AAPL) announced its Q4 business services sector earnings grew to a record $78 billion annualised and would continue to grow this year at double-digit rates. The gadget sector was about flat.

As experienced traders/investors well know, with success comes extravagant forecasts – and often well over the top. Anyone who has kept a ruler from school can draw in bullish forecasts. There is little skill in that.

But when the figures were announced, the share price did not perform the usual knee-jerk surge, but declined instead. To a trader, that was a 'Hmm' moment and could mean one very real possibility – that the share price had already baked in the good news.

- No trading fees on US shares until 11 February. Click here for details

- US stock market outlook 2022: more record highs for Wall Street?

- Meta’s share crash wipes $200 billion off valuation

- Stockwatch: should you copy Fundsmith and buy this FAANG stock?

If so, logic suggests that to keep the bull expectations alive, no nasty surprises can be contemplated.

In the bigger picture, I have been laying out my case for months now that the market-leading FAANG Gang was vulnerable to corrections – and perhaps something worse. Remember, they were considered the 'never sell' group last year.

After all, a not-so-perfect scenario for Meta (NASDAQ:FB)/Facebook and Netflix (NASDAQ:NFLX) earlier had produced very rapid re-ratings for both with Meta off 40% and Netflix off 50% from their all-time highs, not to mention the 'untouchable' Amazon (NASDAQ:AMZN), which is off 26%.

That carnage has the tech bulls very worried – with panic in some quarters.

- Chart of the week: Netflix shares are half price – should you buy?

- Why Bill Ackman just took a massive punt on Netflix

- Alphabet's bumper results plus stock split news

As I mentioned at the time, I wondered if the Facebook name-change to Meta in late October had been a result of the all-time high just a few weeks earlier. Many were puzzled by that change, which suggested desperation to focus away from the troubled social media platform.

The two holdouts in the FAANG Gang (or should it now be named the MAAAN Gang?) are Apple and Alphabet (NASDAQ:GOOGL). As we have seen with Amazon, even Teflon companies can become less shiny.

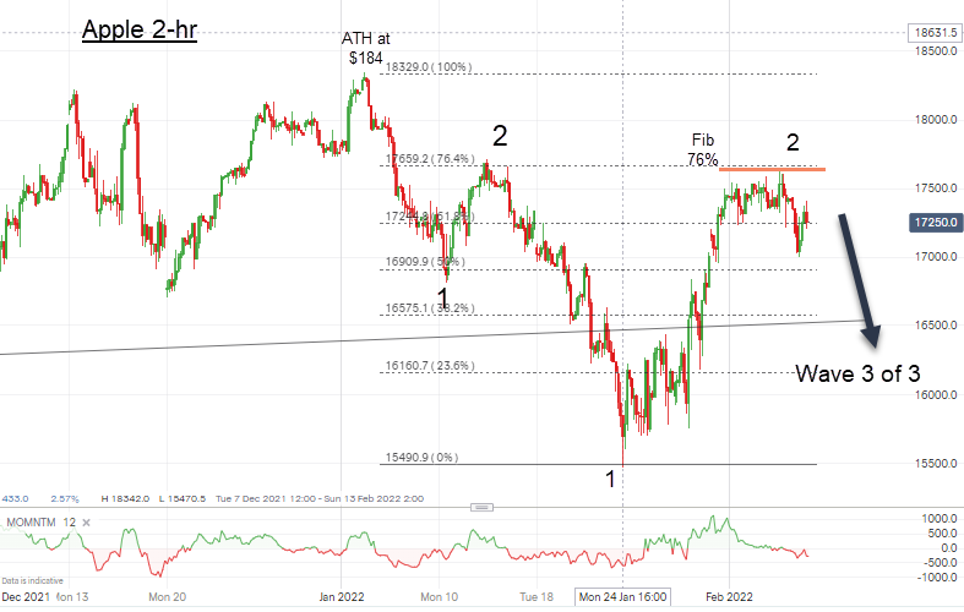

Here is the two-hour chart that tells me Apple shares are at an important juncture:

Past performance is not a guide to future performance.

Last week, the shares rallied to the Fibonacci 76% retrace off the $184 all-time high on 4 January and is now testing that level. If my wave labels are correct, the shares are on the verge of a strong move lower. Only a surge above the wave 2 high at $176 would send me back to the drawing board.

I am staying with my belief that taking profits here is a very prudent move. Traders will be looking to short the shares.

John Burford is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.