This is what fund investors did when the market collapsed

11th December 2018 09:57

by Tom Bailey from interactive investor

We've seen significant declines across global equity markets, but what did fund investors do? Tom Bailey reveals all.

October of this year earned the moniker 'Red October', thanks to the heavy selling that engulfed markets around the world. With fear over the pace of US interest rates rises pushing US bond yields to an eight-year high, investors dumped equities, including the one seemingly unstoppable FAANG tech names, wiping out yearly gains.

During such market chaos, how did UK retail investors react?

According to the Investment Association’s monthly statistics, net retail sales for UK recognised funds was negative, with net outflows totalling £1.6 billion. In comparison, funds saw a net inflow of £5.3 billion in October of 2017.

However, while the month of October will be remembered more for the damage it did to equities (damage that markets are still struggling to recover from), UK retail investors were heavy sellers of bonds, rather than equities. Net outflows from fixed income funds totalled £1.6 billion.

As Chris Cummings, chief executive of the Investment Association, notes:

"With the era of quantitative easing anticipated to end in both the US and Europe, fixed income funds have seen their appeal dented."

In contrast, most equity fund sectors saw more money invested than withdrawn throughout the month, suggesting that many UK investors saw heavy selling as a chance to "buy the dip".

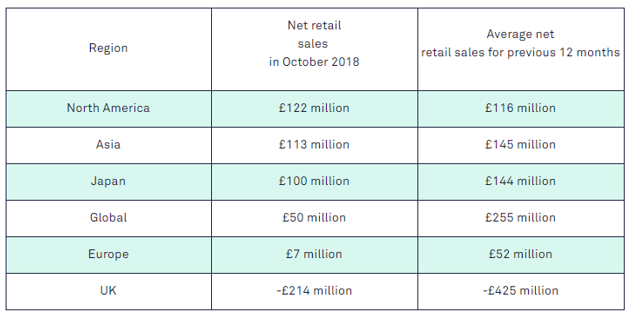

In particular, North America equity funds saw the largest sales, with net inflows of £122 million, above its 12-month average of £116 million.

However, with markets still taking a beating through November and December, such attempts to "buy the dip" may not have made the best choice, at least viewed on a short-term basis.

As George Lagarias, chief economist at Mazars notes:

"The failure of the S&P 500 to break through some key technical levels in a period where it traditionally rallies, could dampen trading expectations for the remainder of a year where “buying the dip”, the universal sign of a bull market, did not work."

Meanwhile, UK-focused equity funds continued to see heavy outflows, albeit it slighter lower than the average net retail sales for previous 12 months.

Source: interactive investor Past performance is not guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.