After savage sell-off, what next?

7th November 2016 10:40

by Lance Roberts from ii contributor

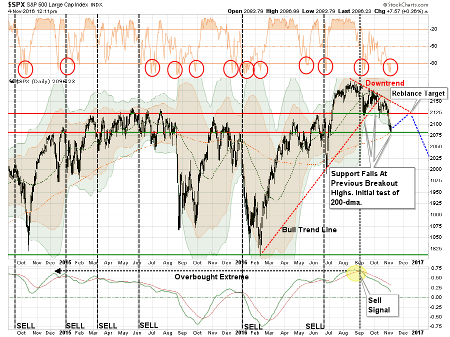

Market breaks support as sell signals trigger

Let me pick up with where I left off last week:

"But first, let's take a quick review of the markets, which currently are flashing some very troubling signs.

"Previously, I discussed the ongoing consolidation and struggle as the markets remain 'trapped' between downtrend resistance and the crucial support levels of the previous breakout to new highs."

"Importantly, while the market has remained in suspended animation over the past three months, the deterioration of the market is quite evident. As long as the markets can maintain support about 2,125, the bull market is still in play, but at this point, not by much."

This past week, that support gave way, leading to the first nine-day straight decline in the index since 1980.

Daily charts suggest a reflexive bounce from oversold conditions is extremely likely.However, as I explained during the Real Investment Hour on Thursday, it is never advisable to "panic sell" when a break of support occurs. This is because by the time you have an extended period of selling, the markets tend to be oversold enough for a short-term reflexive bounce to rebalance portfolio risk at better levels.

The chart below is a daily chart showing the market currently bouncing off support at the 200-day moving average (DMA), combined with a three-standard deviation move from that short-term moving average. This all suggests a reflexive bounce from oversold conditions is extremely likely.

As I have detailed on the chart above, there is a confluence of events currently occurring that suggests further downside risk following the reflexive bounce illustrated by the blue dashed line.

• The downtrend resistance from the previous highs is colliding with the previous support level which now acts as important resistance.

• The 50-DMA is also trending downward, adding further resistance to price advances in the near-term.

• An important "'sell' signal" has been registered at fairly high levels and currently remains intact.

However, if we step back to a longer-term (weekly) picture, we get further evidence of the potential for more corrective action to come.

As shown, the sell signals that are currently being registered in the market have typically suggested further deterioration in the markets to come.

This supports the idea that any reflexive bounces, particularly post-election next week, should be used to rebalance portfolio risk accordingly.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In.