Are active or passive sustainable funds the best?

6th September 2018 09:45

by Marina Gerner from interactive investor

As the range of sustainable ETFs grows, Marina Gerner discusses whether investors should take the cheaper passive route or pay more for an active fund.

A row of solar panels may still be the image that pops into most people's minds when they think of sustainable investing. But the socially responsible investment sector is in fact much broader, and it is steadily becoming more mainstream. Two thirds of investors would like their money to support companies that are profitable but also make a positive contribution to society and the environment, according to Triodos Bank. At the same time a range of active funds with established track records have demonstrated that there is no longer any need to sacrifice returns for principles.

More recently, some 30 exchange traded funds (ETFs) with combined assets of £4.8 billion have been listed on the London Stock Exchange, focusing on companies that have good environmental, social, and governance (ESG) credentials. Adam Laird, head of ETF Strategy at Lyxor, argues this market has been created by the analysis of huge data sets known as ‘big data’, which highlight broad trends in behaviour.

"For years it took an active manager reading reports to choose ethical companies. These days the data is available for ethical funds to be built passively, using the analysis of indices and rating companies."

Draw on specialists

Big asset managers such as iShares (which is part of BlackRock), UBS and Lyxor have created a number of ‘socially responsible’ ETFs that focus on either equities or bonds. To create the ETFs, asset managers draw on data from external companies that specialise in evaluation of the ESG scores of businesses – for example, on how well they rank on carbon efficiency, or how good their human rights record is. However, this means ESG ratings are often skewed in favour of large companies, which publish a lot of data about themselves.

"There are also a number of ETFs which, for instance, track the Equileap Gender Equality index which has a particular focus on [companies promoting] gender diversity," says Camilla Ritchie, who leads on the 7IM Sustainable Balance fund. So should investors use passive routes to invest sustainably?

The biggest advantage of going passive, as with ETFs more generally, is the lower cost. Laird says: "Ethical funds hadn't seen the cost cuts that the wider investment market had; but passive options are now giving an incentive to cut fees."

Ritchie agrees: "Cost is the only advantage I can think of." Matt Coppin, manager of financial advice at ethical IFA Castlefield, says: "Cost is obviously a key driver, and if it really is a determinant then ETFs are likely to be one of the best options to go for."

Past performance is not a guide to future performance

Charged more for ETFs

However, it's worth pointing out that many investment brokers will charge more for dealing in ETFs, which are typically treated the same way as shares, than for dealing in unit-based funds. Trading in ETFs in small volumes can become expensive. Coppin adds:

"In some cases these "screened" ETFs aren't massively cheaper than some of the quality managed funds these days, and I think this gap will continue to shrink."

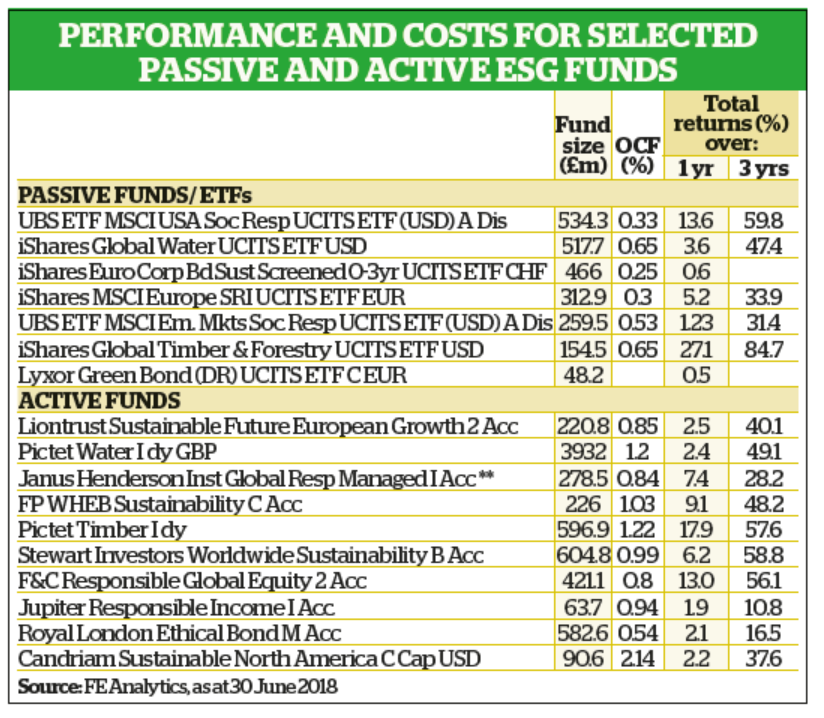

Often active funds charges slightly more but may also outperform the trackers in the long run.

So what may be the disadvantages of using an ETF in this case? "Passive doesn't give the option for engagement," says Coppin.

"Active managers will be able to engage with the businesses and also control the holdings more readily than would be the case with a passive vehicle."

Ritchie adds: "ETFs, with their passive focus, are only ever going to track, so they won't appeal to investors who want the potential to outperform an index."

Another potential downside to consider is that passive approaches tend to rely heavily on third-party data about companies to construct their portfolios, and that applies to ESG considerations too. Amelia Sexton, investment manager at financial adviser Holden & Partners, comments: "This data can be overly simplistic in its assumptions."

She adds: "There is often a lack of consistency in the methodology used between providers, and inherent biases in the process, which mean that companies who simply provide more data or engage in a greater number of "box-ticking" exercises can gain higher ratings." The strong ESG scores of Volkswagen preceding the German car manufacturer's emissions scandal in 2015 is a case in point.

Sexton adds: "ESG scoring systems consistently over-weighted the importance of the management’s commitment to sustainability whilst neglecting to recognise a declining standard of corporate governance and the pursuit of higher profits at all costs."

Index may not be what it seems

Maybe the biggest disadvantage is that an index may not be what it seems at face value. Unexpected companies can appear in ESG ETFs if the provider does not apply negative screens, or if the scores they use don’t consider the nature of the business (for example, an oil business might have great gender equality on its board, and the scores could be valuing this at the expense of the nature of the business itself.)

The iShares MSCI Europe ETF, for example, has an oil and gas company as one of its biggest holdings, making up 6% of the portfolio. While that may be acceptable to investors who are mainly looking to avoid arms or pornography, it may bother others.

According to Coppin, other less socially responsible companies that may crop up in ESG ETFs also include Total (the oil and gas company) and Nestle (which is criticised for its baby milk products). One solution to avoid dodgy holdings in ETFs that track bigger indices is to go for 'cleaner' ETFs that are dedicated to one particular area, such as water.

However, Coppin says that global clean energy and water ETFs "are quite specific in terms of sector and should only be considered as a small part of a portfolio." He adds that even then it's worth looking under the fund's bonnet. "Just because a timber ETF has a focus on timber, that doesn't mean it hasn't got companies who are part of irresponsible deforestation. It is a matter of analysing each holding to see if it matches your values."

And what should be the balance for those who want to use both active and passive strategies to create a sustainable portfolio? Sexton says using ETFs "alongside an active approach, with a manager's specific investment knowledge and judgement, can produce far superior results to their use in isolation".

It's also possible to get funds that combine both passive and active in a single product. Commenting on this, Tanya Pein, adviser at In2 Planning, concludes: "Largely this is less of an ESG question, and more a question of how much you are willing to trade lower fees (especially when compounded over time) on passives for the risk of a lack of downside protection in unsettled markets and the absence of an expert fund manager who can contribute ideas and good market timing."

Pick your own sustainable ETF

Investors should consider five key questions when picking a socially responsible ETF, according to Hortense Bioy, director of passive strategies and sustainability research for Europe at Morningstar:

Does the fund apply exclusions?

Many ESG ETFs use negative screens (for example, to exclude weapons). Investors must evaluate whether an index's exclusions align with their ethical and investment objectives.

Does it have sector or geographic biases?

ESG scores tend to vary across geographies and sectors. For example, Europe is the world's leading region for sustainability, while emerging markets tend to score poorly. While sectors such as oil and gas tend to have low overall ESG scores, technology often has higher scores because of the fundamental nature of the underlying businesses.

Does the fund charge an ESG premium?

Fees charged by ESG ETFs are generally higher than those levied by their ordinary passive peers. For example, the iShares MSCI Europe SRI UCITS ETF has an ongoing charge figure of 0.3%, while its non-ESG version charges 0.12%. The difference can be small, but in some cases it's bigger, as with some older funds.

How good is the fund’s track record?

Performance analysis can be a challenge, as most of the newer ESG ETFs track indices with short track records. This means that a returns-based analysis must often rely on back tests that can be manipulated, whether consciously or not, to achieve desirable outcomes.

Is the fund company a 'responsible steward'?

Investors should select responsible asset managers who vote company shares and engage with companies on a variety of ESG issues to implement better practices and effect beneficial change.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.