Why US fund managers are struggling to beat the index

Tom Bailey explains why active managers were battling to provide outperformance in 2019.

17th January 2020 09:45

by Tom Bailey from interactive investor

Tom Bailey explains why active managers were battling to provide outperformance in 2019.

Fund managers struggle to beat their benchmark in the US market at the best of times. With thousands of participants and analysts, it is often argued that the S&P 500 is just too efficiently priced for stock-pickers to consistently provide outperformance.

Fund managers, however, were even more handicapped in 2019, owing to the sort of stocks that provided the best returns for the year, according to Chris Bennett, director of index investment strategy at S&P Dow Jones Indices.

Bennett notes that active managers attempt to provide outperformance by deviating from the benchmark. There are two ways that fund managers can go about this: they can be underweight and overweight different stocks, and they can be underweight or overweight certain sectors or factors.

In 2019, however, many active managers would have struggled to be overweight the index’s best performers, with the five largest stocks in the S&P 500 producing an average gain of 51%.

Rather than being overweight these stocks, active managers were more likely to be underweight, when compared to a market-cap weighted index.

For many active managers, building overweight positions in the largest companies in the index would have been viewed as taking on too much risk.

Added to that, the larger sectors of the S&P 500 index also outperformed their smaller peers. Chiefly, the S&P 500’s largest sector, the information technology sector (21%), gained a total of 50% on the year. Without being overweight the information technology sector, active managers would have struggled to provide outperformance.

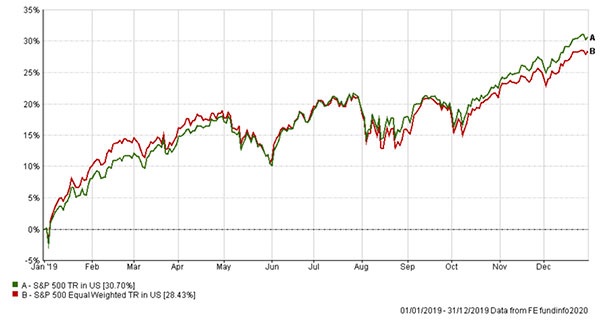

The importance of larger stocks and sectors to the S&P 500’s overall return in 2019 can be seen by comparing the returns of a market weighted version of the index to an equal weight.

As Bennett notes:

“The performance of equal weight indices provides an easy way to analyse the importance of size in stock and sector selection. S&P 500 Equal Weight index has the same constituents as the S&P 500 index, but weights each constituent equally, with the result that the sector allocations are also more balanced.”

For example, according to figures from the S&P 500, the S&P 500 index had a total return (in USD) of 30.7% in 2019. In comparison, the S&P 500 Equal Weighted provided a total return (in USD) of 28.43%.

The S&P 500 vs the S&P 500 Equal Weighted

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.