Help to Buy gives Persimmon an added boost

21st August 2018 09:58

by Richard Hunter from interactive investor

Housebuilder Persimmon has something to cheer about, with plenty of metrics ticking north thanks to Help to Buy. Head of markets at interactive investor Richard Hunter analyses the highlights.

Persimmon is certainly fixing the roof while the sun is shining, as it reported a sparkling set of figures driven by a number of beneficial factors.

The government's Help to Buy scheme remains a tailwind, as does the historically low interest rate environment and few problems surrounding mortgage availability. This has propelled an impressive set of metrics, with earnings per share up 13%, return on capital growing by 14% and gross margin ticking north of 30%, all part of a positive package which has seen pre-tax profit jump 13%.

Meanwhile, there is a high quality land bank in reserve, outlook comments are positive and the strength of Persimmon’s cash generation has enabled the continuation of a generous return to shareholders, where a prospective dividend yield of 9.6% is eye-watering.

Equally, and as seen in the aftermath of the referendum, a poor Brexit outcome would leave housebuilders in the firing line. This is quite apart from any change in government policy with regard to the fillip it currently provides the sector, or indeed any further weakness in sterling which would mean that materials were more expensive.

The housing market generally has shown some signs of fatigue, although Persimmon maintains that it is well positioned to weather the economic storm if and when it arrives.

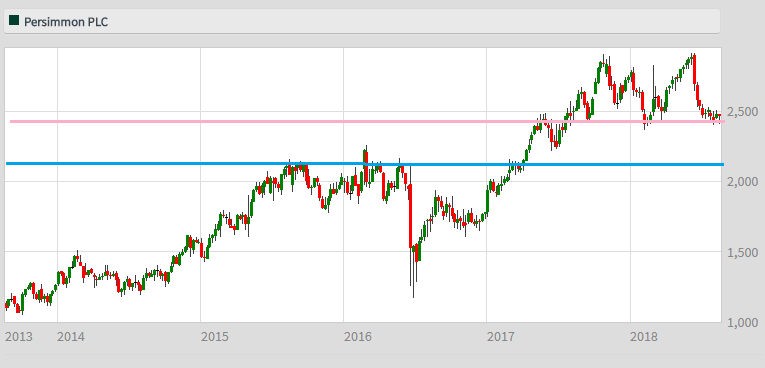

Source: interactive investor Past performance is not a guide to future performance

Despite these positives, investors have been cautious on the industry and on Persimmon in particular. A 14% decline in the share price over the last three months has deflated the annual performance, namely a drop of 3% as compared to a 3.6% increase in the wider FTSE 100 for the period.

As such, and aside from the well-deserved hike in the price in early trade, the murmurings that there could be better value elsewhere in the sector has constrained the market consensus, which currently refuses to budge from a 'hold'.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.