Are Barclays' results enough to fuel recovery story?

2nd August 2018 10:59

by Richard Hunter from interactive investor

There are plenty of experts calling Barclays shares lower, but these results reveal some positive developments. Richard Hunter, head of markets at interactive investor, talks us through the detail.

The clouds are beginning to clear at Barclays as it ushers in a new era as a more effective and streamlined global bank.

The figures are significantly skewed by the litigation and conduct costs flagged at the Q1 update in April. Indeed, stripping those out transforms the 29% pre-tax loss into a 20% pre-tax profit for the six months, a figure which the bank is keen to stress as being more representative of how the business is performing.

The fact that there were no further charges in the second quarter (including no additional PPI provisions) is hopefully a sign of better things to come.

Meanwhile, the Cards and Investment Banking units continue to perform well, the earnings per share metric has swung into positive territory, and the credit impairment charge has fallen sharply.

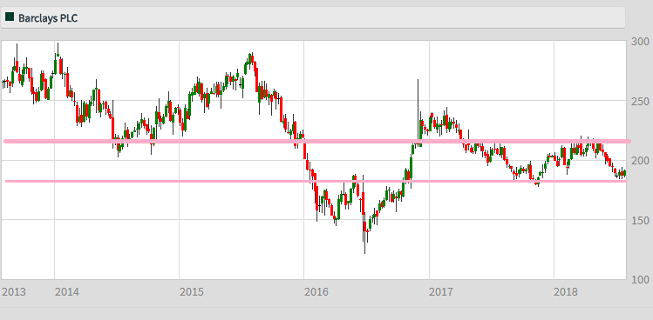

Source: interactive investor Past performance is not a guide to future performance

The increase to the dividend gives a projected yield of 3.4% and, whilst this is not of itself notable, it could imply further returns to shareholders and even a share buyback programme in the not too distant future.

Less positively, there a few areas of concern which will need to be addressed. Operating expenses in the UK arm increased, coupled with a decline in income, the cost/income ratio is still higher than some of its peers (although improving) and currency headwinds have hampered performance.

In the background, the activist investor stake could be an unwelcome distraction for management, whilst the bank is certainly not alone in wanting full clarity from the ongoing Brexit negotiations before deciding how best to proceed.

In all, the light at the end of the tunnel seems to be getting brighter. The shares have yet to react to these positive developments, with the price having dropped 7% over the last year, as compared to a 3% hike for the wider FTSE 100.

The market consensus, on the other hand, has seen the potential for the Barclays recovery story, such that the general view has more recently improved to a 'buy'.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.