Ask ii: what are options and why do you trade them?

No question is a stupid one, so whether you want to find out what you need to do to start investing or how the stock market works, don’t be shy, ask ii. Email yours to: ask@ii.co.uk

26th September 2023 15:57

by Lee Wild from interactive investor

An investors asks:“A recent company statement I read from Frasers Group mentioned options trading. What are options, who would use them and what do they mean for ordinary investors?”

Lee Wild, head of equity strategy at interactive investor (pictured above), says: UK investors very rarely have cause to worry about the complicated world of financial futures and options. Derivatives contracts like these are typically used only by City types looking to manage risk, or by individual companies as part of a hedging strategy.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

In short, an option gives the owner of the contract the right but not the obligation to buy or sell an underlying asset at a specified price (strike price) on or before a specified date (expiry date). The underlying asset could be a commodity like oil, natural gas, wheat or cocoa, bonds or shares.

They are a leveraged instrument, which means traders can gain exposure to greater potential upside than would be the case if they bought the underlying asset. There are also many complicated strategies that options traders employ such as 'straddles' and 'strangles', although these are normally only of interest to professional investors.

However, a recent stock market update issued by Frasers Group (LSE:FRAS), which describes the recent options trading activity of its founder, former chief executive and now majority shareholder Mike Ashley, has piqued the interest of a reader.

Ashley stepped down as CEO at Frasers in May 2022, handing over the reins to his son-in-law Michael Murray. He still owns around 73% of the company and is a regular trader in Frasers shares, although usually via less conventional means.

The most recent update on director dealings at Frasers reads as follows:

On 20 September 2023, Frasers Group PLC (the "Company") was informed that on 20 September 2023 Michael Ashley (a PDMR [person discharging managerial responsibility]) sold share settled put options over 500,000 Ordinary Shares equivalent with a strike price of 820p and expiry of December 2023.

This follows similar updates through August and September, and others reported in December last year. The trades carry a value of many millions of pounds. But what do they mean and why would he do it?

In simple terms, Ashley is positive about Frasers’ share price and will even make money if the share price falls slightly. It’s a speculative trade that doesn’t involve buying or selling the actual shares, although the price of the option is linked to Frasers’ share price.

What is a put option?

A ‘put’ option gives the owner the right but not the obligation to sell - or ‘write’ an option to use the jargon for selling - at a predetermined price until the option’s expiry date.

If the price of the asset goes down, the price of the put option goes up. So, you would buy a put option if you thought the asset price was going to fall.

But you can also sell options without having to own the underlying asset (in this case Frasers shares). You might do this if you believed the asset would rise in value. That’s because the price of the option (the right to sell) would fall if the share price rose.

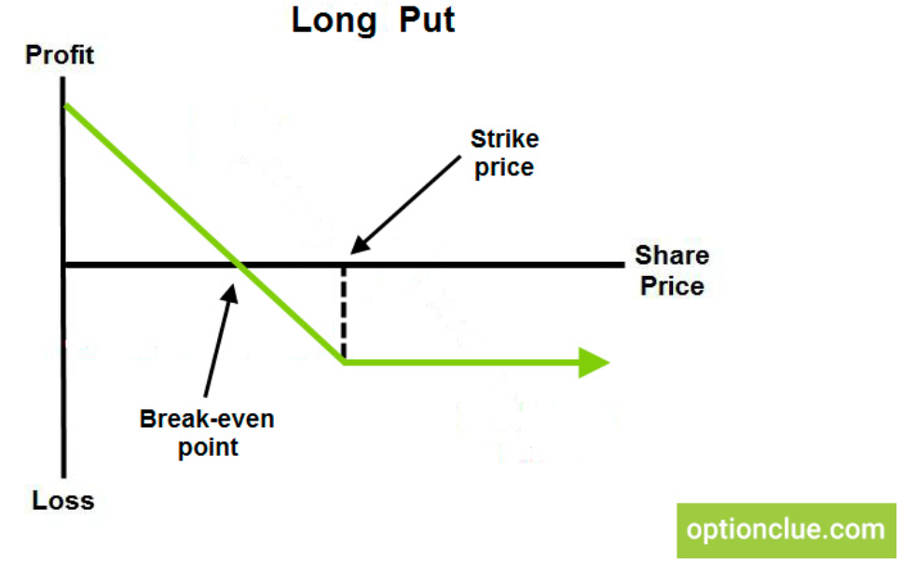

Here’s what happens when you buy – or go long – a put option. A loss is limited to the price – or premium (see below these two diagrams) – that you paid. The lower the share price goes (including making back the value of the premium you paid), the more money you make.

Source: optionclue.com

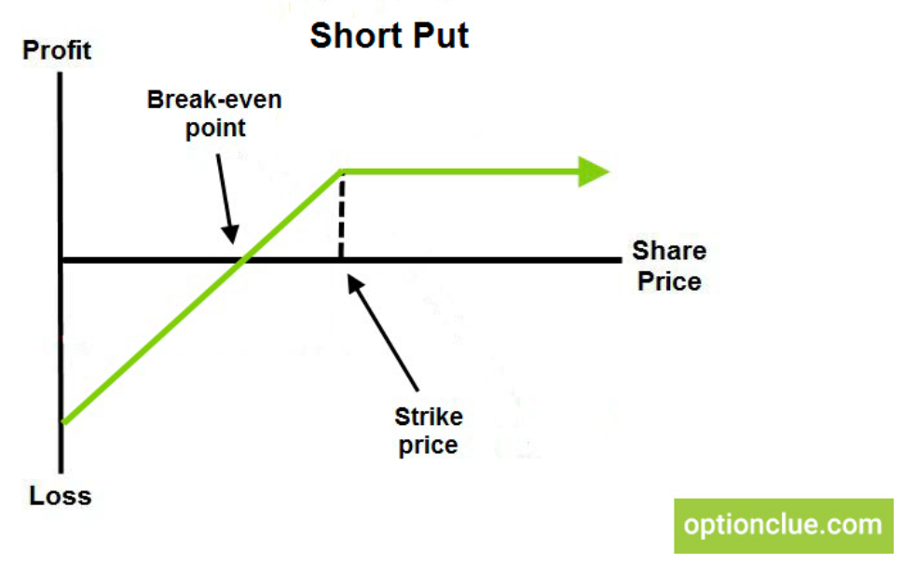

Here’s what happens when you sell – or go short – a put option. You will make a profit as long as the share price at expiry is more than the strike price minus the premium that you received. Your maximum profit is limited to the price – or premium (see explanation below these two diagrams) – that you pay.

Source: optionclue.com

It’s important to understand that the price of an option - what’s referred to as the premium - includes two elements: intrinsic value and time value.

Intrinsic value is the difference between the strike price and the current share price, which is 805p. So, in our example, the intrinsic value is 15 (820p minus 805p). Only options that are ‘in the money’ have intrinsic value. In the money means an option that would be profitable if it were exercised right now.

A strike price of 820 is in the money if Frasers shares are below 820p. Above 820p is ‘out of the money’ – ie the put option has no intrinsic value because you can sell the underlying shares for more than the strike price.

Time value refers to time left until the option expires. The longer there is, the greater the element of time value included within the option premium. That’s because there’s more opportunity for the option to include intrinsic value - be in the money - by the time it expires. The amount of time value included within the option premium decreases at a more rapid pace the nearer the option gets to expiry.

For completeness, it’s worth explaining that there are also ‘calloptions’. These give the buyer the right but not the obligation to buy the shares at the strike price up until the option’s expiry date. You would buy a ‘call option’ if you thought the shares were going higher and sell the option if you thought they would decline in value.

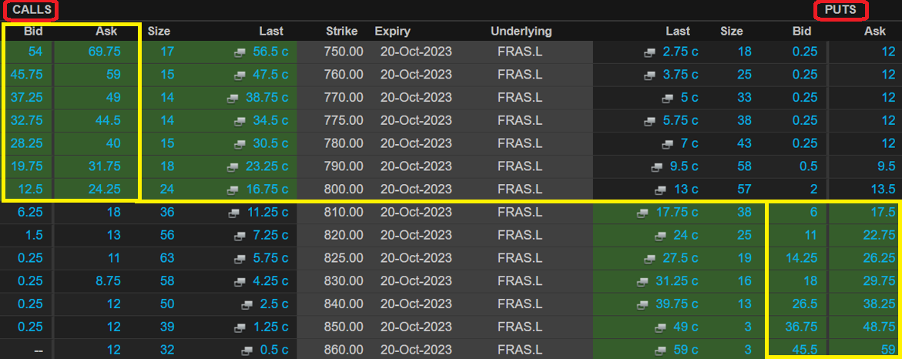

In the screen for Frasers options below, you see Calls on the left and Puts on the right. Frasers share price is 805p.

Every call option with a strike price of less than 805p is considered in the money (see top left below).

Every put option with a strike price more than 805p is considered in the money (bottom right below).

Source: Refinitiv as at 25 September 2023.

Why did Mike Ashley sell a put option?

Remember, Ashley has sold the right to sell Frasers shares at 820p to someone else. That means he thinks Frasers shares will be worth at least 820p minus the premium he received by the expiry date in December this year.

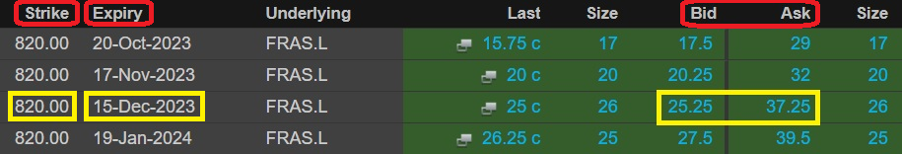

Here’s a snapshot of current trading in the same Frasers Group put option that Ashley sold:

Source: Refinitiv as at 25 September 2023.

The screen above shows it costs 37.25 to buy the option and you’d receive 25.25 if you sold, with a mid-price of 31.25. If Frasers shares are currently 805p, the intrinsic value is 15 (820 minus 805). This means that at the mid-price of 31.25, the time value must be 16.25 (31.25 minus 15).

If the put option expires above 820, it is worthless, and Ashley keeps whatever he sold the option for. Say he sold the option for 30p, the underlying share price could fall as far as 790p (820 minus 30) at option expiry date and Ashley would still breakeven.

Selling a put option that is in the money is a bold move, but the 820 strike price gives Ashley a healthy amount of intrinsic value, while the December expiry gives him plenty of time value which will eventually erode away the nearer it gets to expiry.

It’s also important to understand that billionaire Mike Ashley has very deep pockets. He’s done it before and can afford to take risks involved in options trading which is very speculative and high risk. If you sell a put option and the share price goes against you, or even to zero, however unlikely, your losses are potentially huge and can rack up very quickly.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.