Commodities Focus: This is the real driver of prices right now

3rd September 2018 13:38

by Rajan Dhall from interactive investor

Industry analyst Rajan Dhall discusses where investors should expect oil, gold and copper prices to move this week.

Commodities started last week full of hope as the trade tensions across the world looked like they might be easing. Little did they know that we would see a stalemate in negotiations with no significant comments from China.

The US and Mexico managed to come to an arrangement the week before and it is now crunch time between the US and Canada. Through the week, Canadian and US officials expressed hope that a deal could be reached by Friday and the market started to price this in.

Once Friday came the rumour mill turned and in the afternoon disappointment ensued. Souring sentiment, president Trump tweeted the fact he may exit the agreement (NAFTA) altogether.

US dollar resilience has also been a major issue for commodities recently, although we had a sell-off last week. Interestingly, during bouts of dollar (USD) strengthen, commodities have sold off more than they rise when the dollar weakens. This suggests it may now be a secondary issue and the trade talks carry more weight in terms of negative sentiment and, of course, each major commodity has its own themes.

Copper struggled again last week - at the beginning, the market was full of hope and pushed to reach a high of $2.74/lb. Toward the end, sentiment turned sour and we closed the week near the lows of $2.64/lb.

Overnight, we also had some important manufacturing data from China; Caixin manufacturing PMI activity grew at the slowest pace for more than a year. To add salt to the wound, the market also received some data from the state-owned mine in Chile (Cochilco) - output at the mine rose 2% in the first half of 2018 to hit 813,000 tonnes.

From a price perspective, we are still in the value area from late 2016 to early 2017. It seems we are destined to stay in this zone until the market receives more information regarding the dispute between America and China.

Past performance is not a guide to future performance

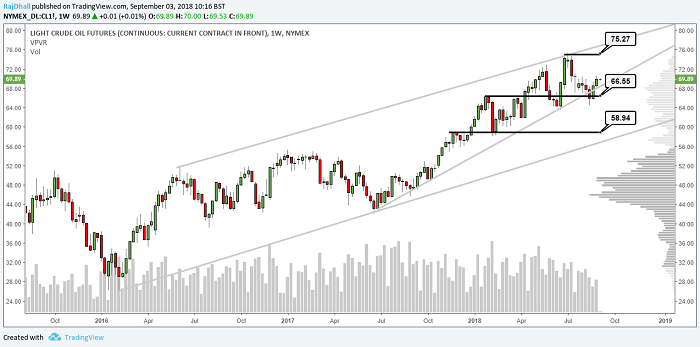

WTI managed to close the week around the $70/bbl level - both Saudi Arabia and Russia had previously stated that this price was an acceptable zone for their production levels. The Department of Energy (DoE) inventory data from last week produced a bigger draw than expected and the market reacted by pushing prices higher.

Volumes are interesting when prices reach this area as we notice there is limited 'interaction' in the intraday. This week we get the latest OPEC report, the key number traders watch on at present is the global demand number. Although it has been creeping higher, last time out the number fell below the previous month’s expectations and the oil price sold off.

Past performance is not a guide to future performance

Gold has started the week on a positive footing after closing the week lower. Safe haven flow continues to favour US paper ahead of the precious metal even when equities sell off quite hard.

Prices continue to oscillate around the $1,200/oz level. We have also seen safe haven flow from Turkey and South Africa heading into the US dollar instead of precious metals. Therefore, it seems only a material US equities drop could instigate a gold rally.

Elsewhere, analysts noted a drop in holdings in the SPDR ETF (GLD) which is the world's largest gold ETF. From a technical point of view, traders will look to see how much of this negativity is priced in.

The price hit a pretty important support zone and the market pushed it back up with decent volume, but we have not managed to sustain the price rises since.

Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.