AB InBev: Shares in this world leader are going cheap

It will be boom time again for this brewer when the pubs reopen, believes our overseas investing expert.

8th April 2020 11:04

by Rodney Hobson from interactive investor

It will be boom time again for this brewer when the pubs reopen, believes our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

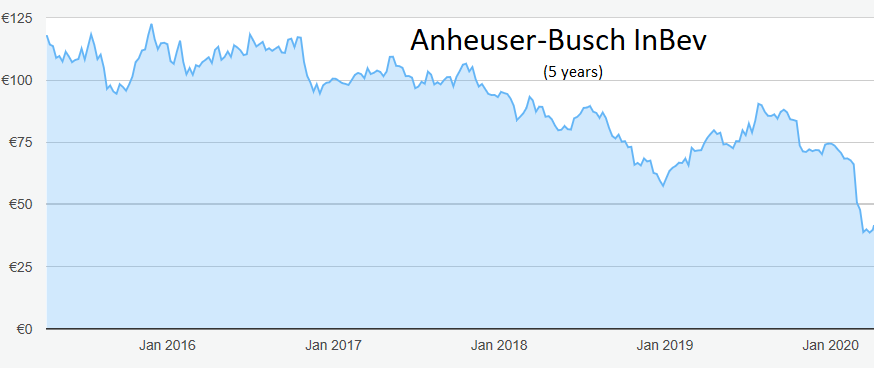

Shares in Anheuser-Busch InBev (EURONEXT:ABI) had been falling long before anyone had heard of Covid-19, but the market panic has had a devastating effect on the brewer’s stock market performance.

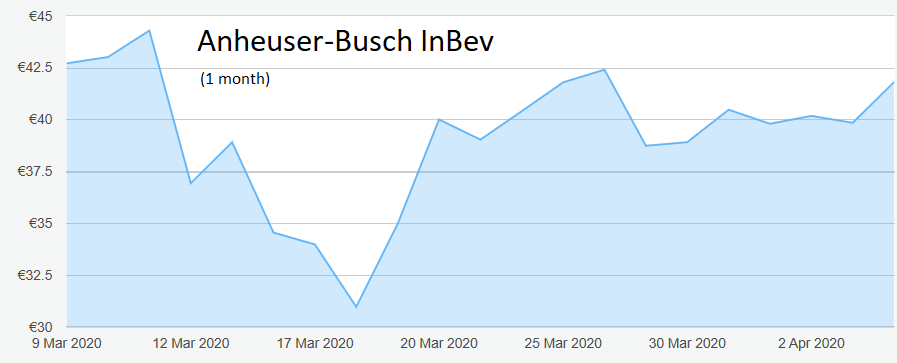

The shares look to be bottoming out at last and this could be an opportunity for buying into a company whose products remain in demand.

Source: interactive investor Past performance is not a guide to future performance

Anheuser-Busch is the largest brewer in the world. It was formed in 2008 through the merger of Belgium-based InBev and its American rival Anheuser-Busch. It produces and distributes beer and other malt beverages and its portfolio includes Budweiser, Corona, Stella Artois and Beck’s. The acquisition of SABMiller in 2016 means it sells five of the top 10 beer brands plus another dozen with retail sales of more than $1 billion.

The shares reached a peak of €122 in November 2015 but a year later they began a remorseless slide to around €57 near the end of 2018. A rally last year was snuffed out by the coronavirus crisis although the shares seem to have bottomed at €39. They now stand at around €43.

Source: interactive investor Past performance is not a guide to future performance

One reason for the slump is that at the end of February, even before Western nations had appreciated the full impact of Covid-19, Anheuser forecast that it would suffer its biggest fall quarterly profits since the 2008 financial crisis, something of the order of 10%.

It said that in the first two months of 2020 it had lost $285 million in revenue and $170 million in profits in China. Its Hong Kong listed subsidiary Budweiser Brewing Co APAC (SEHK:1876) said there was limited activity in Chinese restaurants and virtually a shutdown in nightclubs.

That mirrored a trading update the previous day from rival Diageo (LSE:DGE) predicting a £200 million hit to its own profits from various lockdowns in Asia.

AB Inbev has a brewery in Wuhan, the epicentre of the outbreak. Naturally, the brewery has been shut long term. However, half the company’s Chinese breweries had already restarted operations by the end of February and others followed fairly quickly.

What gave the trading update extra impact was that 2019 had been a disappointing year, falling below the company’s own expectations, particularly in the second half when chief executive Carlos Brito had to forgo his bonus. Even so, revenue rose 4.3% over the year as a whole.

- The first fund we’ve bought since the crash

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

In the final three months, underlying earnings fell 5.5%, a serious blow given that AB Inbev is still lumbered with debt from the SABMiller takeover.

Revenue rose only 2.5% in the quarter, on volumes up 1.6%, so clearly sales were already slowing before the virus outbreak. Canada and Argentine proved particularly difficult but were not the only problem areas.

Another issue is rising commodity prices, although that pressure will have abated as the world faces an economic downturn and the cost of fuel and energy has eased with the collapse in crude oil prices.

On a happier note, Britain is booming – or at least it was up to the lockdown. Revenue growth was running in the high single-digits and may well return to that sort of level as popular craft beers have been added to global brands.

AB Inbev is tidying up its distribution arrangements in the whole of Ireland through an expanded agreement with Dublin-based C&C, which will involve the sale and distribution of Budweiser Brewing Group's complete beer brand portfolio. This should make the arrangements there more efficient.

Hobson’s choice: Buy while the shares remain below €50. The world has not given up drinking beer and sales lost in pubs, clubs and restaurants will have been partly made up by sales for drinking at home. AB Inbev should bounce back comparatively strongly when the Covid-19 crisis abates.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.