Woodford investors find out size of losses on first payment

LF Woodford Equity Income investors have been told how much they will receive on 30 January.

28th January 2020 12:48

by Tom Bailey from interactive investor

Investors in the LF Woodford Equity Income fund have been notified how much they will receive in a first payment on 30 January.

Investors in the LF Woodford Equity Income fund have had a first indication of the sizeable capital losses they will stomach, following the announcement of the fund’s first capital distribution.

According to a letter to investors, Link Fund Solutions, the fund’s administrator, has now formally moved to wind up the fund and investors today (28 January 2020) were notified how much they will receive in a first payment on 30 January.

Investors will be paid an amount based on the number of units or shares they have. Those holding the fund through platforms will receive payment a few days later.

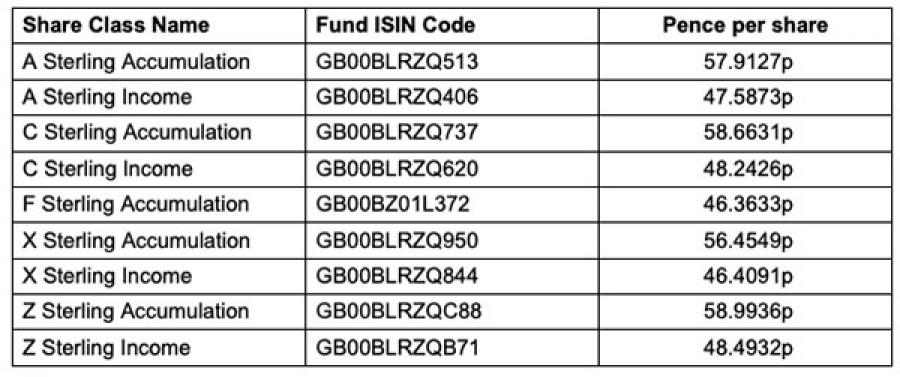

As the table below shows, investors will receive between 46p and 58p per unit, depending on the share class they hold.

These figures are significantly below both the initial unit price of the fund at launch (100p) and the current unit price (around 76p per share, depending on the share class).

On the basis of the A Sterling Accumulation share class giving an investor almost 58p per unit and the unit currently being 78p, investors will receive roughly 74% of the fund’s current value in this first capital distribution.

That leaves around 26% of the fund’s current value to be returned to investors. However, it is not clear how much more investors will end up receiving.

- How should wind-up of Woodford’s fund be treated for tax purposes?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The capital returned to shareholders has come from the sale of the fund’s liquid assets, which asset manager BlackRock was tasked with. That was the easy part.

The remaining part of the portfolio is in illiquid, unlisted assets and have seemingly yet to be sold. Park Hill, the private equity specialist, was tasked with the sale of the unlisted businesses.

Information of the progress of these sales has been notably lacking. For example, a letter from Link to investors in December 2019 noted that while BlackRock had sold the majority of its portion of the portfolio, it was “unable to confirm when [the unlisted] assets will be sold”.

According to Ryan Hughes, head of active portfolios at AJ Bell: “For Park Hill, it is a hugely challenging task to sell the illiquid holdings in a timely fashion and investors still remain in the dark as to how long they will have to wait for the remainder of their money, and importantly, how much they are actually likely to get back.”

The fund initially suspended trading in June 2019 as it was unable to meet a wave of shareholder redemptions. While the fund was due to re-open in December, Link announced in October that it had decided to wind up the fund and start the process of returning capital to investors.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.