Bitcoin charges to $5,850 as bulls stampede and Facebook Coin looms

Bitcoin and top coins race higher as market shrugs off Bitfinex implosion.

3rd May 2019 17:00

by Gary McFarlane from interactive investor

Bitcoin and top coins race higher as market shrugs off Bitfinex implosion and Facebook gears up for crypto launch.

Bitcoin has climbed 6.7%, smashing through the $,5,400 barrier to trade above $6,700 for a fresh high for the year.

According to data site coinmarketcap, bitcoin is currently priced at $5,850.

Trouble at the Bitfinex exchange last week, after it was unable to access $850 million held by Panama-based Crypto Capital, triggered panic among its customers and others in the wider crypto community.

That was all down to the New York Attorney alleging Bitfinex has been using Tether (USDT) reserves to cover for the $850 million it can’t access as it sought to fulfil customer withdrawal demands. Tether, a widely used stablecoin on crypto exchanges that don’t have fiat trading pairs, accounts for 20% of crypto trading.

The troubles at Bitfinex and Tether (both owned by iFinex) actually showed that the stablecoin was in fact backed by the necessary fiat, contrary to persistent claims raised in some quarters.

Bitfinex plot thickens

However, a lawyer representing the firm has admitted in court papers that the 1:1 backing has since slipped to 1:0.74.

Despite the uncertainties of late, Tether's peg to the dollar is still holding.

The hostility of the banks to certain crypto exchanges seems to have been at the root of Bitfinex's problems, apparently forcing it down a road of using payment processors perhaps more on the margins of the financial system.

The plot has since thickened, with US prosecutors indicting Reginald Fowler and Ravid Yosef for unlicensed money transmitting and breaking anti-money laundering laws. A firm called Global Trading Solutions (GTS) named in the action is the parent of Crypto Capital.

It is understood that funds have been seized at an HSBC bank account in London belonging to GTS.

Whatever the outcome of the legal and financial woes of Bitfinex, the market is brushing it off, which is probably the strongest sign yet of the buoyed sentiment in the space.

For those who still have faith in Bitfinex and fancy some arbitraging, the premium on the bitcoin price at the exchange has risen steadily since the story broke a week ago, now standing at $450.

Around the market

Total market capitalisation of the crypto marketplace has risen to $185 billion.

Top performers include Litecoin up 9% to $80, Ethereum 5% higher at $169 and EOS trading at $5 for a 7% gain.

Even beaten down Ripple's XRP token is making progress, 2.7% the better at $0.31.

Among the bitcoin fork coins, bitcoin Cash is nearly 8% higher at $295 and bitcoin Gold rocketing 12% to $19. Bitcoin SV has advanced 2.7% to $54.

Something of a laggard is IOTA, despite the Internet-of-Things-focused platform announcing a deal with Jaguar Land Rover earlier this week which saw the MIOTA token price spike 20%.

IOTA uses a distributed ledger approach that uses a technology it calls Tangle, which makes it infinitely scalable and transactions are free. Perhaps because of that it is not much liked by those with a rigid adherence to blockchain to achieve decentralisation.

Another relative underperformer is Basic Attention Token (BAT), which has been in the news after its Brave browser turned on a feature to allows users to earn crypto from viewing ads. It is currently down 0.4% at $0.380.

What the traders are saying

With the Tether farrago in mind, DonAlt, a crypto trader with 94,000 followers, thinks there may be a dump incoming, as the market is being "pulled up by a Bitfinex premium" (see chart below).

Others think the same he reckons, so the current uptick is a short squeeze but "once that's done the bears get their turn".

Source: TradingView Past performance is not a guide to future performance

Underpinning the latest leg up was a call from a technical analyst at Fundstrat to buy the dips.

"Use pending pullbacks to continue accumulating bitcoin in the second quarter in anticipation of a second-half rally through ~6,000 resistance," said Fundstrat's Robert Sluymer, claiming that bitcoin was in the early stage of a long-term recovery.

In a similarly bullish tone, Peter Brandt, a trader with 250,000 followers, tweeted the last time "weekly MA [moving average] was in the current profile of turning from down to up was in Nov 2015 just as $BTC began its move from $340 to $19,800" (see chart below).

Source: Peter Brandt Past performance is not a guide to future performance

'Facebook Coin' – more details emerge

Another factor contributing to bitcoin and the wider market's surge may have come from Facebook (NASDAQ:FB).

The Wall Street Journal (WSJ) appeared to confirm previous reports that Facebook was seeking funding of $1 billion for its crypto project – known internally as Project Libra.

At the time of the earlier reports, commentators were puzzled by the funding angle, given that Facebook could fund its own crypto out of its own substantial internal resources.

The WSJ story says that Facebook is looking for investments from other players in the payments sector to tie them into the 'FB Coin' initiative.

According to the report Facebook has spoken to "dozens financial firms and online merchants". Companies specifically mentioned in the WSJ report are Visa and Mastercard and payment processor First Data Corp but there are apparently many others in the frame.

"Facebook is also talking to e-commerce companies and apps about accepting the coin, and would seek smaller financial investments from those partners, one of the people said," the WSJ claimed.

In addition to powering payments on Facebook and to allow users to move the coin between users, the social media giant also plans to build a virtual checkout so that the coin could be used to pay for purchases outside of Facebook on websites external to it.

As predicted here at ii, Facebook is also reported to be looking at using the coin to reward users for watching ads, engaging with and creating content among other activities.

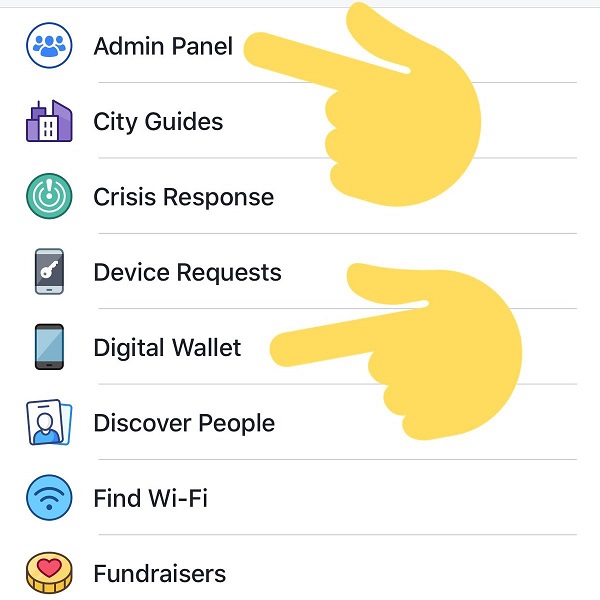

Adding to the furtive rumours, which are edging closer to being concrete fact, last month a screenshot of a "Digital Wallet" and "Admin Panel" from the UK iOS version of the Facebook app began circulating on social media (see screenshot below from social media commentator Matt Navarra posted on Twitter).

Qtum partners with Google Cloud

Other crypto news saw blockchain platform Qtum team up with Google Cloud, so that developers can now, with literally a single click, get a development environment up and running on Google Cloud.

The free to use tools should help spur adoption by developers of the platform. Google is currently crediting the accounts (£300 in the UK) of new users of its cloud service as it competes to lure customers away from market leader Amazon Web Services and Microsoft's Azure.

Zilliqa and user-friendly wallet addresses

Zilliqa, the crypto platform that claims to be the first to implement sharding, whereby the blockchain is effectively split into lots of smaller blockchains in order to increase transaction throughput, is the leading player behind the unstoppabledomains.com project.

The project, which is now open for registering domain names using the .zil suffix, enables crypto users to replace alphanumeric wallet addresses with human-readable names, potentially a big step forward in usability.

Unstoppabledomains is built on the Zilliqa blockchain and could work in conjunction with Zilliqa's Moonlet wallet which has recently been updated to store addresses from different blockchains under one master seed, another important usability initiative.

The .zil domains are scheduled to go live in June this year. At the moment it is limited to supporting Zilliqa and Ethereum with a goal of "supporting all cryptocurrencies".

Zilliqa is currently conducting a token swap as it migrates the ZIL token from the Ethereum ERC-20 standard.

Central banks transfer crypto

The Bank of Canada and the Monetary Authority of Singapore became the first central banks to transfer a digital currency.

The trial was conducted with the help of Accenture and JPMorgan through cooperation between the distributed ledger projects of the respective central banks.

In a statement Scott Hendry, the Bank of Canada's senior special director of financial technology, said:

"Only through continued collaboration and fundamental research will it be possible for this technology to mature and for policy makers to fully understand its potential."

ETrade getting into bitcoin and Ethereum

Last week we reported that TD Ameritrade may be looking to provide its customers with access to crypto after evidence emerged that it was testing bitcoin and Litecoin trading. Now it's ETrade's turn to tease the crypto market.

A Bloomberg report said the online broker intends to enable trading in bitcoin and Ethereum.

As one of the top four brokerages in the US, the implications for adoption of crypto by mainstream investors are significant.

ETrade has seven million customers in the US.

NYSE owner buying up bitcoin

Jeffrey Sprecher, the chief executive of Intercontinental Exchange (ICE) and the owner of the NYSE and parent of crypto platform Bakkt, the launch of which has been delayed, spoke to Reuters about the crypto industry.

He hinted that ICE have been buying bitcoin while the price has been languishing at distressed levels.

"It's really been helpful that the cryptocurrency industry sort of went into what they call a winter."

He added:

"We've actually looked at a number of different companies and acquired a company earlier this week that wouldn't have been available to us if the market had been really hot."

Sprecher was referring to its acquisition of Digital Asset Custody Company, news of which emerged earlier this week.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.