Attractive returns make General Motors one to own

12th December 2018 09:59

by Rodney Hobson from interactive investor

Leading industry commentator, accomplished author and new interactive investor columnist Rodney Hobson finds high yield in this $50bn giant.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stockmarket. He is qualified as a representative under the Financial Services Act.

Make the rust belt great again was the decisive factor in the 2016 US presidential election. Yes, Donald Trump offered the same prospect to the whole country but, as the Sun newspaper might have said it, 'it was the rust belt wot won it'.

Now General Motors, the largest car manufacturer in the US, has shown its ingratitude by threatening to close seven factories and lay off 14,000 workers in a restructuring designed to save $6 billion (£4.8 billion) a year by 2020.

GM's best-known brands are Chevrolet, Buick, Cadillac. It is mainly, but not exclusively, an American company. It has about 180,000 employees worldwide, and only 103,000 or about 57% are based in the US. And to President Trump's chagrin, it makes cars in China.

By the end of next year, production will cease at assembly plants in Ohio, Michigan and Maryland. Ontario in Canada and two other, so far unnamed, factories outside the US are also for the chop. Trump isn't best pleased. He rather thought that his trade wars would encourage GM to stop making cars in China and open a new plant in Ohio.

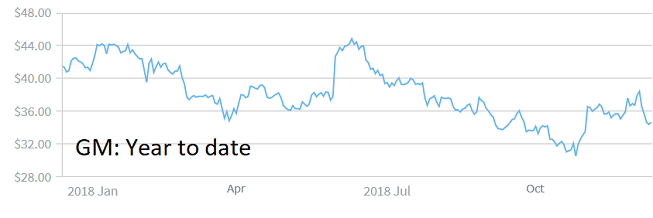

Source: interactive investor (*) Past performance is not a guide to future performance

Unfortunately for American industry, a major part of Trump's actions has been to spark trade wars, most notably with China but also with Europe and with his North American neighbours.

Furthermore, he has been making policy on the hoof and changing it as he goes along. The quixotic nature of his decision making may have disconcerted some foreign leaders, but it is also extremely distracting for America industry, especially any sectors such as manufacturing where long-term planning involves heavy financial commitment.

There are serious doubts over whether it is working anyway. The US's trade deficit has widened for five consecutive months to reach $55.5 billion (£44.2 billion) in October, with imports of vehicles, engines and parts actually increasing by $700 million (£550 million) that month, possibly because of stockpiling ahead of a ramping up of tariffs.

GM is a very different beast from the one that went bankrupt 10 years ago when it required a bailout of more than $50 billion. It has made record operating profits in each of the past two years but, like many businesses, it is seeking to cut costs.

Of greater concern is that it also proposes to reduce capital spending by $1.5 billion (£1.2 billion) at a time when it is seeking to move into electric cars and driverless vehicles. However, it is proposing to double the resources it puts into electric and self-driving cars over the next two years - and not before time.

Tesla has spent 10 years gradually accelerating away from the traditional automotive industry leaders in developing electric cars, once seen as an improbable dream but now recognised as the future.

It has become a serious threat to the likes of GM and Ford, who are only just getting serious about making electric cars, and may not be able to make a decent profit from them for some time. As a result, Tesla's market capitalisation has overtaken that of GM and is nearly double Ford's.

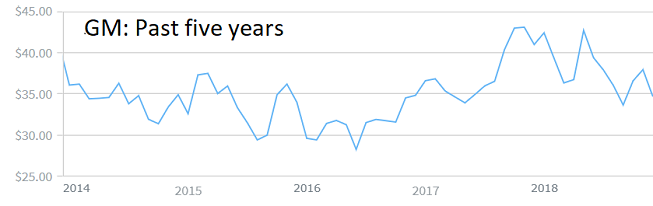

Source: interactive investor (*) Past performance is not a guide to future performance

Other issues affecting GM are an ongoing rise in interest rates that will dampen the spending power of consumers and potential disruption to the supply chain from trade wars.

Whatever the challenges, GM shares have moved remarkably little over the past five years, although the fall of 15% from the start of the year to November 23, the last trading day before it announced the cutbacks, was more severe than for the market as a whole. The latest news actually put 5% back on the share price, which now stands at just under $35, giving a decent yield of 4.38%.

Hobson's Choice: It will probably never be a get rich quick investment but GM is a strong, solid company that should weather the admittedly tough challenges and provide good returns for the foreseeable future. Long term buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.