Will the UK enjoy a Santa rally this December?

Statistically, the odds are stacked heavily in favour of positive stock market returns each December.

28th November 2019 14:07

by Jemma Jackson from interactive investor

Statistically, the odds are stacked heavily in favour of positive stock market returns each December.

Just as Bing Crosby dreamed of a White Christmas, investors wait in hope for the fabled Santa rally to end what has been a volatile year for investments on a high.

The Santa rally, the long-standing superstition that stock markets bounce in the run-up to Christmas, does have a fair amount of statistical backing.

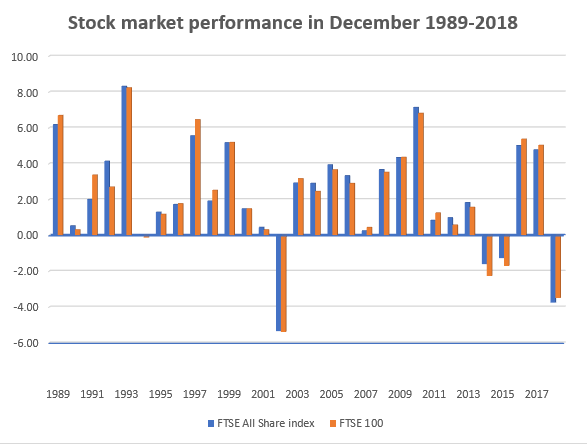

Research by interactive investor has found that over the past 30 years, December has produced positive returns on 25 occasions for the FTSE 100 and the broader FTSE All Share indices respectively - although some years were stronger than others.

While the numbers speak for themselves over the past 30 years, there is certainly no guarantee of a repeat in 2019 - particularly against the backdrop of an impending General Election.

Total returns (in GBP) of the FTSE 100 and FTSE All Share in December over the past 30 years. Source: Morningstar. Past performance is not indicative of future results.

Lee Wild, Head of Equity Strategy, interactive investor, says: “This year, investors have plenty to concern themselves with, but it is the outcome of just two events that could determine whether UK stocks end 2019 with a bang or a whimper.

“The FTSE 100 is already up 3% in the week since China took a more conciliatory tone in trade talks with the US. A deal of some sort is already being priced in, but signing a phase one agreement could give buyers further confidence and boost the chance of a proper Santa rally.

“In the UK, the General Election is seen as a proxy for a referendum on EU membership, and the choice is binary. Regardless of your personal political affiliation, a Boris Johnson majority on 12 December and the perceived certainty around Brexit that it brings, is expected (righty or wrongly) to trigger a rally in UK-focused equities. Implementing extravagant spending promises spelled out in party manifestos could turbo charge returns into 2020.

“Any other outcome could see a further period of indecision around Brexit during which both businesses and money managers may well continue to sit on cash rather than invest it.”

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “In truth, investors shouldn’t get bogged down in the ‘festive hokey-cokey’ when it comes to the performance of stocks over the Christmas season. It is often better to stick with the tried and tested approach of investing for the long term and diversifying your portfolio across asset classes and markets.

“The Santa rally was cancelled last year amid concerns of a global economic slowdown and fears over the Federal Reserve’s plans for interest rates, as well as the ongoing US-China trade dispute. This year, the unfolding of the General Election will undoubtedly play a huge role in how the UK stock market performs over the festive period and beyond, and this could push stock prices in either direction.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.