Are Saga shares a bargain yet?

Life as a quoted company has rarely been enjoyable for over-50s expert Saga, and today is no different.

19th June 2019 13:00

by Graeme Evans from interactive investor

Life as a quoted company has rarely been enjoyable for over-50s expert Saga, and today is no different.

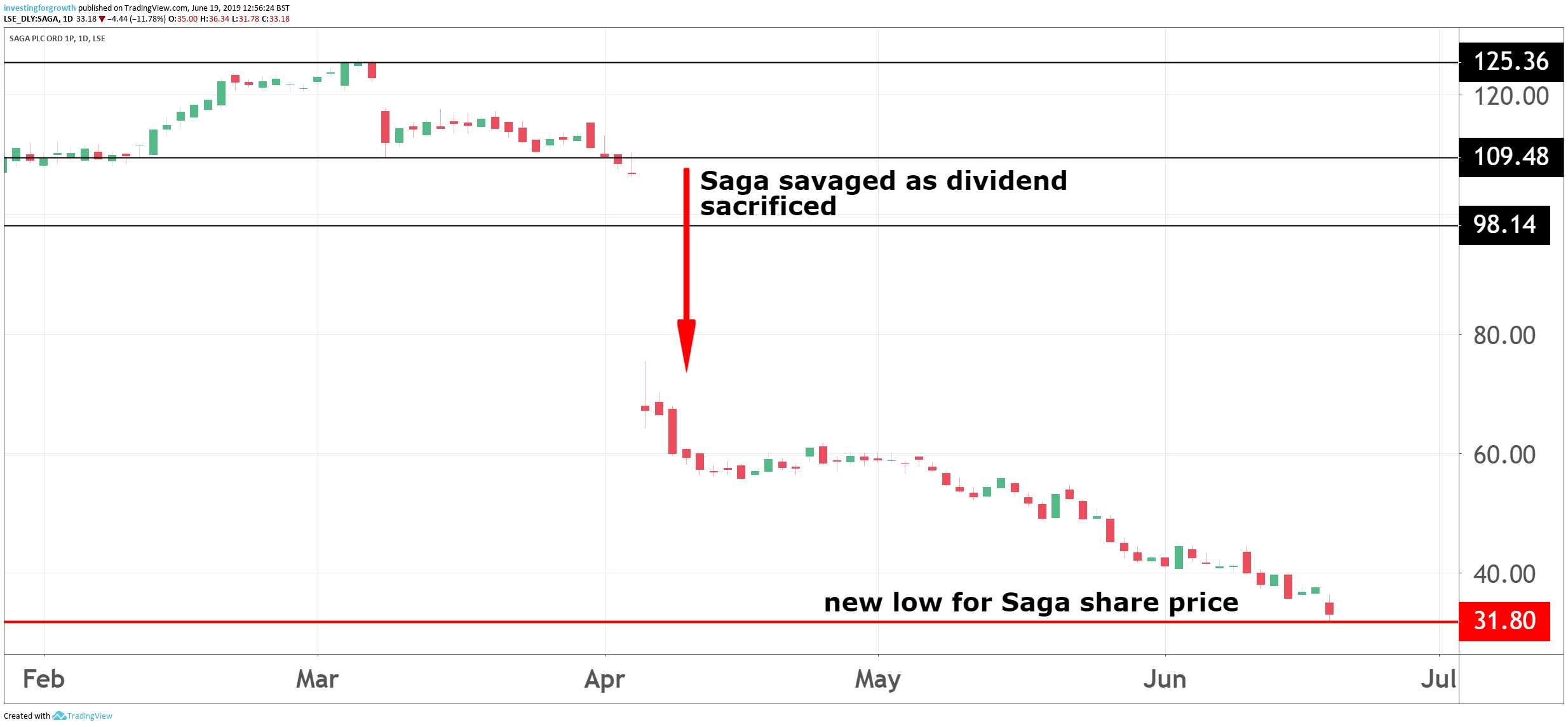

Despairing Saga investors felt even more pain today, with a new record low for shares at the holidays-to-insurance specialist adding to the blow of April's savage dividend cut.

The former FTSE 250 index stock is now worth little more than £350 million after shares tumbled another 15% to below 32p on the back of another poor trading update.

It dashed any hopes that April's profits warning, bottom-line loss and cut in dividend might have represented the start of a turnaround in fortunes under a refreshed management strategy. The shares have halved in value since those annual results, when chief executive Lance Batchelor unveiled a new approach to insurance by attempting to forge more customer loyalty.

Source: TradingView Past performance is not a guide to future performance

While Saga today reported "good early progress" following the launch of new insurance products, it has been undone by 4% lower revenues for its tour operations amid the current political uncertainty. Margins will also be impacted by competitive discounting.

Saga announced earlier this month that Batchelor would step down next January after six years with the group — a period in which he's reportedly been paid £11.6 million since the company's flotation in May 2014.

Thousands of private investors, many of them Saga customers, haven't been so fortunate after buying into the heavily over-subscribed IPO at a price of 185p a share. Many stayed on board in the hope that Saga could weather its insurance-related storms, helped by the lure of a high-yielding dividend and a number of City 'buy' recommendations. But even that dividend promise was taken away after a reduction of the final pay-out from 6p to just 1p in April.

Amid this investor turmoil, chairman Patrick O'Sullivan recently accused Saga's former private equity owners and bankers of "over-egging" its potential at the time of the IPO.

But it's also clear that Saga lost sight of what had made it successful in the first place, such as products specifically designed for its demographic and which built strong brand loyalty.

Saga is working to restore this ethos by creating a more differentiated insurance offer aimed directly at customers rather than attempting to compete on price. Its new approach to renewal pricing includes premiums fixed for three years if there is no change in a customer's circumstances.

By Sunday it had sold over 60,000 of these three-year fixed price policies, with more than half of direct new business customers choosing a fixed price product. It also recently announced plans to expand its personal finance business with the launch of a new long-term savings partnership with Goldman Sachs starting in the autumn.

Longer term, however, the question remains whether a business model targeting the over 50 age group still works when so many reaching this landmark still feel youthful.

Industry analyst Jeremy Grime said a price earnings multiple of 4.5 times and dividend yield of 10% made the stock look interesting.

He added: "Debt is £322 million which is not too high given £100 million plus of profits. The problem is that warnings normally come in threes because of the human trait of denial.

"The dividend has been cut and the recovery plan is visible. I could get excited about the savings products while the direct insurance broking model may alienate some brokers. I suspect we may be somewhere close to the trough."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.