Is bitcoin about to surge above $10,000 again?

As an historic moment looms, our award-winning crypto writer looks at where the next peak might be.

7th May 2020 14:28

by Gary McFarlane from interactive investor

As an historic moment looms, our award-winning crypto writer looks at where the next peak might be.

Bitcoin has roared ahead to trade at $9,200 as bulls target a $10,000 breakthrough for next week.

With bitcoin block rewards paid to incentivise miners (the network’s book keepers) halving next week, against a tentative risk-on backdrop in other asset classes, the leading digital currency may well be set fair for future advance.

The reward of 12.5 bitcoins paid to miners for verifying a block of transactions is set to half to 6.25 on 11 May.

The exact time is determined by the algorithm that sets halving to occur every 210,000 blocks, which means the next event takes place when block 630,000 is mined.

At the time of writing that is scheduled to arrive at approximately 01:30 Coordinated Universal Time (UTC) on 11 May. Halving takes place every four years.

The halving mechanism should see bitcoin reach an inflation rate of zero by 2140. Block rewards began at 50 BTC when the bitcoin “genesis block” was mined on 3 January 2009.

Previous halvings have led to substantial prices increases, albeit not immediately. Indeed, on the past two occasions the price actually fell in the immediate wake of halving activation, which could be accounted for by traders “selling the news”.

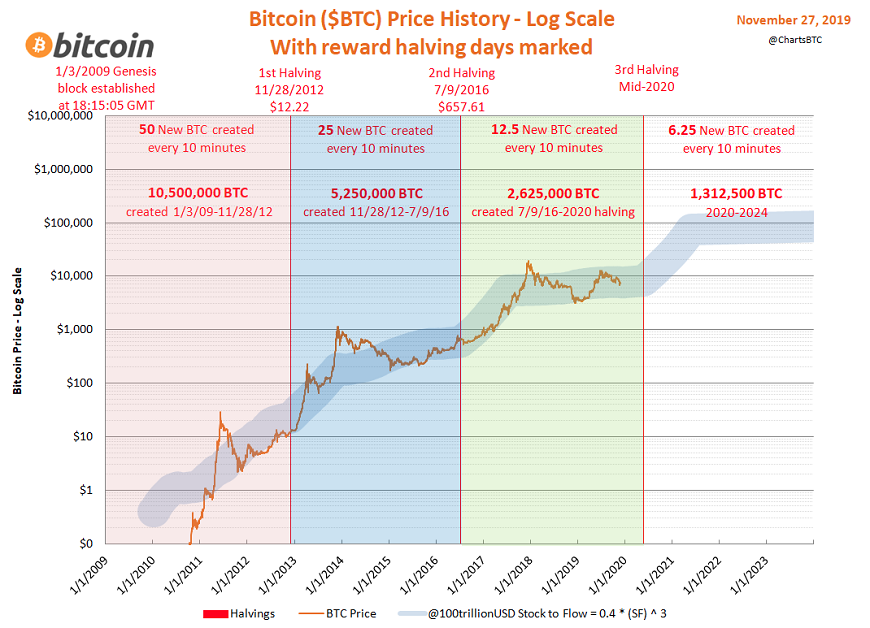

Here’s what has happened to the bitcoin price in previous halvings

Let’s look at how the price has moved after the two previous halving events, which took place on 28 November 2012 (priced: $12.22; reward: 25 BTC) and 9 July 2016. (price: $657.61; reward 12.5 BTC).

After the 2012 halving the price went on to reach a high of $1,142 on 30 November 2013.

In the second halving, the price appreciation was similarly spectacular, touching an intraday high of $19,989 on 17 December 2017.

For what it’s worth, the two historic halvings saw the bitcoin price return register 9,245% and 2,938%, respectively, in those cycles.

Received wisdom has it that constrained supply should be positive for bitcoin, assuming demand is stable or rising.

That being so, should bitcoin watchers, or those tempted to make a small speculative investment, consider doing so at this point, or wait for the near-term noise to pass to allow the post halving short-term dip phenomenon to pass? Or alternatively, to continue not to touch bitcoin with a barge poll!

Does stock-to-flow modelling a guide to bitcoin’s price future?

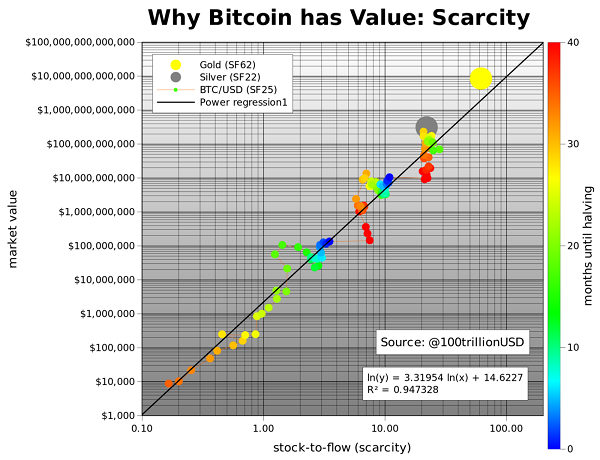

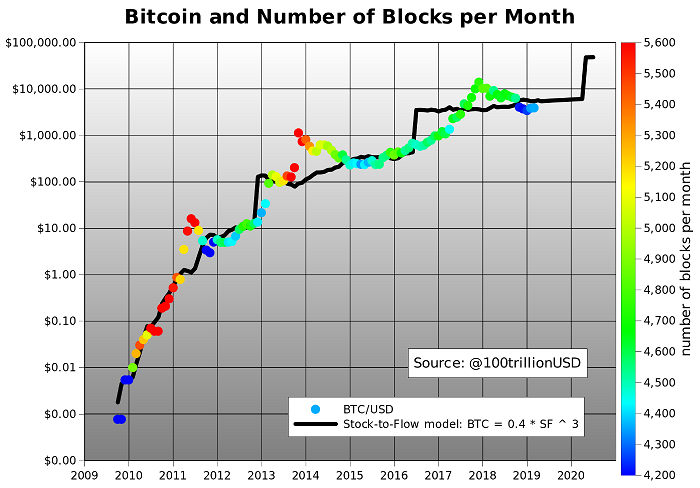

Those holding bitcoin – and the supporters of the halving bull case – are apt to cite stock-to-flow (SF) modelling to predict where the next price peak might be, if there is one.

Used widely in commodity analysis, SF is an attempt to measure scarcity by determining the ratio of the stock of an asset to its flow of new production.

As the chart below shows, $100,000 is a widely cited bitcoin price projection derived from the model for the four-year halving cycle high point.

Source: ChartsBTC

A quantitative researcher using the moniker ‘Plan B’ has attracted a lot of attention.

He or she predicted in March 2019 a price “after” this month’s halving event of $55,000, based on a bitcoin market capitalisation of $1 trillion, with the price rising to $100,000 by mid-year 2021.

At the time of that analysis (see chart below) comparative SF for gold (big yellow dot) and silver (big grey dot) was 62 and 22 respectively, with bitcoin on 25.

The current market capitalisation (price x current supply) of bitcoin is $171 billion.

“What is very interesting is that gold and silver, which are totally different markets, are in line with the bitcoin model values for SF. This gives extra confidence in the model. Note that at the peak of the bull market in Dec 2017 bitcoin SF was 22 and bitcoin market value was $230bn, very close to silver,” claimed the anonymous researcher.

But a $1 trillion market cap is quite a leap from the current valuation, so where are the buyers coming from to bring that about?

“People ask me where all the money needed for $1 trillion bitcoin market value would come from? My answer: silver, gold, countries with negative interest rate (Europe, Japan, US soon), countries with predatory governments (Venezuela, China, Iran, Turkey etc), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best performing asset of last 10 years.”

Those words were of course written before the coronavirus-induced meltdown of the global economy and the record-breaking debt-raising by the advanced economies, arguably adding fuel to the fire for a raging bitcoin bull market over the next couple of years.

See below the chart showing the price at $55,000. That evidently hasn’t come to pass and it would be a brave soul indeed to expect such a price to be achieved in the near future, or next year.

Price to crash as miners die?

A diametrically opposed bearish view of the market comes from the “mining catastrophe” school of thought.

As researcher Christopher Bendiksen at crypto exchange product provider CoinShares points out in research published this week, halving could lead to selling pressure.

The thinking is that just as a high bitcoin price can see miners hoard the bitcoins they earn from mining, conversely when the price falls and breakeven on return on investment is above the current price, then selling pressure can build up.

Miners can even be pushed into selling hoarded reserves, further adding to selling pressure, which is what the Coinshares analyst thinks was the sort of feedback going on in the March 2020 price crash.

Reducing the available reward to all miners by 50% is, on the face of it, the same as reducing the price, so some fear the least efficient miners will go to the wall.

But it is not quite that simple, because in practice a price drop does not reduce production, given that miners are locked into contracts that at minimum commit them to take electricity from suppliers for a month.

And besides, unplugging all that computing capacity and writing off the capital expenditure would not be rushed into, with the bigger players likely to fall back on reserves, hoping to grab business from those that fail.

And, as the Coinshares paper explains:

“The halving on the other hand does reduce new flow by 50%, thereby providing significant relief on persistent selling pressure even if miners must dip into reserves during a limited transition period.”

But on balance Bendiksen concludes that halving will be a net positive for the bitcoin price.

“These dynamics, in combination with the macroeconomic tailwinds presented by global governments, and the existing and growing inflows into passive bitcoin investment products we’re currently observing, could cause a perfect storm for the bitcoin price over the mid- to long-term.”

Here's a handy summation of his thoughts on the likely (and least likely scenarios) and their impact on price:

Source: Coinshares

Buy bitcoin, says respected analyst at US broker Jeffries

Global head of equity strategy at US broker Jeffries, Chris Wood, in his latest ‘Greed and Fear’ note, dated 30 April, has made a bold call for the firm’s clients to consider investing in bitcoin on the back of halving, because it “should increase upward price pressure”.

It is worth quoting his remarks more fully. He underscores bitcoin’s volatility, brackets bitcoin with gold, makes the case for it as a diversifying element in an investment portfolio and as a hedge against central bank money-printing.

“Now it is true that bitcoin price was hit in the March risk-off, declining by 57% from $9,184 to $3,915 in the week to 13 March … Still this does not necessarily mean to GREED & fear that bitcoin is just another high beta asset.

"In this respect, GREED & fear continues to believe that investors should own both gold and Bitcoin in the sense that they are not mutually exclusive, though clearly attitudes to both vary according to the demographic profile of the investor.

“It also should be a source of diversification in a portfolio, as is gold, precisely because of its truly decentralised nature…

“It is this feature, combined with the fixed supply, which makes it a hedge against central bank manipulated fiat money.”

Argo Blockchain results

LSE-listed bitcoin miner Argo Blockchain (LSE:ARB) this week reported that it had mined 1,237 bitcoin in the first quarter ending April, although revenues were flat (£1.8 million), with mining difficulty adjustment impacting margins.

Nevertheless, the minting figures show a production increase of 122% on the previous quarter. It now has a total of 18,000 mining machines installed, which includes the addition of 1,000 Antminer S17 machines, the latest offering from manufacturer Bitmain.

The company has also replaced chief financial officer Timothy Le Druillenec with immediate effect. John Savage takes over.

Argo’s shares rose 2% on Tuesday in early market reaction to the news.

The mining firm closed its consumer-facing operation early last year to concentrate on mining on its own account.

Libra Association has a high-powered chief executive

One-time US terrorism finance tsar and for the past eight years HSBC’s top legal honcho, Stuart Levey is starting a new job in July as chief executive of the Libra Association, the Facebook-initiated digital currency non-profit organisation.

The appointment is something of a masterstroke by Facebook as it seeks to play nice with regulators, by showing its willingness to play by the rules and assuage government fears around the world that Libra could end up being a facilitator for dark money transfers.

This hire of Libra’s first chief executive – someone well-placed in Washington, having served in both Republican and Democrat administrations, according to the Financial Times – is perhaps the clearest signal yet that Facebook has far from given up on Libra.

Independent of Facebook, the Libra Association has also made it known that it has applied for a licence in Switzerland from the country’s Financial Markets Supervisory Authority. The association is based in Switzerland.

In comments provided to the FT, Levey said gaining US approval was “an important priority” but that was not quite the same as previous statements from Mark Zuckerberg that had indicated that Libra would not launch without US authorities’ approval.

Commenting on the news, Henry Paulson, a former US Treasury Secretary and Goldman Sachs chief executive, provided a significant endorsement of the nascent currency.

“The fact that Stuart is an expert at countering abuses of our financial system by terrorists [and] money launderers…gives me confidence that this digital currency is highly likely to set a standard for safety.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.