Baillie Gifford to take over management of Witan Pacific investment trust

The trust will also adopt a new China-only mandate in an attempt to make it more appealing to investor…

22nd July 2020 14:09

by Tom Bailey from interactive investor

The trust will also adopt a new China-only mandate in an attempt to make it more appealing to investors from an asset allocation perspective.

The board of Witan Pacific has proposed that Baillie Gifford takes over management of the investment trust and invest solely in China stocks.

In a proposal to shareholders, the trust’s board said that after an extensive review of the trust’s current management arrangement, it has agreed to appoint Baillie Gifford as the trust’s new manager. The changes are still subject to shareholder approval.

Since 2005, Witan Pacific has used a multi-manager approach. As of 2017, it had four management companies: Aberdeen Standard Investments, Dalton Investments, Matthews Asia and Robeco Institutional Asset Management.

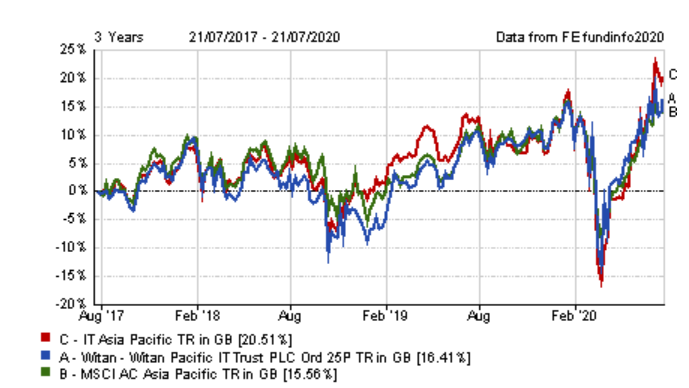

The trust’s performance has not been disastrous, but at the same time has not shot the lights out. The trust’s return over the past three years beat the MSCI Asia Pacific index, 16.4% versus 15.6%. However, that was below the AIC Asia Pacific sector average, which stood at 20.5%.

Looked at over the longer term, the pattern is similar. Figures from FE Analytics show the trust delivering a total return of 130.9% since 2010, beating the index’s 122.5% but falling short of the sector average of 155%.

However, the change in management is part of a wider attempted shake-up of the trust. The board’s proposal would also see the trust shift its investment focus to just China equities. The plan is for the trust, under Baillie Gifford’s management, to have a portfolio of 40 to 80 China stocks, with a potential for up to 20% of the portfolio to be invested in unlisted holdings.

That a significant change from the trust’s current investment policy. The trust’s latest factsheet showed that at the end of June, it had a 30% weighting towards China/Hong Kong, roughly in line with its benchmark at the time (the MSCI AC Asia Pacific). Its largest weighting was Japan, which accounted for 34% of its holdings, followed by South Korea with 9%. The trust’s largest holding was in South Korea’s Samsung Electronics, accounting for 3.9% of the portfolio.

According to Susan Platts-Martin, chair of Witan Pacific, the shift in focus to China should help performance. In the proposal she notes: “The board believes that China provides a compelling investment opportunity that is currently underrepresented in global portfolios. China's domestic stock market and economy have grown to become the second largest in the world and we believe that China will be one of the most important markets of the next decade.”

However, alongside potential better performance, the trust’s new China mandate should also make the trust more appealing to investors from an asset allocation perspective. First, as the board notes, there are currently only two investment trusts focused on China, compared to eight that focus on the Asia Pacific region.

On top of that, many investors looking for Asia-Pacific exposure have rebuffed Witan Pacific due to its heavy weighting towards Japanese equities. As investment trust broker Numis notes: “The fund has been off the radar of most investors given its Asia Pacific including Japan mandate, whilst most investors wish to make separate asset allocation decisions on these regions.”

The new management should also result in a reduction of the trust’s fees. Currently, the trust has an ongoing charge of roughly 1%. Under the new proposal, Baillie Gifford will be paid an annual management fee of 0.75% on the trust’s first £50 million of assets, 0.65% on up to £200 million and 0.55% when assets are above £250 million. The fee will also be waved for the first six months of the new management.

The trust’s proposed new name is Baillie Gifford China Growth Trust.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.