Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Whether you run your own limited company, you are a contractor or work as a freelancer, finding a pension that suits the way you work is essential.

A Self-Invested Personal Pension (SIPP) lets you choose how much and when you contribute to your retirement pot.

SIPPs deliver the flexibility and control that many self-employed people want.

SIPPs offer generous tax relief on contributions and allow investments to grow free from income tax and Capital Gains Tax. When withdrawing, 25% can be taken tax-free.

The tax benefits on contributions will depend on how your business is set up.

A SIPP is designed to be flexible. You can contribute whenever it suits you, whether regularly or in lump sums. When you retire, you can choose how and when to access your pension.

Each time you contribute to a SIPP from your taxable income, you receive 20% tax relief from the government.

If you’re a higher-rate taxpayer, you can claim up to 40% tax relief, and additional rate taxpayers can claim up to 45%.

Any investment growth you make within a SIPP is protected from Capital Gains Tax (CGT), dividend tax and income tax.

You can choose to take up to 25% of your pension tax-free, subject to a maximum of £268,275, once you reach 55 (57 from 2028).

If you've set up a limited company, you can make contributions to your SIPP directly from the company's pre-taxed company income.

This allows you to avoid paying Income Tax and National Insurance on that money, and your company also saves on employer National Insurance contributions.

These contributions count as an allowable business expense, reducing your company’s taxable profits and lowering its Corporation Tax liability.

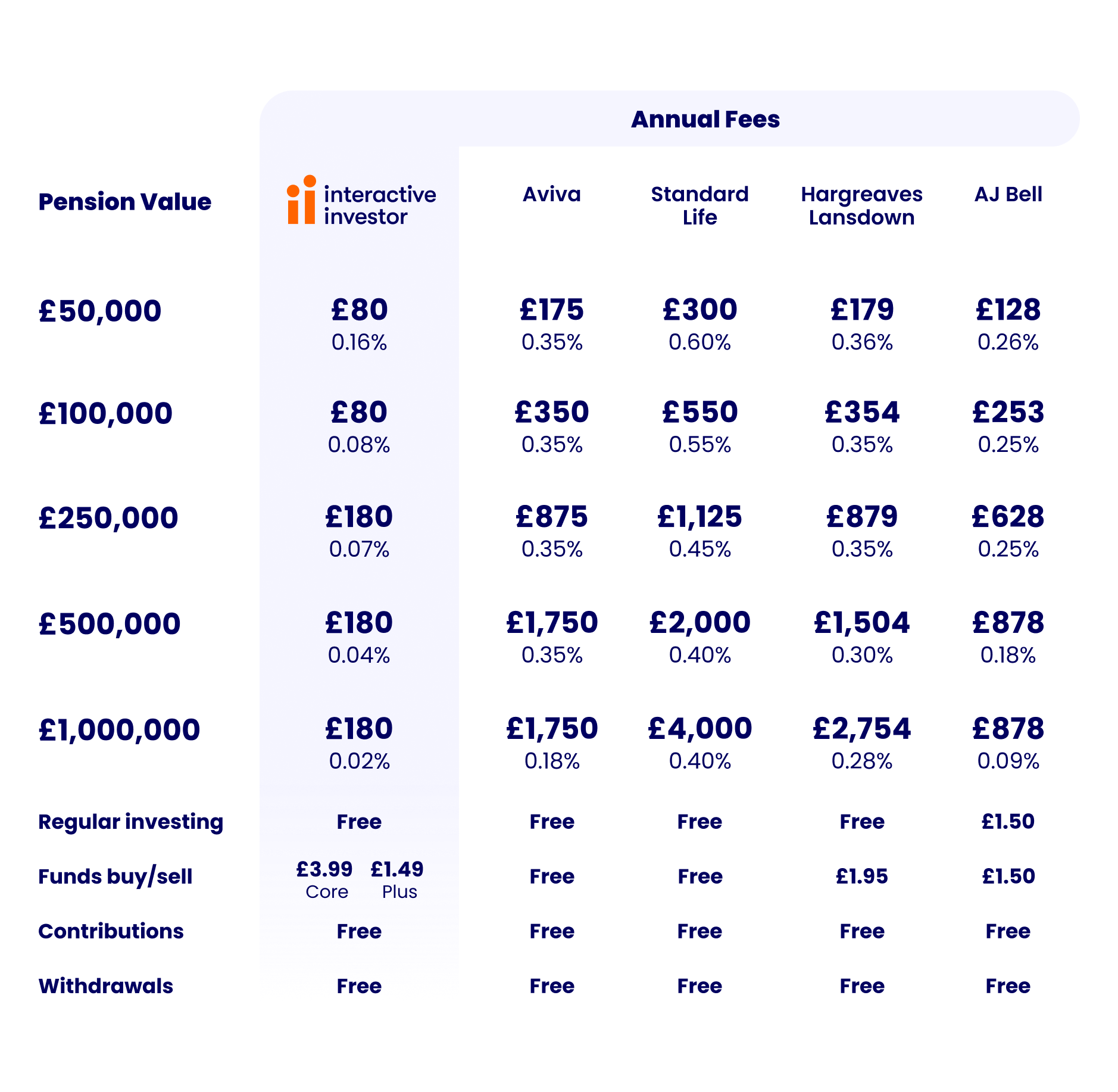

Other providers usually charge a percentage of your pot. That means you’ll be charged more as your pension grows in value. The ii SIPP is different. With our low, flat fee - you can keep more of what’s rightfully yours.

The ii SIPP offers a wide range of investments and flexible retirement options to suit most people’s needs. More choice doesn’t have to mean more complexity. Our expert picks and SIPP investment ideas can do the hard work for you.

It’s easy to keep track of your pension via our website and secure mobile app. But if you’re ever in need of SIPP support, you can count on us. We’re happy to say that ii has more 5-star Trustpilot reviews than any other UK SIPP provider.

See how much you could save with our flat-fee SIPP compared to other SIPP providers.

Comparison information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP & Standard Life SIPP (Level 2 Investment Options). Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. The calculator compares SIPP charges only – other types of pensions may have lower or higher charges. For ii charges you'll start on our Core plan for £5.99 a month and move to our Plus plan for £14.99 a month if your account goes above £100,000. Verified as accurate by The Lang Cat.

Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis.

Other providers like Aviva or Hargreaves Lansdown usually charge a percentage of your pot. That means the more your pension grows, the more they’ll take. Our SIPP is different. With our simple flat fee, you can keep more of what’s rightfully yours.

Mark, 47, wanted to make up some ground with his pension. Having the benefit of reduced costs with ii, Mark can now retire earlier.

“Being really blunt, ii was just so much cheaper. With other platforms, it’s this plus that plus that. Whereas with ii, what I pay is what I pay. It’s straightforward. That’s why I’m with ii.”

“I took out a SIPP because it is really easy to adjust my contributions. I love this flexibility but I also like the investment choice I get with my SIPP. I can put my money in investments that match my views.”

“I love how tax-efficient this is, my primary focus is growing my business but these tax benefits mean it makes sense to start building a pension pot for the future.”

“It’s great they let me do this, I’m about 10 years from retirement so I’m really focused on paying as much as possible into my SIPP.”

It takes less than 15 minutes to open an ii SIPP.

Then, you can set up personal contributions through one-off payments or a regular, monthly Direct Debit.

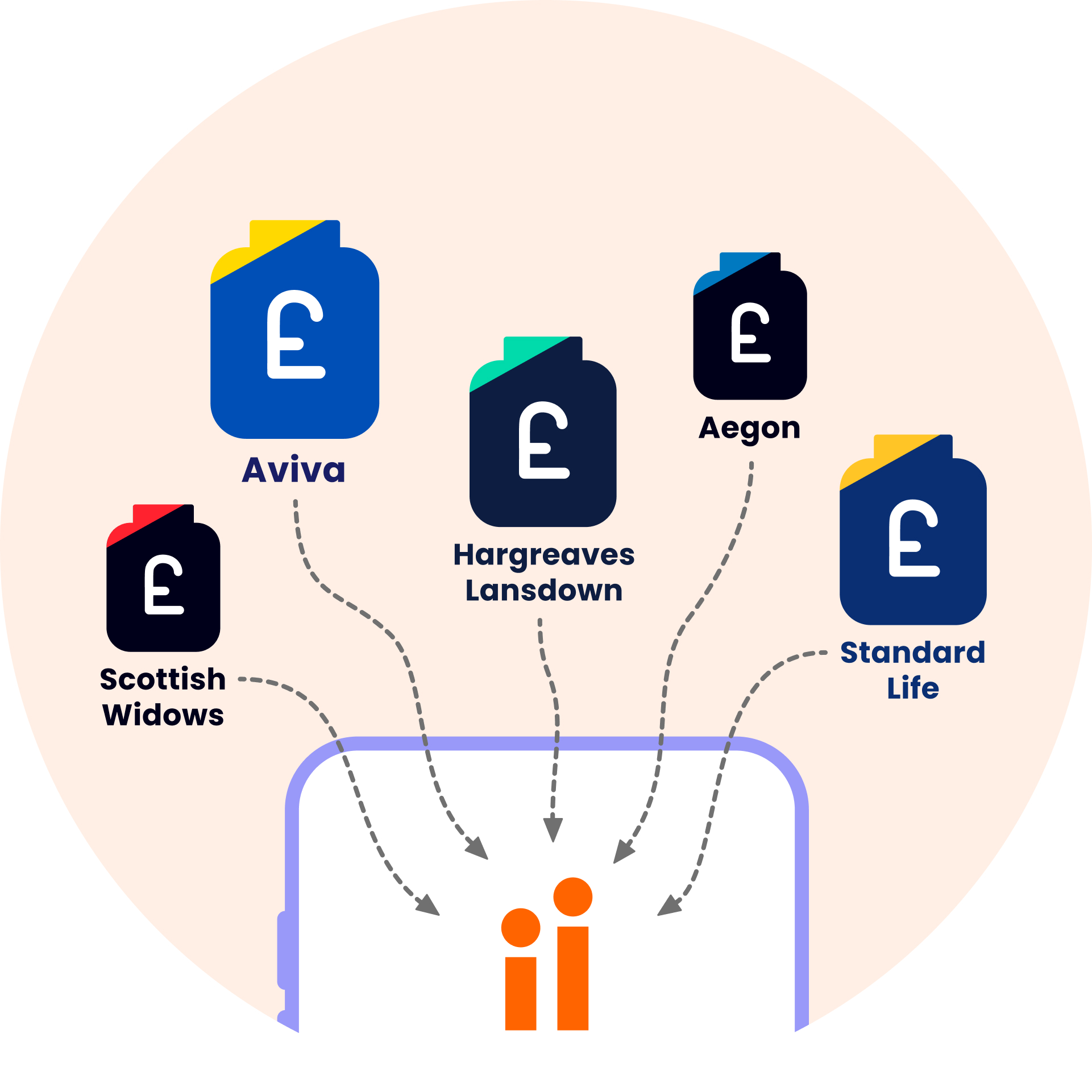

Once your account’s set up, you can transfer any existing pensions to your SIPP using our simple online process.

Transfer and combine other pensions, either when you open your SIPP or later, to save more with ii.

When ready, choose from our extensive range of shares, funds, bonds and more. Or get tips from our experts to help you choose.

Save on trading fees and automate your investments with free regular investing.

One of the very best things about a SIPP is what you can do with it when you reach retirement.

Check out the different ways you can access your pension when you reach age 55 (57 from 2028).

If you're unsure if a SIPP is right for you, we recommend seeking professional financial advice. An independent financial adviser will be able to assess your circumstances and recommend the most appropriate action to achieve your goals.

An accountant can advise on your specific tax status and recommend the most tax-efficient way to save for your future.

If you are over 50, you can get free and impartial pensions guidance from Pension Wise.

Everyone has different needs when it comes to their retirement, so there isn’t a one-size-fits-all solution for choosing the best pension for the self-employed.

You’ll need to look into the options out there and find the pension which best fits your circumstances and needs. SIPPs can be a good option if you’re after flexibility in how you contribute and control your investments, but they may not be for everyone.

Self-employed personal pensions, like a SIPP, are easy to set up and can be opened online in minutes.

With ii, there are no extra steps if you’re self-employed. Just complete your SIPP application to get started.

You can withdraw money from your pension once you reach 55 (57 from 2028) - although you don't have to.

We offer a range of flexible options for accessing your SIPP with ii.

A Self-Invested Personal Pension and a company, or workplace, pension are both pension schemes that help you save for retirement. Other than a workplace pension being set up by an employer, the two types of pension also differ on the control you have over your pot, the investment options available and the level and frequency of contributions.

Find out more about workplace pensions vs SIPPs.

A SIPP is still a good pension option if you are caught by the off-payroll working rules, commonly known as IR35, and deemed to be an employee rather than self-employed.

By making contributions to your SIPP, you may be able to offset the additional tax you have to pay as a result of falling inside the IR35 regulations. For more information head to the government page Understanding off-payroll working (IR35).

When it comes to taking profits, owner or directors of private limited companies typically have three options that they can mix and match: draw it as salary, take dividends or stick it in a pension.

Pension contributions made by the company are deemed an allowable business expense - provided the ‘wholly and exclusively’ test is met - so there is no corporation tax to pay. In addition, unlike drawing the money as salary, it avoids employer and employee National Insurance.

Read more: How SIPPs can beat the corporation tax raid.

You don’t have to declare your SIPP contributions on your tax return to get basic-rate tax relief—your pension provider usually claims the 20% tax relief automatically and adds it to your pension.

However, if you're a higher or additional-rate taxpayer, you should declare your contributions through Self Assessment to claim up to an extra 25% in tax relief.

Learn more about higher rate pension tax relief.