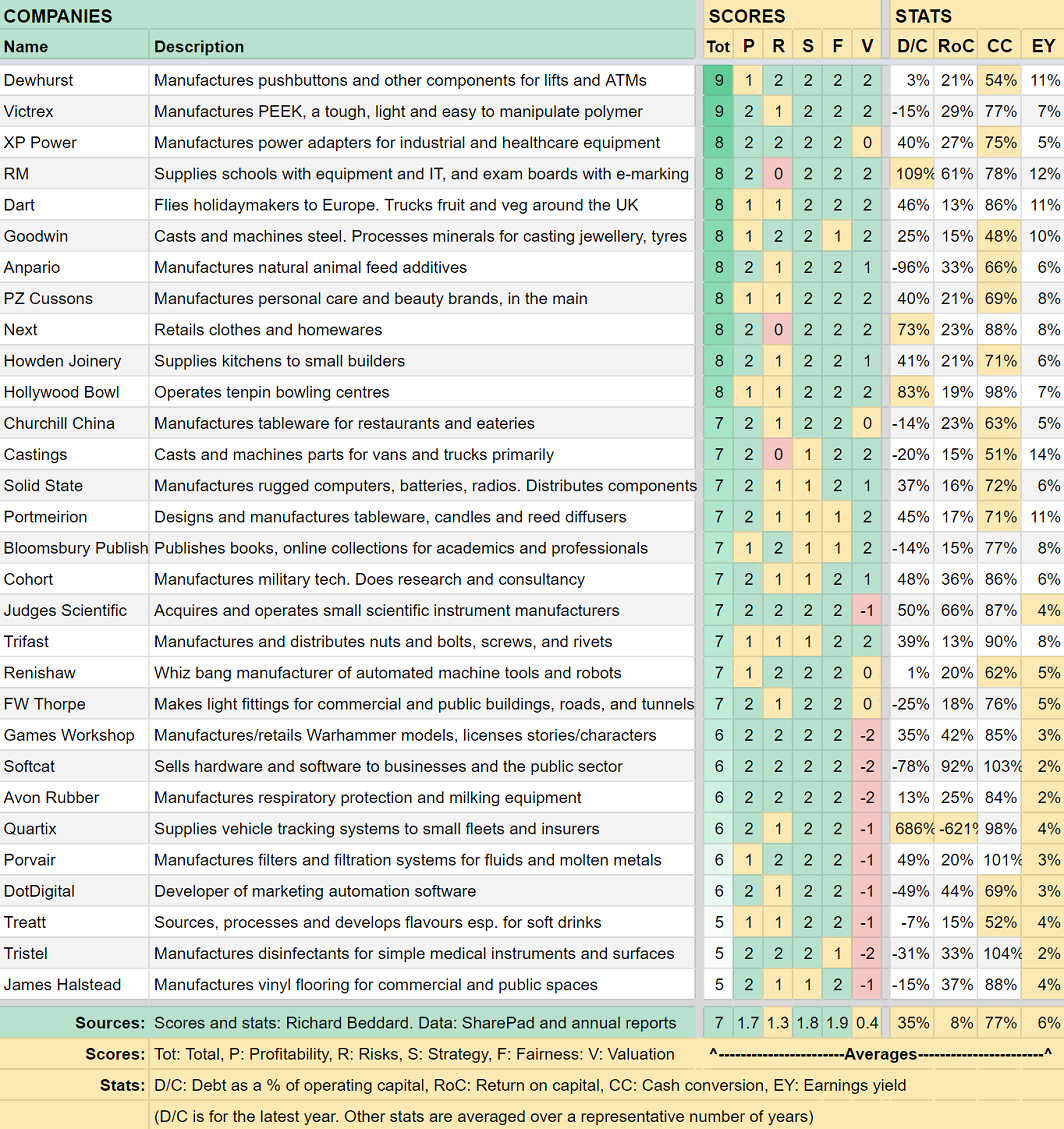

21 shares for the future

Designed to generate ideas for portfolios, our companies analyst’s Decision Engine lists his top stocks.

1st May 2020 15:30

by Richard Beddard from interactive investor

Designed to generate ideas for portfolios, our companies analyst’s Decision Engine lists his top stocks.

Don’t hate. A few weeks before the ‘lockdown’ and a few days before theatres closed, we visited our local venue to hear Ben Fogle talk about his adventures.

The show was a sell-out and there were only a few empty seats, but it felt a bit edgy being with hundreds of people, until Ben took us to the South Pole by way of a small Hebridean island.

I hadn’t thought much about the event until yesterday, when a request came from the venue. Could I answer a survey? Cambridge Corn Exchange wanted to know when I thought I might return, and what it could do to make returning easier for me.

The results I’ve seen of surveys like these indicate that when restrictions are lifted, a small proportion of us will return to restaurants, pubs, cinemas and so on. I don’t trust these surveys.

Attitudes change. If I could go back in time privileged with the knowledge of how things have turned out so far, I might advise my former-self to empty-seat Ben. Whenever theatres open again, my attitude may well flip back.

An uneasy relationship with the future

A long-time correspondent, Larry, sent me an ominous email in the early days of the lockdown entitled “the future”. He had decided that investing in businesses requiring us to gather, holiday companies, physical retailers, restaurants, bowling alleys and cinemas, simply isn’t necessary.

Larry was alarmed by the fact that a pandemic had shut these businesses down. So am I, but I haven’t sold my shares in companies that need people to meet, and I haven’t removed them from the Decision Engine, which helps me decide which shares to buy and sell.

Judging by the initial impact of the pandemic on share prices, many traders thinking like Larry incorporated the pandemic into their visions of the future and traded accordingly.

Judging by the subsequent bull market, attitudes may have softened, although I don’t take any comfort. To me, the future is a mystery and my strategy is not to be influenced by how I feel about it in the moment.

The Decision Engine helps with that. It ranks companies according to how I score them, an annual event tied to their reporting cycles. I try to evaluate each company soon after it has published its annual report, and I try to imagine whether it will be more prosperous in 10 years' time by understanding the risks it faces, the strategy it is using to address those risks and the company’s culture.

In-between annual evaluations I am not continuously adjusting my view to a newly updated vision of the future, so my 10-year forward vision of the future is as I imagined it months, or perhaps even a year ago. This artifice enables me to skip lightly over current events, almost as if they aren’t happening, and evaluate things once the dust has settled.

Implicit in this strategy is a constant vision of the future, that it won’t be so radically different from the past that good companies cannot adapt to it.

Revamping the Decision Engine

I have revamped the guts of the Decision Engine to make it easier for me to keep up to date and enable me to score more companies.

Hitherto, I collected up to 10 years of data exclusively from annual reports, a time consuming and error prone activity, but now the numbers powering the Decision Engine are a mashup of data exported from SharePad, a third-party supplier, and annual report data. Collecting the annual report data is just as tedious as ever, but there is less of it. Exporting data from SharePad is fantastically easy.

The numbers decide a company’s valuation score, one of five criteria I use to score companies:

[V] Are the shares cheap?

Shares with earnings yields of more than 5% (less than 20 times adjusted profit) earn positive scores up to a maximum of 2. Earnings yields of less than 5% (multiples of more than 20) score negatively (down to a minimum of -2).

Earnings yields are the reciprocal of earnings multiples. Instead of dividing the price (technically market capitalisation plus debt, aka enterprise value) by profit, we divide profit by price and express it as a percentage, so we can make comparisons with other investments, like the interest rate on a savings account.

The profit component of the earnings yield is normalised over a representative number of years (through thick and thin) by taking the average return on operating capital and multiplying it by the current level of capital required to operate the business.

The other four criteria are judgements, and I form these the same way as before, every year after a company publishes its annual report, although I have tightened up my definitions to be more rigorous. I score each of these criteria 0, 1, or 2 depending on how confident I am in my answers to these questions:

[P] Profitability: Has the business made good money?

Judges whether the company has been profitable in cash and accounting terms.

[R] Risks: What could stop the company growing profitably?

Examines debt, the variability of earnings, and competition.

[S] Strategy: How will the company make more money?

Considers whether the company’s strategy addresses the risks.

[F] Fairness: Will shareholders, staff, and customers benefit?

Assesses executive pay and share ownership, company policies and reputation

There’s a lot of detail in the right-hand side of the Decision Engine table (below), but the list in rank order is the end product.

Shares near the top are, based on my annual reviews and the current share price, the best value long-term investments out of a group that are all probably decent long-term investments.

We use an arbitrary value of seven to determine which are the best of the best, which gives us a catchy headline. This month there are 21 shares for the future...

If you have a head for detail, you can see how I scored the companies in the “SCORES” section. The greener the total score “Tot” the higher the score (out of 10). The score for each criterion in the columns to the right add up to the total, and are coloured green, yellow or red/pink so we can easily see where my biggest concerns lie.

Concerns will usually fester in the “V” column (for valuation) because I try not to follow unprofitable businesses addressing insurmountable risks with incoherent strategies, or businesses that seem intent on enriching their executives at the expense of all the rest of us!

The purpose of the Decision Engine is to generate ideas for portfolios, the portfolios I write about and invest in, and, perhaps reader’s portfolios. When I construct or rebalance my own portfolios I ensure I have more invested in the companies near the top of the list than those near the bottom, but I am prepared to hold some shares in good businesses at higher valuations to maintain diversification.

If you can stand more complexity, the column on the right shows four statistics for each share, the four I pay most attention to. They are explained beneath the table, and they are averaged along with the scores in the bottom row.

Finally, to see how exactly I scored and profiled these companies, here are the links:

Richard owns shares in most of the shares in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.