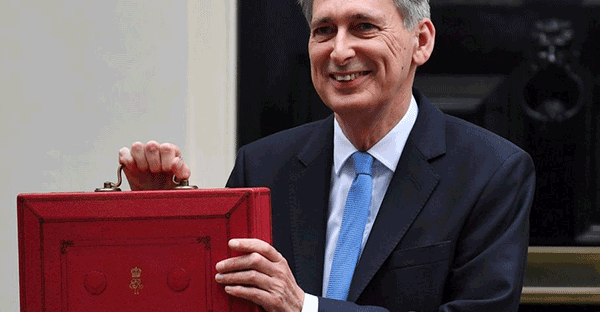

Autumn Budget 2018: What Chancellor Philip Hammond announced, and what it means for your money

29th October 2018 14:52

by Edmund Greaves from interactive investor

The Chancellor of the Exchequer, Philip Hammond, has announced his new Autumn Budget. Here's a round up of what it means for you and your money.

26-30 Railcard

A new 26-30 year-old railcard will be made available by the end of 2018. The Chancellor says it will save up to 4.4 million young people a third on their rail fares.

50p 'Brexit' coin

A special 50p coin to commemorate Britain leaving the EU will be issued next year. Read the full story.

Air passenger duty

Short-haul air passenger duty is frozen for the eighth year in a row. Long-haul duty will rise in line with inflation.

Broadband

The Chancellor is expected to announce extra funding for broadband connectivity to households in rural areas. This comes in the form of a £250 million spending pledge for the most remote parts of the UK to gain access to super-fast internet connections.

Digital services tax

The Chancellor has announced a 2% "digital services tax" on the revenue of large online businesses to generate at least £500 million per year globally from April 2020. The Chancellor says the tax will be designed to avoid hurting consumers and is instead aimed at large corporations that pay little tax in the UK currently. It is expected to raise £400 million revenue each year.

Tim Bennett, Partner at Killik & Co comments: “Fiscal Phil’s only real Budgetary firework is the announcement that the UK is prepared to go it alone with a digital sales tax from April 2020, in the absence of an international agreement on this issue.

"Setting Britain on a solo collision course with some of the world’s biggest technology companies may be interpreted as either brave, or a little foolish.”

- Super-size your savings with these easy switches

Employment

The Chancellor will apply IR35 employment changes to private sector to large and medium sized businesses, having already implemented a crackdown in the public sector on employees who are paid via personal services companies to avoid paying tax. Currently, many workers function as self employed despite working only for one company, by setting themselves up as a 'personal services companies' (PSCs), as this provides a National Insurance tax break.

Angela James, director, contractor wealth & senior adviser, CMME comments: “The extension of public sector IR35 reforms to the private sector is disappointing at best.

"Although this is applied only to medium and large businesses at present, my concern is that increasing tax liabilities may spark a trend of the self-employed ditching their limited companies for umbrella ones, where all income will be PAYE. This disincentivises a fast-growing, entrepreneurial section of the economy."

- How much cash would you need to quit work?

Fuel duty

Duties on petrol, as previously announced, have been frozen for the ninth year in a row. Mr Hammond says this will save the average car driver over £1,000 and the average van driver £2,500. Prime Minister Theresa May committed the government to this at the Conservative party conference.

Income tax

Mr Hammond has announced that plans to raise income tax thresholds for millions of workers will be brought forward. The tax-free earnings threshold will be raised to £12,500 for the tax year beginning April 2019. The higher rate threshold will be raised to £50,000 from £46,350.

- Workers get highest pay rise in a decade, but prices could increase faster as a result

Housing

The Chancellor has announced a cut to stamp duty for first-time buyers of shared-ownership homes worth up to £500,000. The measure is restrospective, so anyone who bought a house since the last Budget will benefit. A further £500million is also being made available for the Housing Infrastructure Fund, to help build 650,000 homes.

Helen Morrissey, spokesperson at Royal London comments: “While the extension of this stamp duty relief will help first time buyers to get a step on the housing ladder we would argue that more can be done to make the housing market more liquid.

"While first time buyers can buy a home what of those further up the ladder who cannot afford to either move to a larger home to accommodate their growing families or those looking to downsize.

"We would urge the government to look at reliefs for those further up the housing ladder if we really want to free up the housing market.”

Help to buy

The help to buy scheme which was expected to end in 2021 but has been extended until 2023.

Kevin Roberts, director of Legal & General Mortgage Club comments: “Today’s extension of the Help to Buy scheme to 2023 has provided much-needed clarity over the scheme.

"Not only do housebuilders now have more certainty for longer-term planning and building the thousands of new homes our country so desperately needs, but it also gives potential buyers who are saving for a deposit the peace of mind that they too can benefit from the scheme over the coming years.”

Lettings relief

The Chancellor has announced that from April 2020, the government will limit lettings relief to properties where the owner is in shared occupancy with the tenant, and reduce the final period exemption from 18 months to 9 months.

Robert Nichols, chief executive of lettings agency Portico says: “Once again, private buy to let landlords have to get their heads around another tax change that will leave them worse off in the long run.

"The new restrictions on lettings relief is a further punishment to hard working individuals who have chosen to invest sensibly in residential property.

"Limiting lettings relief to properties where the owner is in shared occupancy with the tenant is as good as removing it in its entirety.”

- Buy to let further afield - could it work for you?

National living wage

The national living wage will increase from £7.83 to £8.21 from April 2019.

- Could you claim a uniform tax rebate? Here's how to do it for free

Pensions

Despite speculation he might, the Chancellor has not announced changes to pensions tax relief.

Former pensions minister Steve Webb, now director of policy at Royal London comments: "The Chancellor’s windfall from better-than-expected borrowing forecasts meant that he did not have to cut back pension tax relief in this Budget.

"But having described the system as ‘eye-wateringly expensive’ it is likely to be only a matter of time before this Chancellor – or his successor – comes back for more. Today’s respite for pension tax relief is likely to be only temporary."

- Read our full analysis of the reprieve for savers

Pensions cold calling will also finally be banned, subject to parliamentary approval.

Kate Smith, head of pensions at Aegon comments: “Finally, the government is going to implement the ban on pension cold-calling. Although we still haven’t got a date, we welcome this commitment and are hopeful the ban will become a reality sooner rather than later.

“The pension cold-calling ban has been long-time coming and although it won’t be the panacea, a ban will go some way to protecting people from pension scammers.

“For the ban to be effective, it needs to be accompanied by a public awareness campaign. So we’re pleased to see that the government will work with partners to make sure people are aware that pension cold-calling will be illegal, once the ban is in place.”

The Lifetime allowance is set to rise, but the Isa allowance will stay at £20,000. Read our full story.

Plastic

The government will introduce a new tax on the manufacture and import of plastic packaging which contains less than 30% recycled plastic. However, no tax on plastic cups, including coffee cups, will be introduced as of yet.

Public lavatories

The Chancellor has announced extra business rates tax relief for businesses that make lavatories available to the public. He also says businesses with a rateable value of £51,000 or less will have their business rates cut by a third in the next two years, worth up to £8,000.

Roads

The Chancellor has announced an immediate £420 million in funding for local authorities to tackle potholes on UK roads. The Chancellor has also earmarked £28.8 billion for a 'National Roads Fund' to help fund new roads and maintain theexisting network.

Sin taxes

Beer and cider duty has been frozen for the next tax year. Duty on spirits has also been frozen. Wine duty will increase in line with RPI inflation.

Social care

The Chancellor has announced a further £650 million in grant funding for councils in England to pay for social care in 2019-20. He has also announced an extra £45 million disabled facilities grant in 2018-19.

Steven Cameron, pensions director at Aegon comments: “The commitment to provide an additional £650m of funding for social care will offer some relief to councils struggling with ever increasing demands.

"However, this is little more than a temporary, sticking plaster measure and we urgently need concrete, long-term proposals in the promised Green Paper on how to tackle the huge issue of funding social care costs."

Universal credit

Work allowances under Universal Credit (UC) will increase by £1,000 per year. The government says this will help 2.3 million people who are in receipt of or will receive the benefit by £630 each per year. The government says it will also implement "enhanced transition measures" for those moving onto UC from old benefits, inculding additional protections for those on Severe Disability Premium to ensure their welfare payments are protected when they move onto UC.

Johnny Timpson, protection expert at Scottish Widows comments: “The increased funding to provide support when people migrate from legacy benefits to Universal Credit plus the increased work taper relief are welcomed.

"However, we ask that financial protection claim proceeds used to pay rent, utility services, council tax, broadband, and care costs be disregarded from the means-testing process. Doing this could mean that not only does work pay, it supports people in improving their financial resilience too.

“We also ask that, in addition to supporting consumers in better managing debt and pension provision, the new Single Financial Guidance Body helps households in improving their financial resilience, especially in relation to income shocks.”

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.